Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5872

Pages:89

Published On:December 2025

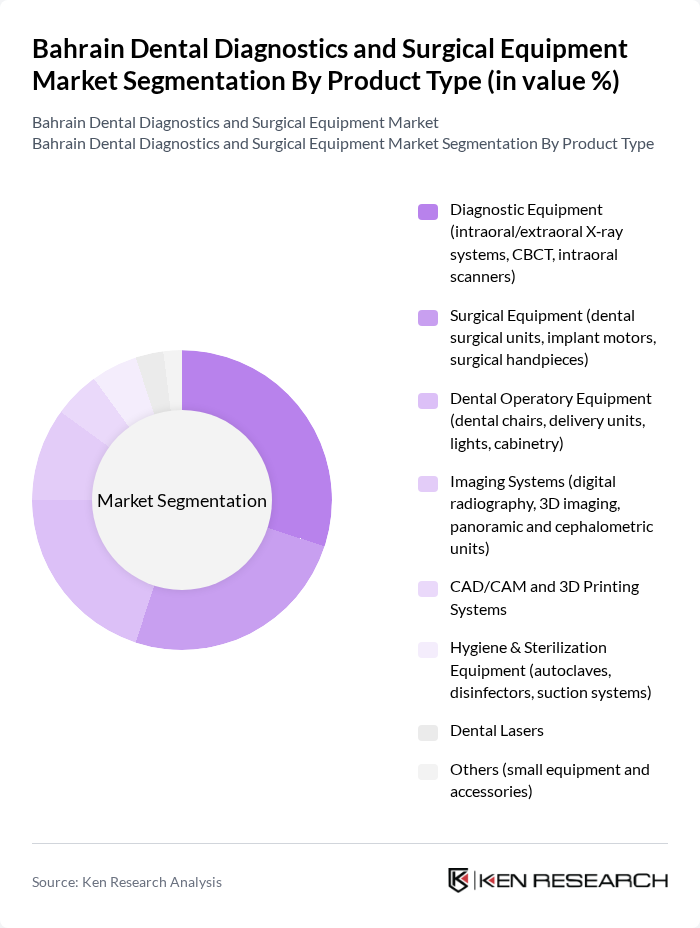

By Product Type:The product type segmentation includes various categories that cater to different aspects of dental diagnostics and surgical procedures. The subsegments are as follows:

The Diagnostic Equipment segment, which includes intraoral and extraoral X-ray systems, CBCT, and intraoral scanners, is currently dominating the market, in line with regional data showing strong demand for diagnostic and imaging systems within Bahrain’s broader dental equipment mix. This is largely due to the increasing emphasis on early diagnosis and preventive care in dentistry and the adoption of digital imaging and chairside diagnostics across GCC dental practices. The rise in dental awareness among the population has led to a higher demand for advanced diagnostic tools that provide accurate and efficient results, particularly for implant planning, orthodontics, and endodontics. Additionally, technological advancements in imaging systems, integration with practice?management software, and falling unit costs have made these tools more accessible and user-friendly, further driving their adoption in dental practices.

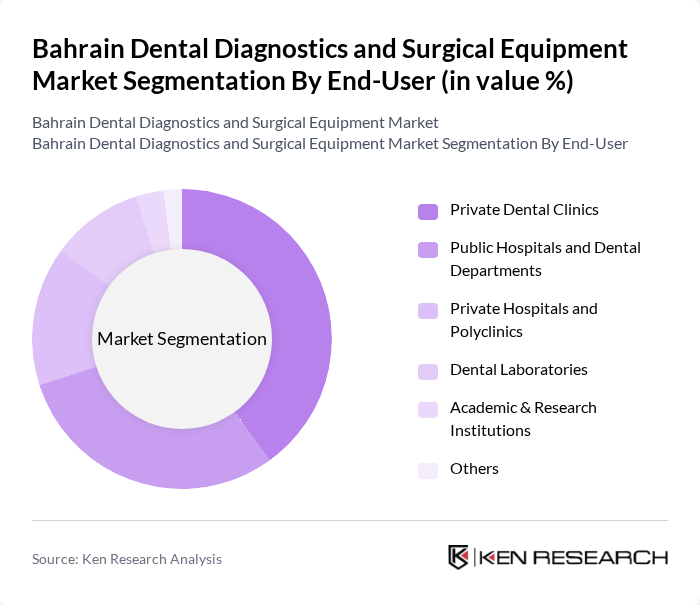

By End-User:The end-user segmentation includes various categories that represent the primary consumers of dental diagnostics and surgical equipment. The subsegments are as follows:

Private Dental Clinics are the leading end-user segment, accounting for a significant portion of the market, consistent with GCC data indicating that independent clinics and corporate dental chains are the primary purchasers of dental equipment. This dominance can be attributed to the growing number of private practices and the increasing preference for personalized dental care and cosmetic procedures among residents and expatriates. Patients are increasingly opting for private clinics due to shorter wait times, flexible appointment schedules, and a wider range of elective and aesthetic services offered. Additionally, the rise in cosmetic dentistry, implantology, and aligner-based orthodontics has further fueled the demand for advanced diagnostic, surgical, and CAD/CAM equipment in these settings.

The Bahrain Dental Diagnostics and Surgical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona Inc., Straumann Holding AG, Henry Schein, Inc., Planmeca Oy, 3M Oral Care (3M Company), KaVo Dental GmbH (KaVo Kerr), A-dec Inc., GC Corporation, Nobel Biocare Services AG, Vatech Co., Ltd., Biolase, Inc., Midmark Corporation, DentalEZ Integrated Solutions, Ivoclar Vivadent AG, Zimmer Biomet Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space, supplying Bahrain largely through GCC-wide distributors and regional partners.

The future of the Bahrain dental diagnostics and surgical equipment market appears promising, driven by ongoing technological innovations and increasing public health initiatives. As the government continues to invest in healthcare infrastructure, dental practices are likely to expand their services, integrating advanced technologies. Additionally, the rise in dental tourism is expected to further stimulate demand for high-quality dental services, creating a favorable environment for market growth and attracting international partnerships.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic Equipment (intraoral/extraoral X?ray systems, CBCT, intraoral scanners) Surgical Equipment (dental surgical units, implant motors, surgical handpieces) Dental Operatory Equipment (dental chairs, delivery units, lights, cabinetry) Imaging Systems (digital radiography, 3D imaging, panoramic and cephalometric units) CAD/CAM and 3D Printing Systems Hygiene & Sterilization Equipment (autoclaves, disinfectors, suction systems) Dental Lasers Others (small equipment and accessories) |

| By End-User | Private Dental Clinics Public Hospitals and Dental Departments Private Hospitals and Polyclinics Dental Laboratories Academic & Research Institutions Others |

| By Clinical Application | Preventive Dentistry Restorative and Prosthetic Dentistry Orthodontics Endodontics Implantology and Oral Surgery Cosmetic and Aesthetic Dentistry Others |

| By Distribution Channel | Direct Sales by Manufacturers Local Authorized Distributors Online B2B Platforms Regional Trading Companies (GCC-based) Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Technology | Digital Imaging and Radiography Laser Dentistry CAD/CAM Systems D Printing and Milling Chairside Integrated Digital Solutions Others |

| By Policy and Financing Support | Government Capital Expenditure on Dental Facilities Public–Private Partnership (PPP) Programs Tax and Customs Incentives for Medical Devices Healthcare Insurance Coverage for Dental Procedures Grants and Funding for Dental Research & Training Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 100 | Dentists, Clinic Managers |

| Hospitals with Dental Departments | 50 | Dental Surgeons, Hospital Administrators |

| Dental Equipment Distributors | 40 | Sales Managers, Product Specialists |

| Dental Equipment Manufacturers | 30 | Product Development Managers, Marketing Directors |

| Dental Associations and Regulatory Bodies | 20 | Policy Makers, Industry Analysts |

The Bahrain Dental Diagnostics and Surgical Equipment Market is valued at approximately USD 100 million, reflecting a five-year historical analysis of dental equipment spending and import trends in the region.