Region:Middle East

Author(s):Dev

Product Code:KRAC1294

Pages:97

Published On:December 2025

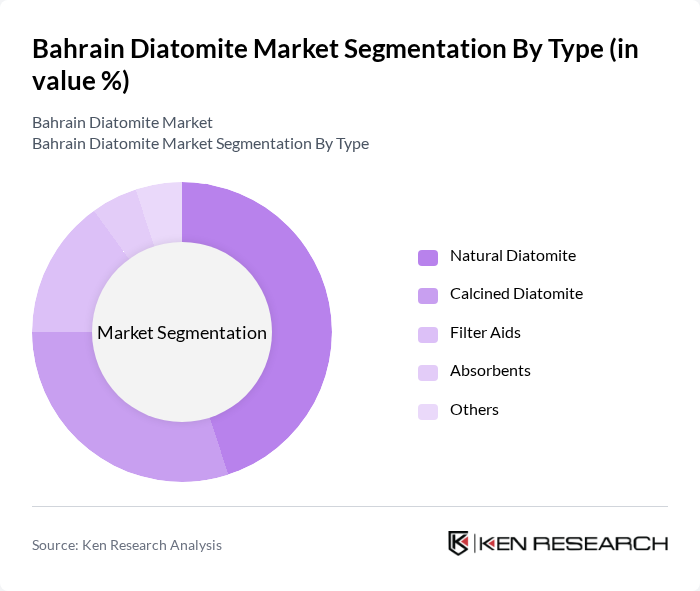

By Type:The diatomite market can be segmented into several types, including Natural Diatomite, Calcined Diatomite, Filter Aids, Absorbents, and Others. Among these, Natural Diatomite is the most dominant due to its extensive use in filtration and absorbent applications, driven by its eco-friendly properties and effectiveness in various industrial processes. The demand for Calcined Diatomite is also significant, particularly in construction and agriculture, where its thermal insulation properties are highly valued.

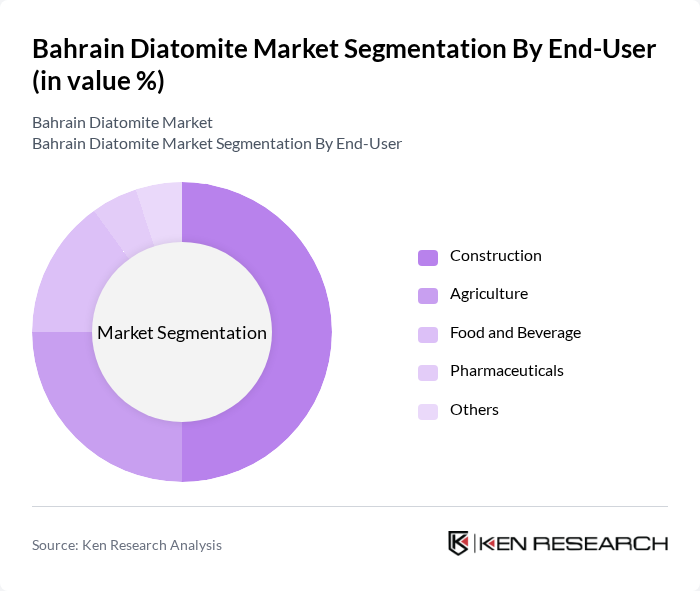

By End-User:The end-user segmentation of the diatomite market includes Construction, Agriculture, Food and Beverage, Pharmaceuticals, and Others. The Construction sector is the leading end-user, driven by the increasing demand for diatomite in insulation and lightweight construction materials. Agriculture follows closely, where diatomite is utilized as a soil amendment and pest control agent, enhancing crop yield and sustainability.

The Bahrain Diatomite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., EP Minerals, LLC, Diatomite Earth, Inc., C.E. Minerals, Ceres Media, Inc., Dicalite Management Group, C.E. Minerals, Diatomite Direct, U.S. Silica Holdings, Inc., Ceres Global Ag Corp., Aegean Marine Petroleum Network Inc., KATANA S.A., Axiom Materials, Inc., ACG Materials, A.P. Green Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain diatomite market appears promising, driven by ongoing economic diversification efforts aimed at reducing reliance on hydrocarbons. By future, non-hydrocarbon sectors are projected to account for nearly 90 percent of the economy, fostering new applications for diatomite in advanced filtration and specialty materials. Additionally, strengthening financial and technological sectors will enhance industrial capabilities, supporting innovations in diatomite processing and extraction, ultimately positioning Bahrain as a competitive player in the regional market.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Diatomite Calcined Diatomite Filter Aids Absorbents Others |

| By End-User | Construction Agriculture Food and Beverage Pharmaceuticals Others |

| By Application | Filtration Absorption Insulation Soil Amendment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Product Form | Powder Granules Pellets Others |

| By Quality Grade | Food Grade Industrial Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diatomite Mining Operations | 100 | Mine Managers, Operations Directors |

| Filtration Industry Users | 80 | Product Managers, Quality Control Specialists |

| Construction Material Suppliers | 70 | Procurement Managers, Sales Directors |

| Agricultural Product Manufacturers | 60 | Research and Development Managers, Agronomists |

| Environmental Consultants | 50 | Sustainability Officers, Environmental Engineers |

The Bahrain Diatomite Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including filtration, construction, and agriculture, as well as a rising preference for sustainable materials.