Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3884

Pages:86

Published On:November 2025

By Type:The market is segmented into various types of failure analysis, including Mechanical Failure Analysis, Electrical Failure Analysis, Metallurgical Failure Analysis, Chemical Failure Analysis, Software Failure Analysis, Structural Failure Analysis, and Others. Each type addresses specific failure modes and is crucial for different industries. The adoption of advanced analytical techniques such as electron microscopy, spectroscopy, and thermal imaging is increasingly prevalent across these segments, improving the accuracy and speed of root cause identification .

The Mechanical Failure Analysis segment is currently dominating the market due to its critical role in industries such as manufacturing and oil and gas. The increasing complexity of machinery and equipment necessitates thorough mechanical assessments to prevent costly downtimes and ensure safety. Additionally, the rise in automation and advanced manufacturing techniques has further amplified the need for mechanical failure analysis, making it a key focus area for companies aiming to enhance operational efficiency .

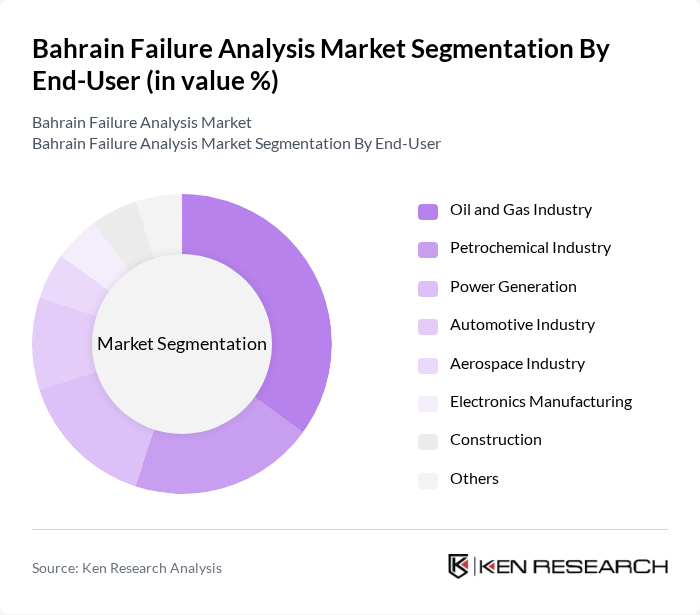

By End-User:The market is segmented by end-user industries, including Oil and Gas Industry, Petrochemical Industry, Power Generation, Automotive Industry, Aerospace Industry, Electronics Manufacturing, Construction, and Others. Each sector has unique requirements for failure analysis services based on their operational complexities. The oil and gas and petrochemical sectors are particularly reliant on advanced failure analysis to ensure asset integrity, regulatory compliance, and environmental safety .

The Oil and Gas Industry is the leading end-user segment, driven by the critical need for safety and reliability in operations. The sector's inherent risks associated with equipment failure and environmental hazards necessitate comprehensive failure analysis to mitigate potential disasters. Additionally, the ongoing investments in infrastructure and technology upgrades within this industry further bolster the demand for specialized failure analysis services .

The Bahrain Failure Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS Bahrain, Bureau Veritas Bahrain, Intertek Bahrain, TÜV Rheinland Bahrain, DNV Bahrain, Applus+ Bahrain, Element Materials Technology Bahrain, ALS Limited Bahrain, Mistras Group Bahrain, Acuren Group Bahrain, National Technical Systems (NTS) Bahrain, Exova Group Bahrain, Kinectrics Bahrain, EWI (Engineering Workforce Inc.) Bahrain, Bahrain National Laboratory (BNL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain failure analysis market appears promising, driven by technological advancements and increasing regulatory pressures. As industries continue to expand, the demand for sophisticated failure analysis tools and methodologies will likely rise. Companies are expected to increasingly adopt predictive maintenance strategies, leveraging data analytics to preemptively identify potential failures. This proactive approach will enhance operational efficiency and safety, positioning failure analysis as a critical component of industrial processes in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Failure Analysis Electrical Failure Analysis Metallurgical Failure Analysis Chemical Failure Analysis Software Failure Analysis Structural Failure Analysis Others |

| By End-User | Oil and Gas Industry Petrochemical Industry Power Generation Automotive Industry Aerospace Industry Electronics Manufacturing Construction Others |

| By Industry | Manufacturing Construction Oil & Gas Power & Utilities Healthcare Telecommunications Others |

| By Service Type | Consulting Services Testing & Inspection Services Failure Investigation Services Training Services Maintenance Services Others |

| By Technology Used | Non-Destructive Testing (NDT) Scanning Electron Microscopy (SEM) Energy Dispersive X-ray Spectroscopy (EDX/EDS) X-ray Diffraction (XRD) Failure Mode and Effects Analysis (FMEA) Root Cause Analysis (RCA) Others |

| By Geographic Distribution | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Customer Segment | Large Enterprises Small and Medium Enterprises (SMEs) Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Failure Analysis | 100 | Quality Control Managers, Production Supervisors |

| Construction Safety Compliance | 80 | Site Safety Officers, Project Managers |

| Aerospace Component Failure Review | 50 | Engineering Managers, Compliance Auditors |

| Oil & Gas Equipment Failure Analysis | 60 | Maintenance Engineers, Risk Assessment Specialists |

| Automotive Quality Assurance | 70 | Product Development Engineers, Quality Assurance Leads |

The Bahrain Failure Analysis Market is valued at approximately USD 135 million, reflecting a significant growth driven by the increasing complexity of industrial systems and the rising demand for effective risk management strategies across various sectors.