Region:Middle East

Author(s):Dev

Product Code:KRAA9702

Pages:89

Published On:November 2025

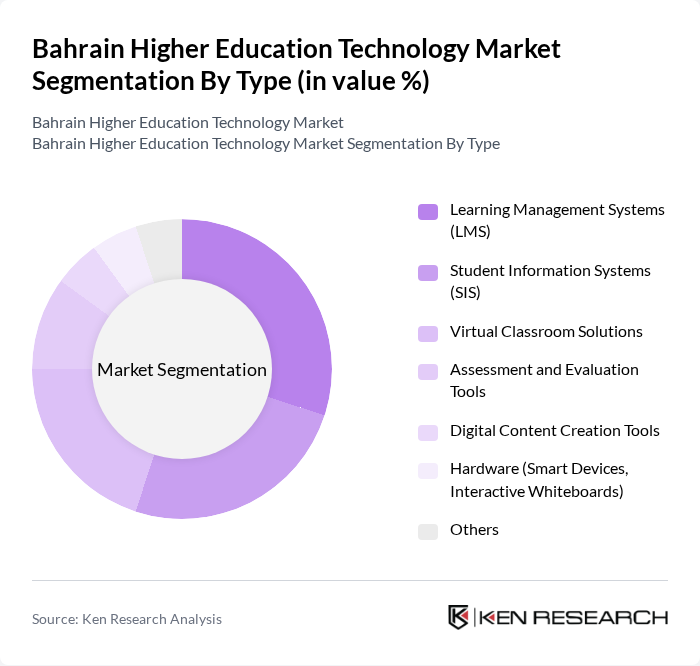

By Type:The market is segmented into various types, includingLearning Management Systems (LMS),Student Information Systems (SIS),Virtual Classroom Solutions,Assessment and Evaluation Tools,Digital Content Creation Tools,Hardware (Smart Devices, Interactive Whiteboards), andOthers. Each of these subsegments plays a crucial role in enhancing the educational experience and operational efficiency of institutions. LMS and SIS are central to digital transformation, supporting course management, student tracking, and administrative automation. Virtual classroom solutions and assessment tools enable interactive and remote learning, while digital content creation tools and hardware facilitate blended and personalized education.

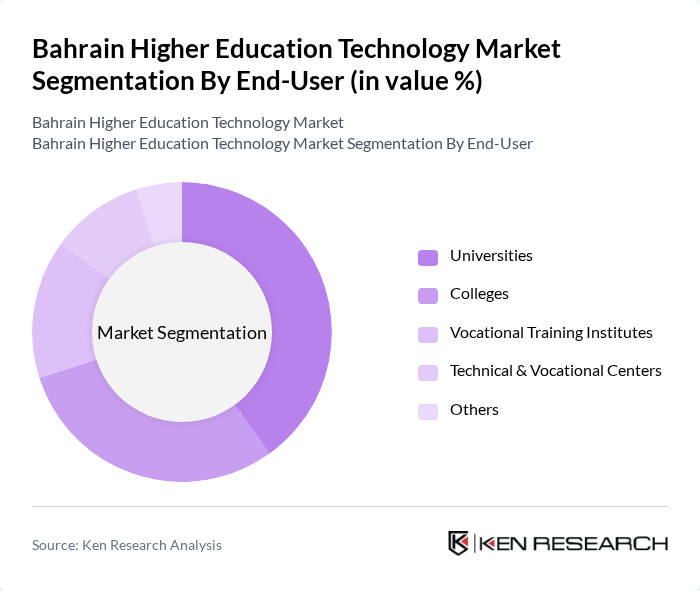

By End-User:The end-user segmentation includesUniversities,Colleges,Vocational Training Institutes,Technical & Vocational Centers, andOthers. Each segment utilizes technology differently, with universities leading adoption of comprehensive digital solutions, including AI-powered platforms, e-learning modules, and blended learning environments. Vocational and technical centers focus on simulation-based training and upskilling, while colleges and other institutions prioritize accessibility and operational efficiency.

The Bahrain Higher Education Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Bahrain, Bahrain Polytechnic, Ahlia University, Arabian Gulf University, Bahrain Institute of Banking and Finance (BIBF), Gulf University, Royal University for Women, University College of Bahrain, Bahrain Training Institute, British School of Bahrain, American School of Bahrain, Bahrain Teachers College, Al-Hekma International School, St. Christopher's School, Quest International School, Naseem International School, Bahrain International School, International School of Choueifat - Bahrain, The Indian School, Bahrain, Bahrain EdTech Solutions (private sector vendor), Classera Bahrain, Pearson Middle East (Bahrain operations), Blackboard Inc. (Bahrain clients), Microsoft Education (Bahrain partners), Google for Education (Bahrain partners) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain higher education technology market appears promising, driven by ongoing government support and increasing student demand for innovative learning solutions. As institutions continue to adopt hybrid learning models, the integration of advanced technologies will likely enhance educational experiences. Furthermore, the focus on personalized learning and data analytics will shape the educational landscape, fostering a more engaging and effective learning environment for students across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Student Information Systems (SIS) Virtual Classroom Solutions Assessment and Evaluation Tools Digital Content Creation Tools Hardware (Smart Devices, Interactive Whiteboards) Others |

| By End-User | Universities Colleges Vocational Training Institutes Technical & Vocational Centers Others |

| By Delivery Mode | Online Learning Blended Learning Face-to-Face Learning Mobile Learning Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Learning Applications AI-Powered Educational Platforms Interactive Digital Tools (VR/AR) Others |

| By Application | Curriculum Development Student Engagement Administrative Management Assessment & Analytics Others |

| By Investment Source | Government Funding Private Investments International Grants Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Educational Grants Innovation Incubation Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Technology Adoption | 80 | IT Directors, Deans of Academic Affairs |

| Student Technology Usage | 120 | Undergraduate and Graduate Students |

| Faculty Technology Integration | 60 | Professors, Lecturers, and Teaching Assistants |

| EdTech Vendor Insights | 40 | Sales Managers, Product Development Leads |

| Government Education Policy Impact | 40 | Policy Makers, Education Consultants |

The Bahrain Higher Education Technology Market is valued at approximately USD 120 million, driven by the increasing adoption of digital learning solutions and government investments in educational technology infrastructure.