Region:Middle East

Author(s):Shubham

Product Code:KRAD3694

Pages:84

Published On:November 2025

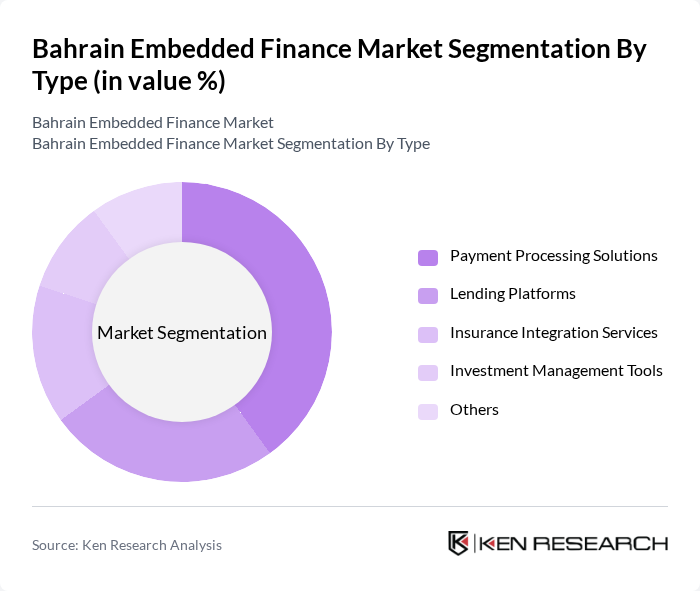

By Type:The market is segmented into various types, including Payment Processing Solutions, Lending Platforms, Insurance Integration Services, Investment Management Tools, and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different consumer needs and preferences.

The Payment Processing Solutions segment is currently dominating the market due to the increasing shift towards cashless transactions and the growing preference for digital payment methods among consumers and businesses. This segment benefits from the rise of e-commerce and mobile payment applications, which have become essential for seamless transactions. The convenience and speed offered by these solutions are driving their adoption, making them a critical component of the embedded finance landscape.

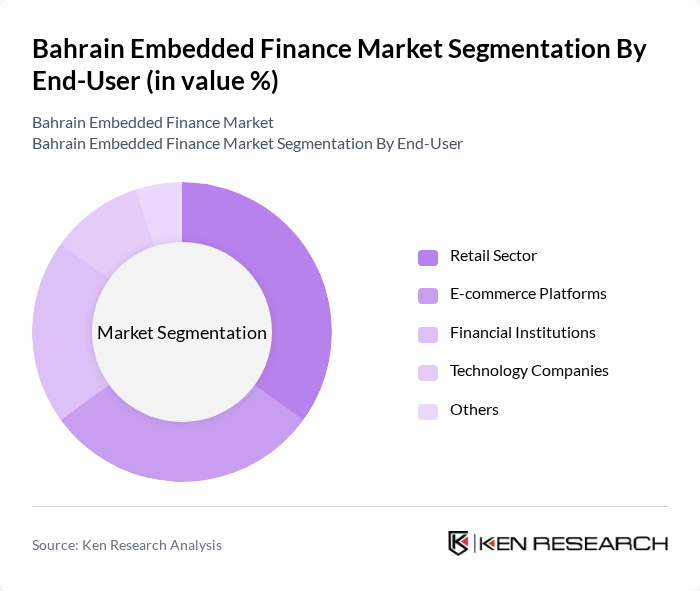

By End-User:The market is segmented by end-user into Retail Sector, E-commerce Platforms, Financial Institutions, Technology Companies, and Others. Each end-user category has unique requirements and contributes differently to the market.

The Retail Sector is the leading end-user segment, driven by the increasing integration of embedded finance solutions into retail operations. Retailers are leveraging these solutions to enhance customer experiences, streamline payment processes, and offer personalized financial services. The growth of online shopping and the demand for efficient payment methods are further propelling this segment's expansion, making it a vital player in the embedded finance market.

The Bahrain Embedded Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Benefit Corporation, Fintech Solutions Bahrain, Bahrain Islamic Bank, Al Baraka Banking Group, Gulf International Bank, Bank of Bahrain and Kuwait, Bahrain Fintech Bay, Aion Digital, Tarabut Gateway, STC Pay, PayTabs, Tamweelcom, Fawry, Zain Cash, RAK Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain embedded finance market appears promising, driven by technological advancements and evolving consumer expectations. As digital banking continues to gain traction, the integration of AI and machine learning will enhance personalized financial services. Additionally, the rise of decentralized finance (DeFi) solutions is expected to reshape traditional financial paradigms, offering innovative alternatives. The regulatory landscape will likely adapt to these changes, fostering a more inclusive financial ecosystem that encourages innovation and consumer protection.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Lending Platforms Insurance Integration Services Investment Management Tools Others |

| By End-User | Retail Sector E-commerce Platforms Financial Institutions Technology Companies Others |

| By Business Model | B2B Embedded Finance Solutions B2C Embedded Finance Solutions C2B Embedded Finance Solutions Others |

| By Industry Vertical | Retail and E-commerce Travel and Hospitality Healthcare Real Estate Others |

| By Technology Integration | API-based Solutions White-label Solutions Custom-built Solutions Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Individual Consumers Others |

| By Geographic Presence | Local Market Players Regional Players International Players Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Adoption of Embedded Finance | 150 | Business Owners, Financial Managers |

| Consumer Awareness of Fintech Solutions | 100 | General Consumers, Tech-Savvy Individuals |

| Banking Sector Insights | 80 | Bank Executives, Product Development Heads |

| Regulatory Perspectives on Embedded Finance | 50 | Regulatory Officials, Compliance Officers |

| Fintech Startups and Innovations | 70 | Startup Founders, Innovation Managers |

The Bahrain Embedded Finance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the rise of fintech companies in the region.