Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7110

Pages:97

Published On:December 2025

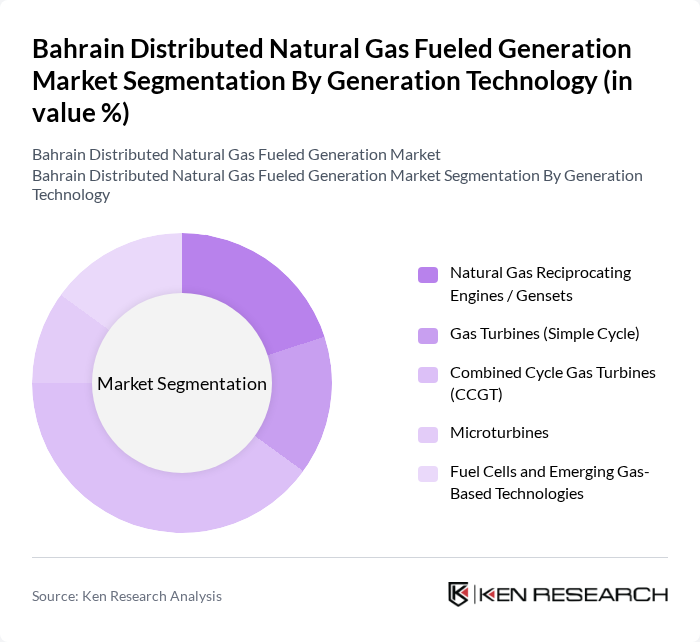

By Generation Technology:The market is segmented into various generation technologies, including Natural Gas Reciprocating Engines / Gensets, Gas Turbines (Simple Cycle), Combined Cycle Gas Turbines (CCGT), Microturbines, and Fuel Cells and Emerging Gas-Based Technologies. Among these, Combined Cycle Gas Turbines (CCGT) are leading the market due to their high efficiency, ability to recover waste heat through heat recovery steam generators, and suitability for large baseload and mid?merit applications in Bahrain’s gas?dominated power system. This technology is favored by large-scale power producers and independent water and power projects (IWPPs) for its lower specific fuel consumption and reduced emissions intensity compared to older simple?cycle and oil?fired units.

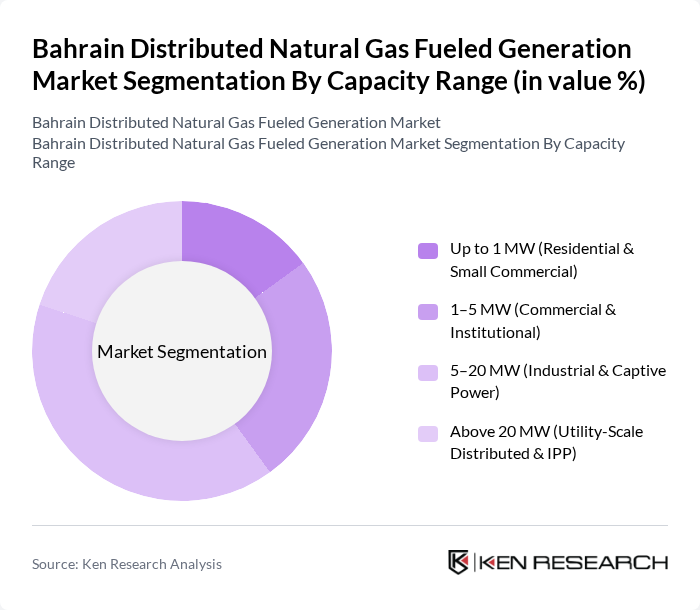

By Capacity Range:The market is also segmented by capacity range, which includes Up to 1 MW (Residential & Small Commercial), 1–5 MW (Commercial & Institutional), 5–20 MW (Industrial & Captive Power), and Above 20 MW (Utility-Scale Distributed & IPP). The segment of 5–20 MW is currently dominating the market, as it caters to industrial and process-driven users such as aluminium, petrochemicals, and manufacturing facilities that require substantial, high-availability power while retaining flexibility in onsite or captive generation. This capacity range is particularly appealing due to its balance between thermal efficiency, modular expansion capability, and integration with combined heat and power (CHP) or utility interconnections for reliability and cost optimization.

The Bahrain Distributed Natural Gas Fueled Generation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Gas Company (Banagas), Tatweer Petroleum – Bahrain Field Development Company W.L.L., Electricity and Water Authority (EWA) – Bahrain, Aluminium Bahrain B.S.C. (Alba) – Captive Gas Power Facilities, Bahrain Petroleum Company (Bapco Energies), ACWA Power Bahrain, GE Vernova (Gas Power – Middle East & Bahrain), Siemens Energy (Middle East & Bahrain), Wärtsilä Corporation, Baker Hughes Company, Schneider Electric Bahrain, ABB Ltd. – Bahrain Operations, Engie Middle East (including Bahrain IPP stakes), Suez – Water & Waste and Energy Services in Bahrain, Gulf Petrochemical Industries Company (GPIC) – Onsite Gas-Based Power & Utilities contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's distributed natural gas generation market appears promising, driven by increasing energy demands and government support for cleaner energy initiatives. As technological advancements continue to improve efficiency, the market is likely to see a shift towards decentralized energy systems. Additionally, the integration of smart grid technologies will enhance energy management, making distributed generation more viable. The focus on sustainability will further encourage investments in natural gas solutions, positioning Bahrain as a regional leader in clean energy generation.

| Segment | Sub-Segments |

|---|---|

| By Generation Technology | Natural Gas Reciprocating Engines / Gensets Gas Turbines (Simple Cycle) Combined Cycle Gas Turbines (CCGT) Microturbines Fuel Cells and Emerging Gas-Based Technologies |

| By Capacity Range | Up to 1 MW (Residential & Small Commercial) –5 MW (Commercial & Institutional) –20 MW (Industrial & Captive Power) Above 20 MW (Utility-Scale Distributed & IPP) |

| By End-User | Residential & Small Commercial Buildings Large Commercial & Institutional (Malls, Hospitals, Hotels, Universities) Industrial & Oil and Gas Facilities Government, Utilities & Public Infrastructure |

| By Connection Type | On-Grid / Grid-Connected Systems Off-Grid / Islanded Systems Hybrid Systems (Gas + Renewables + Storage) |

| By Application | Prime Power Generation Peak Shaving & Load Management Combined Heat and Power (CHP) / Co-Generation Standby & Backup Power |

| By Investment Source | Utility & Government-Owned Projects Private Captive Investments Independent Power Producers (IPPs) Public-Private Partnerships (PPPs) |

| By Commercial & Policy Model | Capital Purchase / EPC Turnkey Model Energy-as-a-Service / BOO / BOOT Models Tariff / PPA-Based Arrangements Incentivized & Subsidy-Linked Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Natural Gas Power Generation Companies | 45 | CEOs, Operations Managers, Technical Directors |

| Energy Regulatory Authorities | 25 | Policy Makers, Regulatory Analysts |

| Energy Consultants and Analysts | 40 | Market Analysts, Energy Consultants |

| Environmental NGOs and Advocacy Groups | 40 | Environmental Policy Experts, Advocacy Leaders |

| Industrial Energy Consumers | 50 | Facility Managers, Energy Procurement Officers |

The Bahrain Distributed Natural Gas Fueled Generation Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for cleaner energy sources and advancements in gas-based power technologies.