Region:Middle East

Author(s):Rebecca

Product Code:KRAD7391

Pages:88

Published On:December 2025

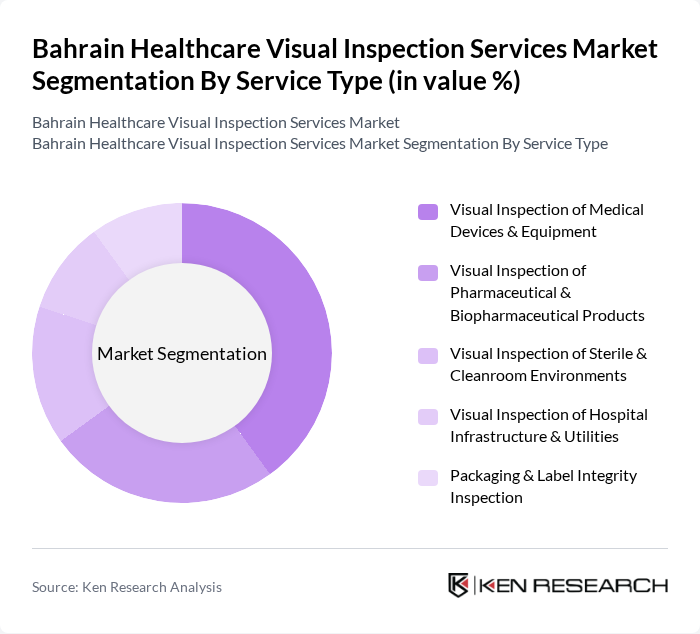

By Service Type:

The service type segmentation includes various subsegments such as Visual Inspection of Medical Devices & Equipment, Visual Inspection of Pharmaceutical & Biopharmaceutical Products, Visual Inspection of Sterile & Cleanroom Environments, Visual Inspection of Hospital Infrastructure & Utilities, and Packaging & Label Integrity Inspection. Among these, the Visual Inspection of Medical Devices & Equipment subsegment is currently dominating the market, reflecting NHRA’s medical device registration, licensing, and compliance monitoring framework, which compels healthcare providers and importers to perform systematic checks on device performance, labelling, and maintenance. This is largely due to the increasing regulatory scrutiny and the need for ensuring the safety and efficacy of medical devices in imaging, surgery, intensive care, and diagnostics. The growing base of device importers and distributors serving Bahrain, together with hospitals upgrading to advanced imaging, monitoring, and minimally invasive technologies, has also contributed to the growth of this subsegment as stakeholders seek to comply with stringent quality and safety standards.

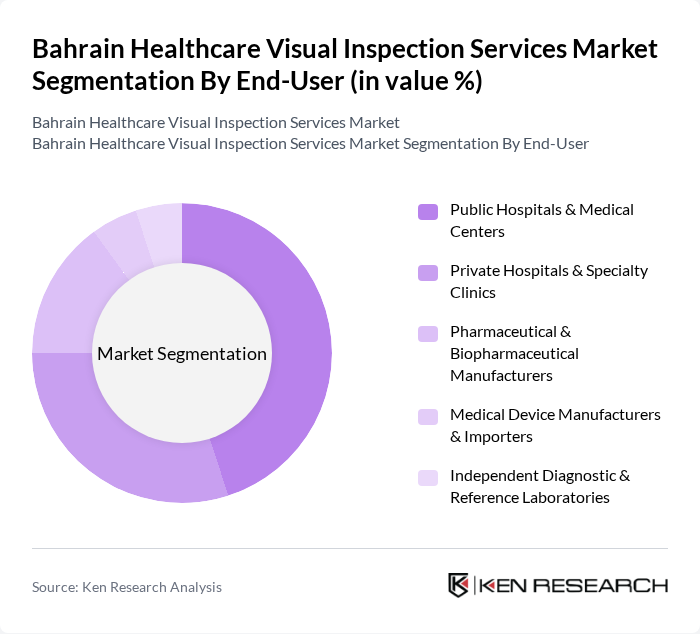

By End-User:

The end-user segmentation encompasses Public Hospitals & Medical Centers, Private Hospitals & Specialty Clinics, Pharmaceutical & Biopharmaceutical Manufacturers, Medical Device Manufacturers & Importers, and Independent Diagnostic & Reference Laboratories. The Public Hospitals & Medical Centers subsegment is leading the market due to the high volume of patients served by facilities such as Salmaniya Medical Complex, Bahrain Defense Force Hospital, and King Hamad University Hospital, which operate under NHRA licensing and periodic inspection. These institutions are subject to stringent regulatory requirements, including facility accreditation, infection prevention and control audits, and equipment quality checks, and are increasingly investing in structured visual inspection services to ensure compliance, minimize adverse events, and strengthen patient safety.

The Bahrain Healthcare Visual Inspection Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Health Regulatory Authority (NHRA) – Bahrain, Ministry of Health – Kingdom of Bahrain, Bahrain Defense Force (BDF) Hospital, King Hamad University Hospital, Salmaniya Medical Complex, Royal Bahrain Hospital, American Mission Hospital, Ibn Al-Nafees Hospital, KIMSHEALTH Hospital Bahrain, Dr. Sulaiman Al-Habib Medical Group – Bahrain Operations, Banoon Center for Women & Children – Bahrain Specialist Hospital Group, SGS Gulf Ltd. – Bahrain Branch, TÜV Nord Middle East W.L.L. – Bahrain, Intertek International Ltd. – Bahrain, Bureau Veritas Bahrain W.L.L. contribute to innovation, geographic expansion, and service delivery in this space by embedding inspection and quality-control activities into clinical operations, accreditation preparation, medical device and pharmaceutical conformity assessment, and facility audits.

The future of the Bahrain healthcare visual inspection services market appears promising, driven by ongoing technological advancements and a heightened focus on patient safety. As healthcare facilities increasingly prioritize quality assurance, the integration of AI and automation will likely streamline inspection processes. Additionally, partnerships with international service providers may enhance local capabilities, fostering innovation and improving service delivery. These trends indicate a robust growth trajectory for the market, aligning with Bahrain's broader healthcare objectives.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Visual Inspection of Medical Devices & Equipment Visual Inspection of Pharmaceutical & Biopharmaceutical Products Visual Inspection of Sterile & Cleanroom Environments Visual Inspection of Hospital Infrastructure & Utilities Packaging & Label Integrity Inspection |

| By End-User | Public Hospitals & Medical Centers Private Hospitals & Specialty Clinics Pharmaceutical & Biopharmaceutical Manufacturers Medical Device Manufacturers & Importers Independent Diagnostic & Reference Laboratories |

| By Service Delivery Model | In?house Inspection (Provider Operated within Facility) Outsourced Third?Party Inspection Services Hybrid (In?house + Third?Party Support) |

| By Technology | Manual & Visual Line?of?Sight Inspection Semi?Automated Vision Inspection Systems Fully Automated Vision Inspection Systems AI?Enabled & Machine?Learning Inspection Solutions |

| By Application | Regulatory Compliance & Accreditation Audits Quality Assurance & Batch Release Preventive Maintenance & Asset Integrity Patient Safety & Infection Control Risk Management & Incident Investigation |

| By Ownership / Sector | Government & Semi?Government Providers Private Sector Providers Military & Royal Medical Services Non?Profit & Charitable Healthcare Organizations |

| By Compliance & Certification Focus | National Health Regulatory Authority (NHRA) Compliance Joint Commission International (JCI) & Other Accreditation GMP / GDP / ISO Standards Compliance Environmental, Health & Safety (EHS) and Infection Control Standards |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Visual Inspection Services | 110 | Hospital Administrators, Medical Directors |

| Private Clinic Visual Inspection Services | 85 | Clinic Owners, Healthcare Practitioners |

| Diagnostic Imaging Centers | 75 | Radiologists, Imaging Technologists |

| Patient Experience in Visual Inspections | 95 | Patients, Caregivers |

| Regulatory Compliance in Visual Inspection | 65 | Compliance Officers, Quality Assurance Managers |

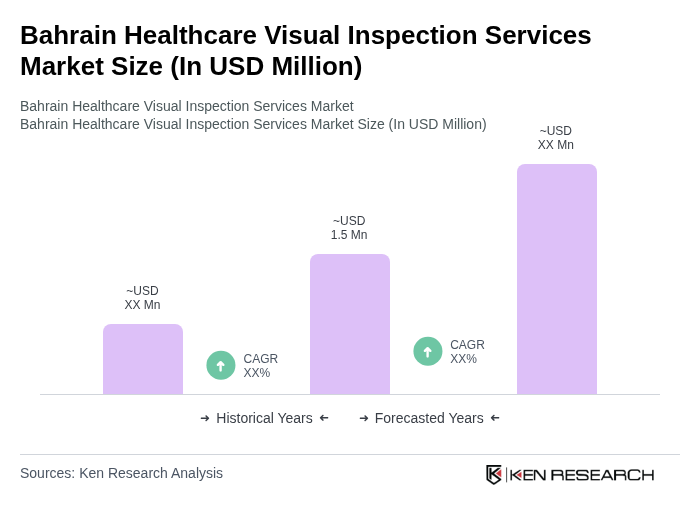

The Bahrain Healthcare Visual Inspection Services Market is valued at approximately USD 1.5 million, reflecting a historical analysis that highlights the increasing demand for quality assurance in healthcare facilities and regulatory compliance requirements.