Region:Middle East

Author(s):Dev

Product Code:KRAC4142

Pages:93

Published On:October 2025

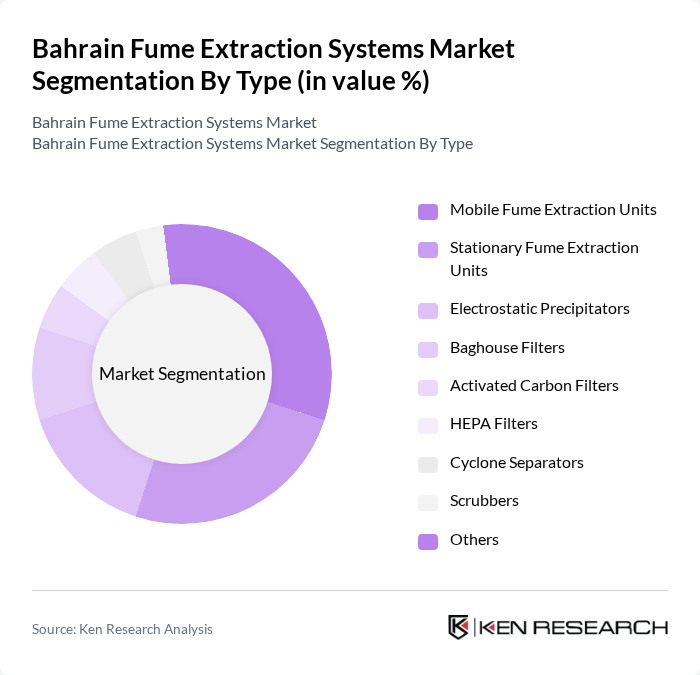

By Type:The market is segmented into various types of fume extraction systems, including Mobile Fume Extraction Units, Stationary Fume Extraction Units, Electrostatic Precipitators, Baghouse Filters, Activated Carbon Filters, HEPA Filters, Cyclone Separators, Scrubbers, and Others. Among these, Mobile Fume Extraction Units are gaining traction due to their flexibility and ease of use in dynamic industrial environments, especially for small and medium enterprises and temporary worksites. Stationary units remain significant in large-scale manufacturing facilities where continuous, high-volume extraction is required for compliance and operational efficiency .

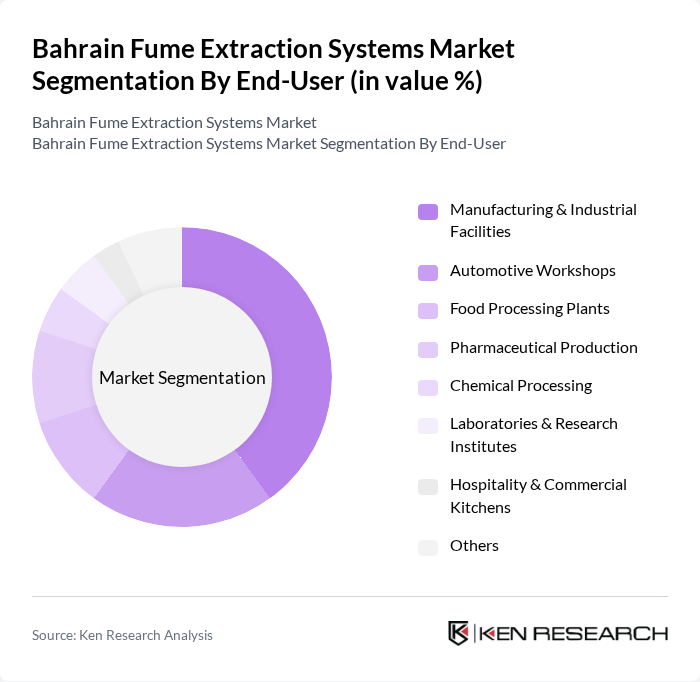

By End-User:The end-user segmentation includes Manufacturing & Industrial Facilities, Automotive Workshops, Food Processing Plants, Pharmaceutical Production, Chemical Processing, Laboratories & Research Institutes, Hospitality & Commercial Kitchens, and Others. Manufacturing & Industrial Facilities dominate the market due to their high demand for fume extraction systems to comply with occupational safety regulations and improve air quality. The automotive sector is also a significant contributor, driven by the need for effective fume management in workshops and service centers .

The Bahrain Fume Extraction Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as AAF International, Donaldson Company, Inc., Camfil AB, Nederman Holding AB, 3M Company, Honeywell International Inc., Airflow Developments Ltd., Filtermist International Ltd., Plymovent Group BV, Sentry Air Systems, Inc., KEMPER GmbH, Absolent AB, BOFA International Ltd., Fumex AB, and local Bahrain distributors (e.g., Almoayyed Air Conditioning, Gulf Air Filtration Systems) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain fume extraction systems market appears promising, driven by technological advancements and increasing regulatory pressures. As industries evolve, there is a growing trend towards integrating smart technologies that enhance system efficiency and monitoring capabilities. Additionally, the focus on sustainability is expected to drive innovation in eco-friendly extraction solutions, aligning with global environmental goals. Companies that adapt to these trends will likely gain a competitive edge in the market, fostering long-term growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Fume Extraction Units Stationary Fume Extraction Units Electrostatic Precipitators Baghouse Filters Activated Carbon Filters HEPA Filters Cyclone Separators Scrubbers Others |

| By End-User | Manufacturing & Industrial Facilities Automotive Workshops Food Processing Plants Pharmaceutical Production Chemical Processing Laboratories & Research Institutes Hospitality & Commercial Kitchens Others |

| By Application | Welding Fume Extraction Laser Cutting Fume Extraction Soldering & Brazing Fume Extraction Laboratory Fume Extraction Kitchen Fume Extraction Chemical & Pharmaceutical Fume Extraction Others |

| By Component | Fans and Blowers Ducting Control Systems Filters Sensors & Monitoring Devices Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Fume Extraction | 100 | Plant Managers, Environmental Compliance Officers |

| Automotive Industry Emission Control | 60 | Operations Managers, Safety Officers |

| Construction Site Air Quality Management | 50 | Site Supervisors, Project Managers |

| Food Processing Fume Management | 40 | Quality Assurance Managers, Facility Managers |

| Research & Development in Fume Extraction | 40 | R&D Managers, Product Development Engineers |

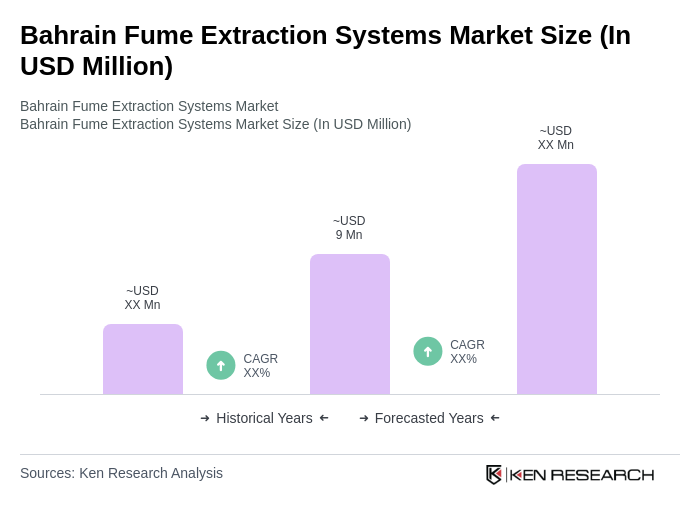

The Bahrain Fume Extraction Systems Market is valued at approximately USD 9 million, reflecting a growing demand driven by industrial activities, regulatory compliance, and a focus on workplace air quality.