Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4078

Pages:84

Published On:December 2025

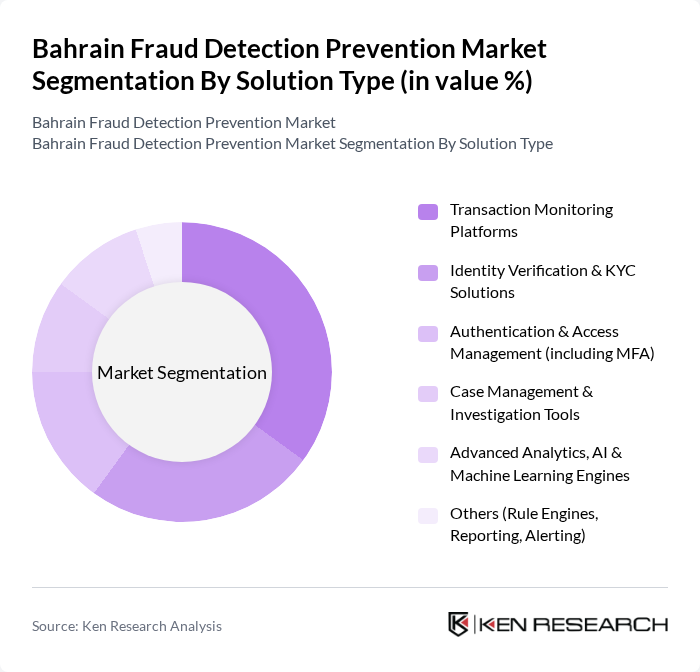

By Solution Type:The market is segmented into various solution types, including Transaction Monitoring Platforms, Identity Verification & KYC Solutions, Authentication & Access Management (including MFA), Case Management & Investigation Tools, Advanced Analytics, AI & Machine Learning Engines, and Others (Rule Engines, Reporting, Alerting). Among these, Transaction Monitoring Platforms are leading due to their critical role in real-time fraud detection and compliance with regulatory requirements. The increasing complexity of fraud schemes has driven financial institutions to invest heavily in these platforms to safeguard their operations.

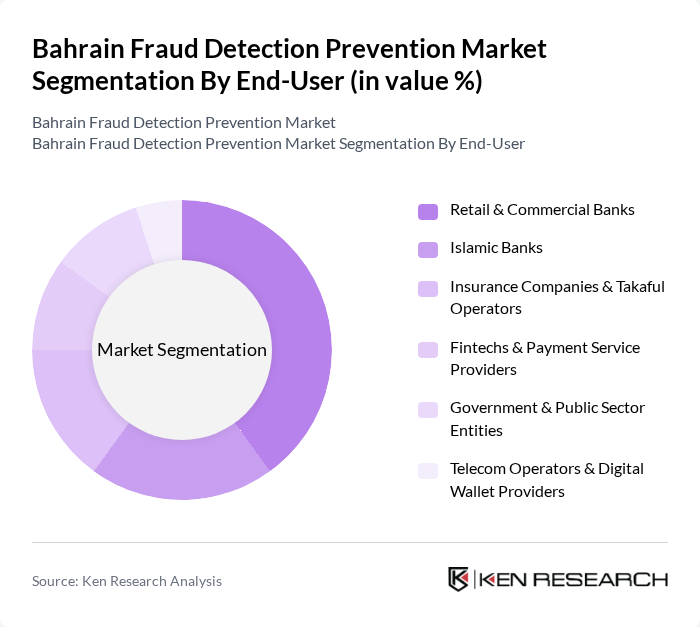

By End-User:The end-user segmentation includes Retail & Commercial Banks, Islamic Banks, Insurance Companies & Takaful Operators, Fintechs & Payment Service Providers, Government & Public Sector Entities, Telecom Operators & Digital Wallet Providers, and Others. Retail & Commercial Banks dominate this segment as they are the primary targets for fraud, necessitating robust fraud detection systems to protect customer assets and maintain trust. The increasing digitalization of banking services has further amplified the need for effective fraud prevention measures.

The Bahrain Fraud Detection Prevention Market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, SAS Institute, ACI Worldwide, NICE Actimize, Oracle, IBM, BAE Systems Digital Intelligence, Experian, RSA Security, Fiserv, Mastercard (including Brighterion & Ethoca), Visa (including Cybersource), Feedzai, Featurespace, GBG (GB Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fraud detection prevention market in Bahrain appears promising, driven by technological advancements and increasing regulatory pressures. As organizations prioritize cybersecurity, investments in AI and machine learning are expected to rise, enhancing detection capabilities. Additionally, the growing e-commerce sector will necessitate more robust fraud prevention measures. With the government’s commitment to improving cybersecurity frameworks, the market is poised for significant growth, fostering a safer digital environment for businesses and consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transaction Monitoring Platforms Identity Verification & KYC Solutions Authentication & Access Management (including MFA) Case Management & Investigation Tools Advanced Analytics, AI & Machine Learning Engines Others (Rule Engines, Reporting, Alerting) |

| By End-User | Retail & Commercial Banks Islamic Banks Insurance Companies & Takaful Operators Fintechs & Payment Service Providers Government & Public Sector Entities Telecom Operators & Digital Wallet Providers Others |

| By Use Case | Card & Payment Fraud Detection Online & Mobile Banking Fraud Anti-Money Laundering & Transaction Monitoring Identity Theft & Account Takeover Prevention Application & Onboarding Fraud Insider & Employee Fraud Others |

| By Deployment Mode | On-Premises Public Cloud Private Cloud Hybrid |

| By Fraud Type | Identity Theft Payment & Card Fraud Account Takeover Application & Synthetic Identity Fraud Money Laundering & Terrorist Financing Cyber & Phishing-Driven Fraud Others |

| By Geography | Capital Governorate (Manama) Muharraq Governorate Northern Governorate Southern Governorate Others (Free Zones & Offshore Financial Centers) |

| By Customer Size | Large Financial Institutions & Enterprises Mid-Sized Banks & Enterprises Small Financial Institutions, Fintechs & SMEs Startups & Emerging Players |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Fraud Prevention | 120 | Compliance Officers, Risk Management Executives |

| Insurance Fraud Detection | 90 | Fraud Analysts, Underwriting Managers |

| Retail Sector Loss Prevention | 80 | Loss Prevention Managers, Store Operations Directors |

| Telecommunications Fraud Management | 70 | Fraud Prevention Specialists, IT Security Managers |

| Government Regulatory Compliance | 60 | Regulatory Affairs Officers, Policy Makers |

The Bahrain Fraud Detection Prevention Market is valued at approximately USD 150 million, reflecting a significant increase driven by the rise in digital banking services and the growing need for advanced security measures to combat fraud.