Region:Middle East

Author(s):Dev

Product Code:KRAC8785

Pages:91

Published On:November 2025

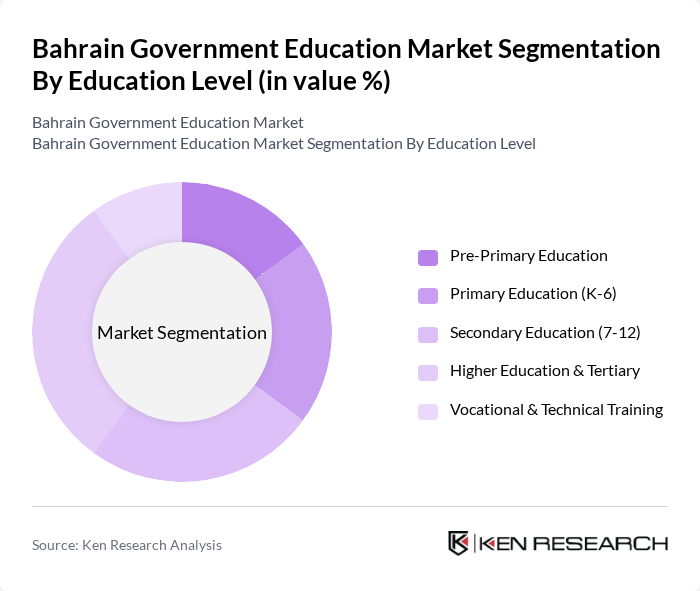

By Education Level:

The education level segmentation includes various subsegments: Pre-Primary Education, Primary Education (K-6), Secondary Education (7-12), Higher Education & Tertiary, and Vocational & Technical Training. Among these,Higher Education & Tertiaryis the leading subsegment, driven by a growing demand for skilled professionals in sectors such as healthcare, technology, and business. The increasing number of universities and colleges, along with international partnerships and the expansion of online and blended learning, has made this segment particularly attractive to students seeking advanced education. The trend towards lifelong learning, upskilling, and the adoption of digital and simulation-based training further supports the growth of this subsegment .

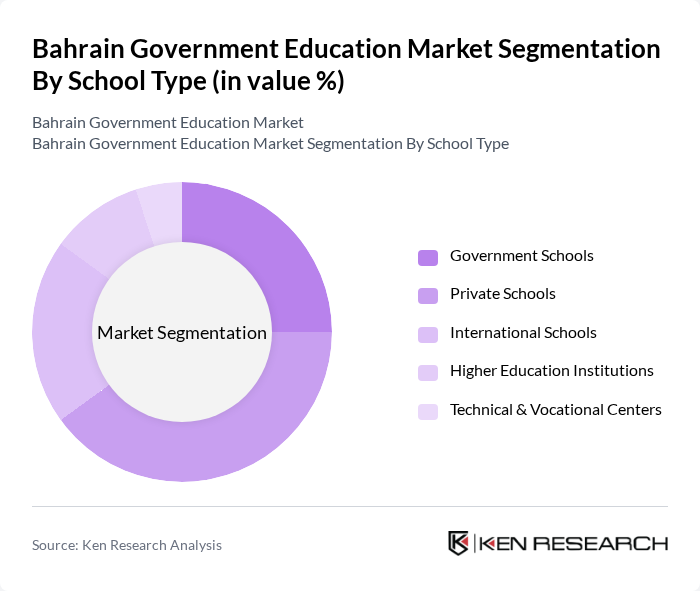

By School Type:

This segmentation includes Government Schools, Private Schools, International Schools, Higher Education Institutions, and Technical & Vocational Centers.Private Schoolsdominate this market segment, as they are preferred by many parents for their perceived higher quality of education, diverse curriculum offerings, and advanced learning environments. The increasing expatriate population in Bahrain has also led to a rise in demand for International Schools, which cater to various nationalities and educational standards. The competition among these school types drives innovation, digital transformation, and continuous improvement in educational services .

The Bahrain Government Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Education, Bahrain, Bahrain Polytechnic, University of Bahrain, Royal University for Women, Arabian Gulf University, British School of Bahrain, American School of Bahrain, International School of Choueifat - Bahrain, Bahrain International School, St. Christopher's School, The Indian School, Bahrain, Naseem International School, Al-Hekma International School, Quest International School, Bahrain Teachers College contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain government education market appears promising, driven by ongoing reforms and investments in technology. The government’s commitment to enhancing educational quality and accessibility is expected to yield positive outcomes. As e-learning and vocational training programs gain traction, educational institutions will likely adapt to meet the evolving needs of students. Furthermore, partnerships with international educational organizations may foster innovation and improve curriculum standards, ultimately benefiting the entire education ecosystem in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Education Level | Pre-Primary Education Primary Education (K-6) Secondary Education (7-12) Higher Education & Tertiary Vocational & Technical Training |

| By School Type | Government Schools Private Schools International Schools Higher Education Institutions Technical & Vocational Centers |

| By Curriculum Type | National Curriculum (Bahraini) British Curriculum American Curriculum CBSE (Indian Curriculum) Arabic/Islamic Curriculum |

| By Delivery Mode | In-Person Learning Online Learning Hybrid Learning Mobile Education |

| By Funding Source | Government Funding Private Tuition Fees International Aid & Grants Public-Private Partnerships |

| By Technology Utilization | Learning Management Systems (LMS) Interactive Digital Tools Virtual Reality & Augmented Reality AI-Powered Educational Platforms |

| By Policy Support | Government Initiatives & Reforms Educational Grants & Scholarships Tax Incentives for Private Schools Digital Literacy Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public School Administrators | 60 | Principals, Vice Principals, Education Coordinators |

| Private School Stakeholders | 50 | School Owners, Heads of Curriculum, Financial Officers |

| Higher Education Institutions | 60 | University Deans, Program Directors, Admissions Officers |

| Educational Technology Providers | 40 | Product Managers, Sales Directors, Implementation Specialists |

| Parents of School-Aged Children | 70 | Parents, Guardians, Community Leaders |

The Bahrain Government Education Market is valued at approximately USD 1.3 billion, contributing nearly 4% to the national GDP. This valuation reflects a five-year historical analysis and indicates significant growth driven by increased government spending and a rising population.