Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3753

Pages:90

Published On:November 2025

By Type:The market is segmented into Aliphatic Solvents, Aromatic Solvents, Chlorinated Solvents, Alcohols, and Others. Aliphatic Solvents currently hold the largest market share, favored for their versatility, low toxicity, and reduced environmental impact. These solvents are widely used in manufacturing and automotive industries for degreasing, cleaning, and surface preparation, aligning with the shift toward safer and more sustainable chemical solutions.

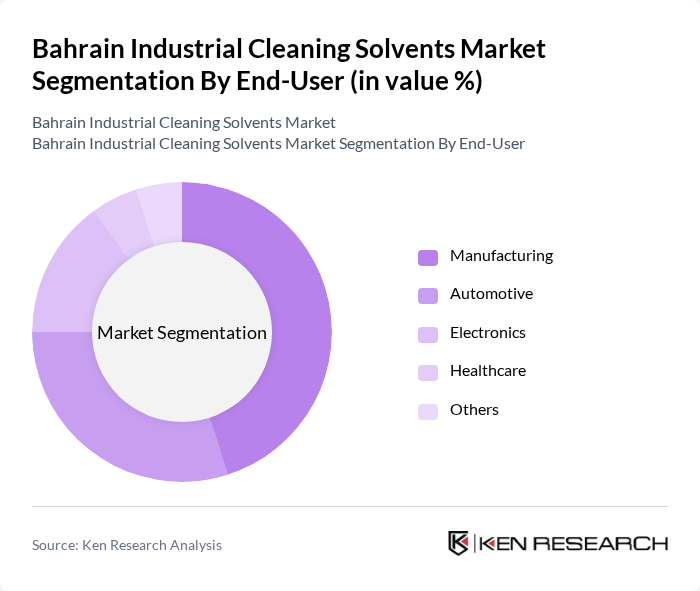

By End-User:End-user segmentation includes Manufacturing, Automotive, Electronics, Healthcare, and Others. Manufacturing remains the dominant sector, driven by the need for high-performance cleaning solutions to maintain equipment, ensure product quality, and comply with hygiene standards. The automotive industry also accounts for a significant share, primarily for degreasing and surface treatment applications, while electronics and healthcare sectors are increasingly adopting specialized solvents for precision cleaning and contamination control.

The Bahrain Industrial Cleaning Solvents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Chemicals and Industrial Oils, Bahrain National Gas Company, Almoayyed International Group, Bahrain Petroleum Company, A. A. Almoayyed & Sons, Al-Hidd Industrial Solutions, Gulf Oil and Gas, Bahrain Industrial Gas Company, Al-Bahrainia Group, Al-Mohsin Group, Al-Salam International, Al-Mansoori Specialized Engineering, Bahrain Chemical Company, Al-Futtaim Group, K. A. Al-Ghanim & Sons contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain industrial cleaning solvents market appears promising, driven by ongoing trends towards sustainability and technological innovation. As companies increasingly adopt eco-friendly practices, the demand for biodegradable solvents is expected to rise. Additionally, advancements in solvent formulations will enhance cleaning efficiency and safety. The integration of automation in cleaning processes will further streamline operations, allowing businesses to meet stringent health and safety standards while reducing labor costs, ultimately shaping a more competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Aliphatic Solvents Aromatic Solvents Chlorinated Solvents Alcohols Others |

| By End-User | Manufacturing Automotive Electronics Healthcare Others |

| By Application | Surface Cleaning Degreasing Paint Thinning Adhesive Removal Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Packaging Type | Bulk Packaging Drums Bottles Pails Others |

| By Chemical Composition | Hydrocarbon Solvents Oxygenated Solvents Halogenated Solvents Others |

| By Industry Standards Compliance | ISO Standards ASTM Standards REACH Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Solvent Usage | 45 | Production Managers, Quality Control Supervisors |

| Cleaning Services Industry Insights | 38 | Operations Managers, Service Coordinators |

| Government Regulatory Compliance | 28 | Environmental Compliance Officers, Policy Makers |

| Research & Development in Solvent Formulation | 32 | R&D Managers, Chemical Engineers |

| Distribution Channels for Cleaning Solvents | 42 | Supply Chain Managers, Logistics Coordinators |

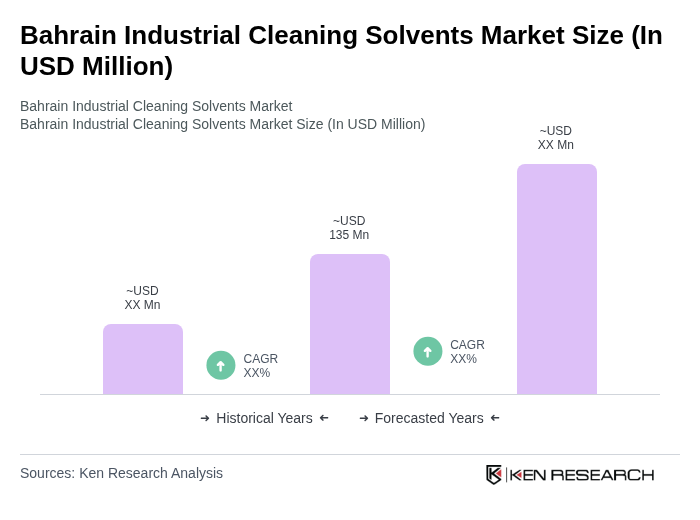

The Bahrain Industrial Cleaning Solvents Market is valued at approximately USD 135 million, reflecting a five-year historical analysis and regional normalization against the broader Middle East & Africa market size of USD 3,087.9 million.