Region:Middle East

Author(s):Rebecca

Product Code:KRAD1469

Pages:80

Published On:November 2025

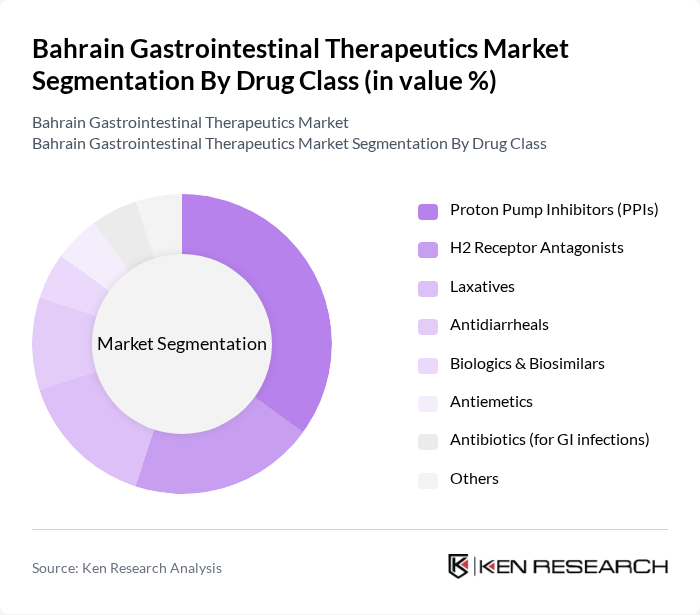

By Drug Class:The gastrointestinal therapeutics market can be segmented into various drug classes, each addressing specific gastrointestinal conditions. The major drug classes include Proton Pump Inhibitors (PPIs), H2 Receptor Antagonists, Laxatives, Antidiarrheals, Biologics & Biosimilars, Antiemetics, Antibiotics (for GI infections), and Others. Among these, PPIs are particularly dominant due to their widespread use in treating acid-related disorders, reflecting consumer preference for effective and convenient treatment options.

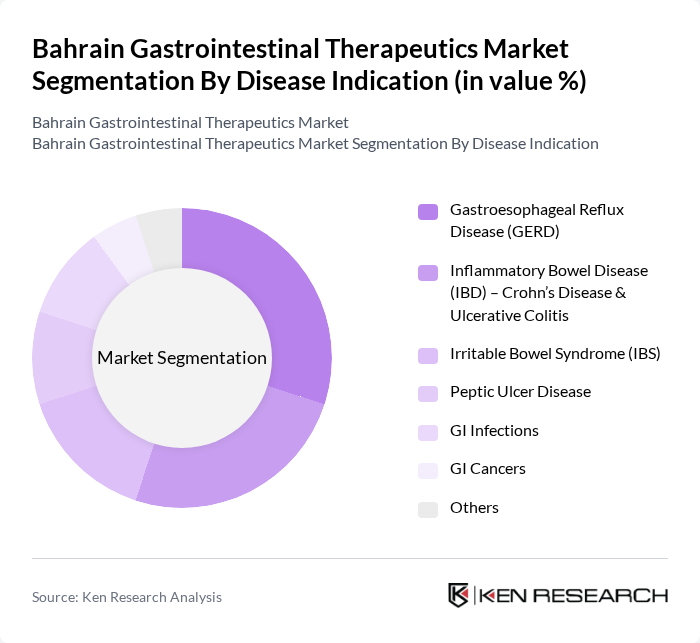

By Disease Indication:The market can also be segmented based on disease indications, which include Gastroesophageal Reflux Disease (GERD), Inflammatory Bowel Disease (IBD) – Crohn’s Disease & Ulcerative Colitis, Irritable Bowel Syndrome (IBS), Peptic Ulcer Disease, GI Infections, GI Cancers, and Others. GERD is the leading indication due to its high prevalence and the effectiveness of available treatments, driving significant market demand.

The Bahrain Gastrointestinal Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Bahrain Pharma, Al-Hekma Pharmaceuticals, Aster DM Healthcare, United Pharmaceutical Manufacturing Company, Novartis Pharmaceuticals, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Merck & Co., Inc., AbbVie Inc., Takeda Pharmaceutical Company Limited, AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain gastrointestinal therapeutics market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government continues to enhance healthcare access and infrastructure, the market is expected to witness a surge in innovative treatment options. Additionally, the integration of digital health solutions and telemedicine is likely to improve patient engagement and access to care, further supporting market growth and enhancing therapeutic outcomes for patients.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Proton Pump Inhibitors (PPIs) H2 Receptor Antagonists Laxatives Antidiarrheals Biologics & Biosimilars Antiemetics Antibiotics (for GI infections) Others |

| By Disease Indication | Gastroesophageal Reflux Disease (GERD) Inflammatory Bowel Disease (IBD) – Crohn’s Disease & Ulcerative Colitis Irritable Bowel Syndrome (IBS) Peptic Ulcer Disease GI Infections GI Cancers Others |

| By Route of Administration | Oral Parenteral Others |

| By End-User | Hospitals Clinics Homecare Settings Pharmacies Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Age Group | Pediatric Adult Geriatric |

| By Gender | Male Female |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 60 | Gastroenterologists, Clinic Managers |

| Pharmacy Sector | 50 | Pharmacists, Pharmacy Owners |

| Hospital Procurement Departments | 40 | Procurement Officers, Supply Chain Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Analysts |

The Bahrain Gastrointestinal Therapeutics Market is valued at approximately USD 11 million, reflecting a five-year historical analysis of the Digestives & Intestinal Remedies segment and regional pharmaceutical trends.