Region:Middle East

Author(s):Rebecca

Product Code:KRAC4633

Pages:86

Published On:October 2025

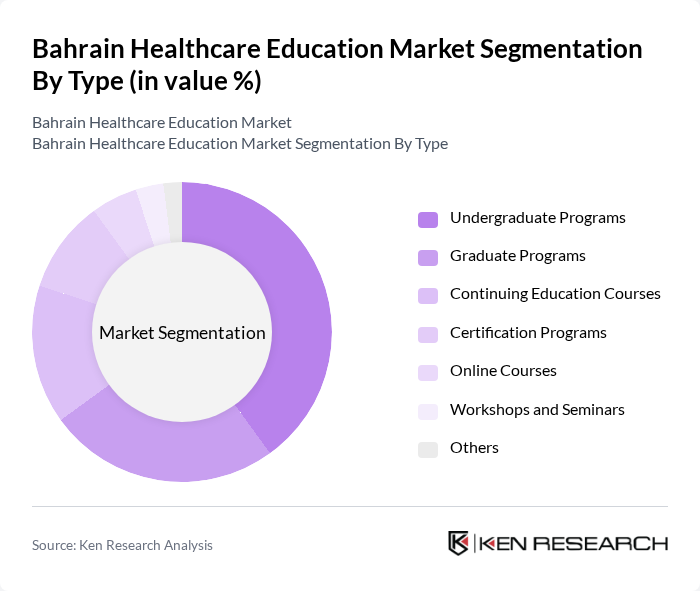

By Type:The market is segmented into various types of educational programs, including Undergraduate Programs, Graduate Programs, Continuing Education Courses, Certification Programs, Online Courses, Workshops and Seminars, and Others. Among these, Undergraduate Programs dominate the market, driven by a rising number of students pursuing degrees in medicine, nursing, pharmacy, and allied health. The demand for skilled professionals in these fields has led to a surge in enrollment, supported by government scholarships and partnerships with international institutions . The expansion of online and blended learning formats, as well as simulation-based training, is enhancing accessibility and quality across all segments.

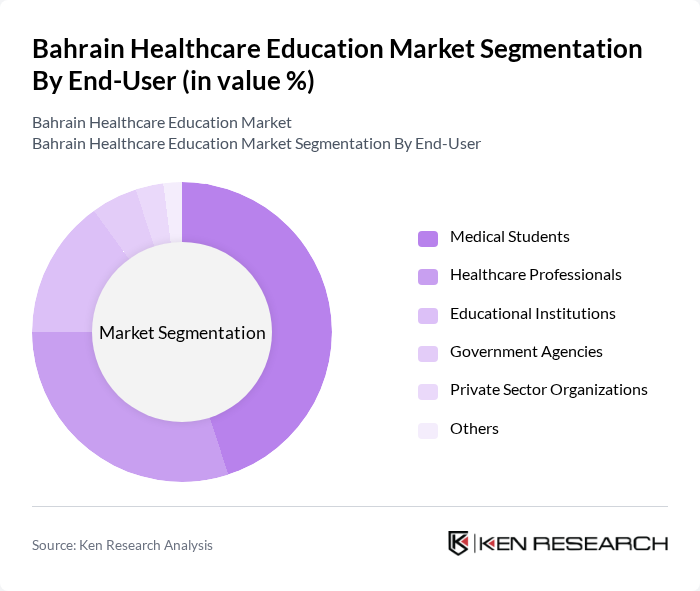

By End-User:The end-user segmentation includes Medical Students, Healthcare Professionals, Educational Institutions, Government Agencies, Private Sector Organizations, and Others. Medical Students represent the largest segment, reflecting the increasing number of individuals pursuing healthcare careers. This growth is fueled by rising awareness of health issues, government investment in education, and the need for qualified providers to address workforce shortages . Healthcare Professionals are the second-largest segment, driven by mandatory continuing education and certification requirements. Educational Institutions and Government Agencies play a pivotal role in curriculum development and quality assurance.

The Bahrain Healthcare Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabian Gulf University, University of Bahrain, Royal College of Surgeons in Ireland - Bahrain, Ahlia University, College of Health Sciences (Ministry of Health), Bahrain Medical Society, Bahrain Polytechnic, American Mission Hospital, King Hamad University Hospital, Salmaniya Medical Complex, Bahrain Specialist Hospital, Royal Bahrain Hospital, Ibn Al-Nafees Hospital, Al Salam Specialist Hospital, Al Kindi Specialised Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain healthcare education market appears promising, driven by ongoing government initiatives and technological advancements. In future, the focus on blended learning models and interprofessional education is expected to enhance the quality of training. Additionally, the integration of simulation-based learning will prepare students for real-world challenges. These trends indicate a commitment to improving healthcare education, ultimately leading to a more skilled workforce capable of addressing the healthcare needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Undergraduate Programs Graduate Programs Continuing Education Courses Certification Programs Online Courses Workshops and Seminars Others |

| By End-User | Medical Students Healthcare Professionals Educational Institutions Government Agencies Private Sector Organizations Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Mobile Learning Others |

| By Specialization | Nursing Pharmacy Dentistry Public Health Allied Health Professions Others |

| By Duration | Short-Term Courses Long-Term Programs Modular Courses Others |

| By Accreditation Status | Accredited Programs Non-Accredited Programs Others |

| By Funding Source | Government-Funded Programs Private Sector Funding International Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Education Institutions | 60 | University Deans, Program Coordinators |

| Healthcare Professionals | 100 | Doctors, Nurses, Allied Health Workers |

| Students in Healthcare Programs | 80 | Undergraduate and Postgraduate Students |

| Healthcare Policy Makers | 40 | Government Officials, Regulatory Bodies |

| Industry Experts and Consultants | 40 | Healthcare Education Consultants, Analysts |

The Bahrain Healthcare Education Market is valued at approximately USD 1.1 billion, reflecting its significant role within the total healthcare market of USD 2.4 billion. This valuation is based on a five-year historical analysis and highlights the growing demand for skilled healthcare professionals.