Region:Middle East

Author(s):Rebecca

Product Code:KRAD4347

Pages:99

Published On:December 2025

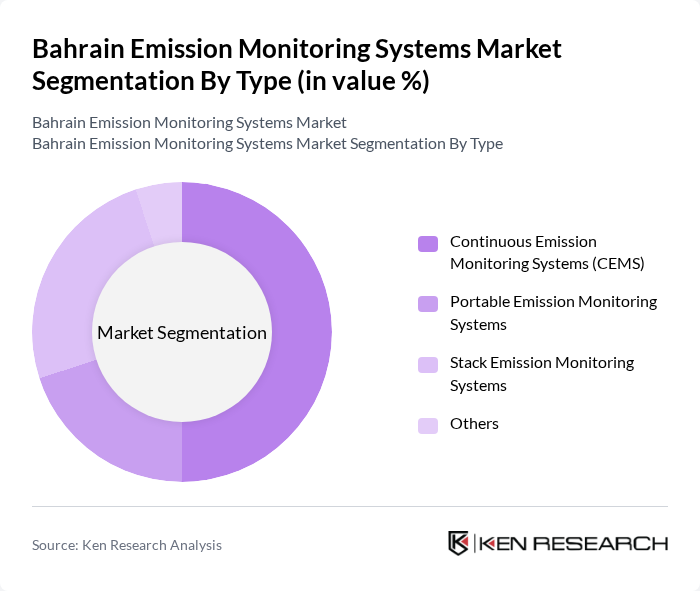

By Type:The market is segmented into Continuous Emission Monitoring Systems (CEMS), Portable Emission Monitoring Systems, Stack Emission Monitoring Systems, and Others. Continuous Emission Monitoring Systems (CEMS) dominate the market due to their ability to provide real-time data and ensure compliance with regulatory standards. The increasing need for accurate and continuous data collection in various industries, particularly in oil and gas and manufacturing, drives the demand for CEMS.

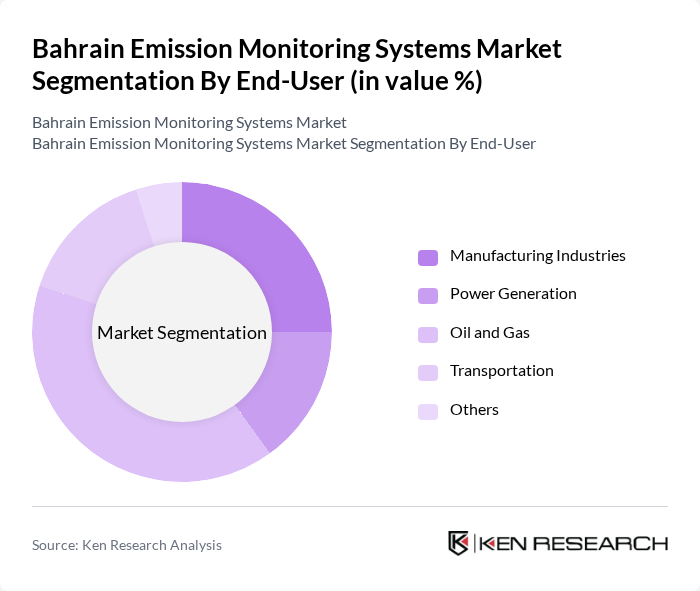

By End-User:The end-user segmentation includes Manufacturing Industries, Power Generation, Oil and Gas, Transportation, and Others. The Oil and Gas sector is the leading end-user, driven by the stringent regulations imposed on emissions and the need for continuous monitoring to ensure compliance. The sector's significant contribution to Bahrain's economy and its environmental impact necessitate advanced monitoring solutions.

The Bahrain Emission Monitoring Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co., Siemens AG, Honeywell International Inc., ABB Ltd., Teledyne Technologies Incorporated, Horiba, Ltd., Ametek, Inc., Thermo Fisher Scientific Inc., PerkinElmer, Inc., Yokogawa Electric Corporation, KROHNE Group, SICK AG, Mettler-Toledo International Inc., RMT, Inc., Landauer, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Emission Monitoring Systems market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on environmental compliance. As the government continues to enforce stricter emission regulations, industries will increasingly adopt advanced monitoring solutions. Furthermore, the integration of IoT and AI technologies is expected to enhance data accuracy and operational efficiency, paving the way for innovative solutions that address air quality challenges effectively and sustainably.

| Segment | Sub-Segments |

|---|---|

| By Type | Continuous Emission Monitoring Systems (CEMS) Portable Emission Monitoring Systems Stack Emission Monitoring Systems Others |

| By End-User | Manufacturing Industries Power Generation Oil and Gas Transportation Others |

| By Application | Regulatory Compliance Monitoring Process Optimization Environmental Impact Assessment Others |

| By Technology | Infrared Sensors Chemiluminescence Gas Chromatography Others |

| By Industry Standards | ISO Standards ASTM Standards National Standards Others |

| By Geographic Coverage | Urban Areas Industrial Zones Rural Areas Others |

| By Investment Source | Private Investments Government Funding International Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Emission Monitoring | 120 | Environmental Managers, Compliance Officers |

| Oil and Gas Sector Emissions | 90 | Operations Managers, Environmental Engineers |

| Manufacturing Emission Controls | 80 | Plant Managers, Sustainability Coordinators |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Inspectors |

| Technology Providers for Emission Systems | 60 | Product Managers, Sales Directors |

The Bahrain Emission Monitoring Systems market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing regulatory requirements, rising industrial activities, and a focus on sustainable practices across various sectors.