Region:Middle East

Author(s):Dev

Product Code:KRAA9509

Pages:97

Published On:November 2025

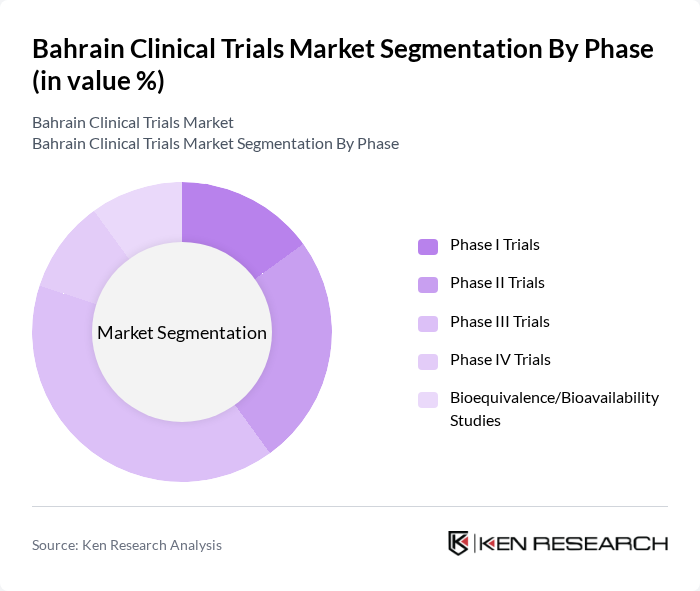

By Phase:The clinical trials market can be segmented based on the phase of the trials conducted. The phases include Phase I Trials, Phase II Trials, Phase III Trials, Phase IV Trials, and Bioequivalence/Bioavailability Studies. Each phase serves a distinct purpose in the drug development process, with Phase III Trials typically dominating due to their critical role in assessing the efficacy and safety of new treatments before they reach the market .

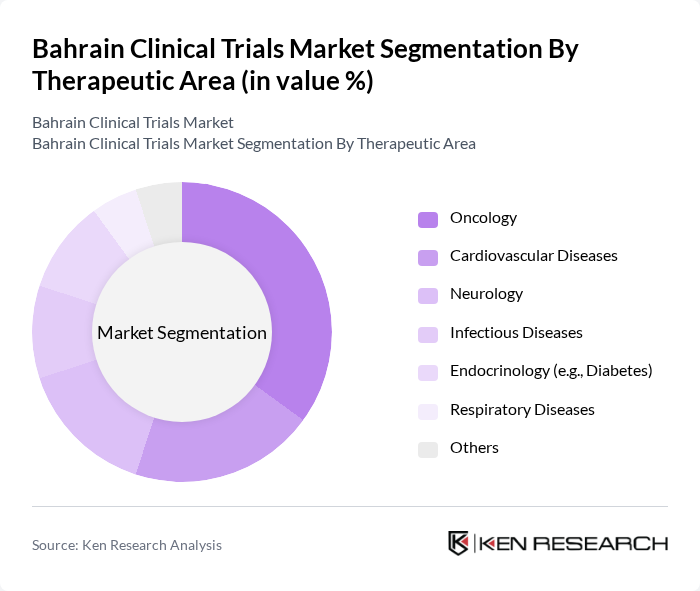

By Therapeutic Area:The market can also be segmented by therapeutic areas, which include Oncology, Cardiovascular Diseases, Neurology, Infectious Diseases, Endocrinology (e.g., Diabetes), Respiratory Diseases, and Others. Oncology is the leading therapeutic area due to the high demand for innovative cancer treatments and the increasing incidence of cancer in the region .

The Bahrain Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Oncology Center, King Hamad University Hospital Clinical Research Center, Salmaniya Medical Complex, Bahrain Specialist Hospital Clinical Research Unit, National Health Regulatory Authority (NHRA), Royal Bahrain Hospital Clinical Trials Unit, Bahrain Defence Force Hospital Research Center, Arabian Gulf University - Clinical Research Center, Al Hilal Hospital Clinical Research, Gulf Diabetes Specialist Center, Al Salam Specialist Hospital Clinical Research, Bahrain International Hospital Clinical Trials Unit, Bahrain Medical Society, Bahrain Red Crescent Society (Clinical Research Division), Bahrain Royal Medical Services Research Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain clinical trials market appears promising, driven by increasing healthcare investments and a growing focus on chronic disease management. As the government continues to enhance regulatory frameworks and infrastructure, the market is likely to attract more international collaborations. Additionally, the integration of digital health technologies and patient-centric approaches will further streamline trial processes, making Bahrain an appealing destination for clinical research in the Middle East.

| Segment | Sub-Segments |

|---|---|

| By Phase | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Bioequivalence/Bioavailability Studies |

| By Therapeutic Area | Oncology Cardiovascular Diseases Neurology Infectious Diseases Endocrinology (e.g., Diabetes) Respiratory Diseases Others |

| By Study Design | Interventional Studies Observational Studies Expanded Access Studies Registry Studies Others |

| By Sponsor Type | Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Academic Institutions Government Agencies Others |

| By Patient Demographics | Age Groups (Pediatric, Adult, Geriatric) Gender Health Status (Healthy Volunteers, Patients) Others |

| By Geographic Location | Manama Muharraq Northern Governorate Southern Governorate Others |

| By Funding Source | Public Funding Private Funding Non-Profit Organizations International Collaborations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 50 | Oncologists, Clinical Research Associates |

| Cardiovascular Trials | 40 | Cardiologists, Trial Coordinators |

| Diabetes Research Studies | 40 | Endocrinologists, Research Nurses |

| Pediatric Clinical Trials | 40 | Pediatricians, Clinical Trial Managers |

| Neurology Trials | 40 | Neurologists, Regulatory Affairs Specialists |

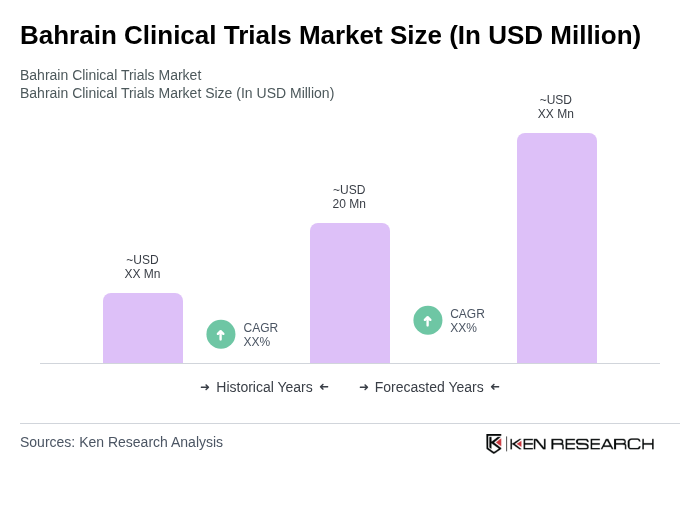

The Bahrain Clinical Trials Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is attributed to increased healthcare investments, rising chronic disease prevalence, and a focus on pharmaceutical research and development.