Region:Middle East

Author(s):Dev

Product Code:KRAD5117

Pages:96

Published On:December 2025

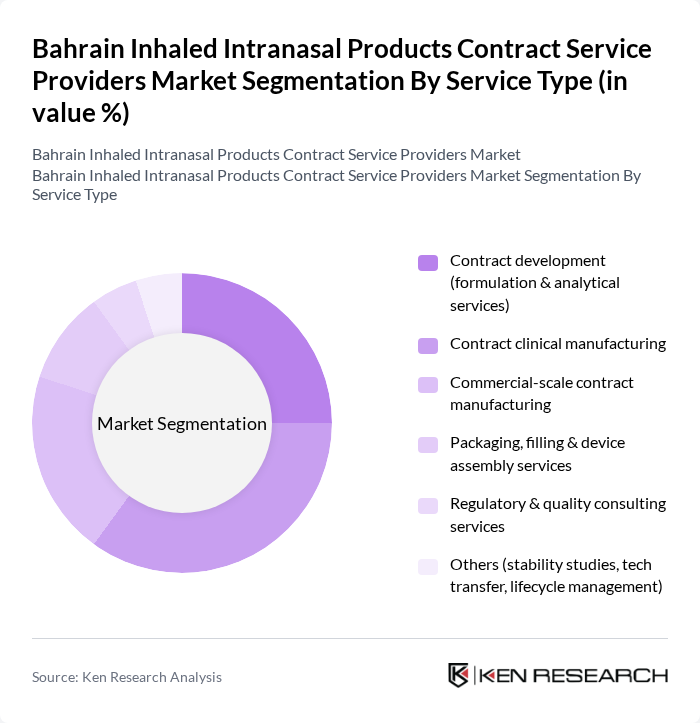

By Service Type:The service type segmentation includes various categories that cater to the diverse needs of the inhaled intranasal products market. The dominant sub-segment is contract clinical and commercial manufacturing, which is crucial for the scalable development, filling, and packaging of metered-dose inhalers, dry powder inhalers, and nasal sprays for both generic and branded products. This segment benefits from the increasing number of regional and global clinical trials involving inhaled routes, the need for specialized device?drug combination capabilities, and the outsourcing of sterile and complex dosage manufacturing to experienced contract development and manufacturing organizations. Other significant segments include contract development and analytical testing, as well as regulatory and quality consulting services, which support formulation optimization, device engineering, bioequivalence studies, and compliance with NHRA, GCC, EMA, and FDA requirements, thereby underpinning overall market growth.

By Dosage / Delivery Type:The dosage and delivery type segmentation encompasses various forms of inhaled products, with metered-dose inhalers (MDI) and dry powder inhalers (DPI) together accounting for a substantial share of inhalation therapy, in line with regional and global usage patterns for asthma and chronic obstructive pulmonary disease treatment. The popularity of MDIs is attributed to their ease of use, familiarity among clinicians and patients, and effectiveness in delivering bronchodilators and corticosteroids directly to the lungs, while DPIs are gaining ground due to propellant?free operation and improved portability. Other notable segments include nebulized solutions and suspensions for hospital and pediatric use, and nasal sprays, powders, and gels, which are increasingly adopted for allergic rhinitis, sinusitis, anti?pollution protection, and emerging systemic indications using intranasal drug delivery platforms.

The Bahrain Inhaled Intranasal Products Contract Service Providers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group Ltd., Catalent Inc., Kindeva Drug Delivery, Recipharm AB, Hovione, Aenova Group, Aptar Pharma, Vectura Group plc, Aetos Pharma Private Limited, Cipla Gulf FZ LLC, Glenmark Pharmaceuticals Ltd., Nasaleze International Ltd., Stérimar (Laboratoire de la Mer), Sandoz (a Novartis division), Bayer AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inhaled intranasal products market in Bahrain appears promising, driven by increasing healthcare investments and a growing focus on patient-centric solutions. As the healthcare infrastructure expands, more patients will gain access to innovative inhalation therapies. Additionally, the integration of digital health technologies is expected to enhance patient engagement and adherence, further propelling market growth. The collaboration between contract service providers and pharmaceutical companies will also play a crucial role in advancing product development and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Contract development (formulation & analytical services) Contract clinical manufacturing Commercial-scale contract manufacturing Packaging, filling & device assembly services Regulatory & quality consulting services Others (stability studies, tech transfer, lifecycle management) |

| By Dosage / Delivery Type | Metered-dose inhalers (MDI) Dry powder inhalers (DPI) Nebulized solutions & suspensions Nasal sprays (aqueous and suspension) Nasal powders & gels Others (soft-mist, novel inhalation devices) |

| By Therapeutic Application | Asthma and COPD Allergic rhinitis & sinusitis Anti-infectives and vaccines (respiratory) CNS and pain management via intranasal route Anti-pollution and saline-based nasal products Others |

| By Client Type | Global innovator pharma & biotech Generic pharmaceutical companies Regional / GCC-based pharma companies OTC and consumer health companies Others (start-ups, research institutes) |

| By Engagement Model | Full-service CDMO (end-to-end) Project-based outsourcing Long-term strategic manufacturing partnerships Technology transfer & licensing-based engagements |

| By Target Market (Demand Origin) | Bahrain domestic market GCC export markets Wider MENA export markets Rest of world |

| By Facility Location | Bahrain-based facilities GCC-based facilities serving Bahrain Europe-based facilities serving Bahrain Asia-based facilities serving Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | Product Managers, R&D Directors |

| Healthcare Providers | 80 | Physicians, Pharmacists |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 50 | Market Analysts, Business Development Managers |

| Patient Advocacy Groups | 45 | Patient Representatives, Health Educators |

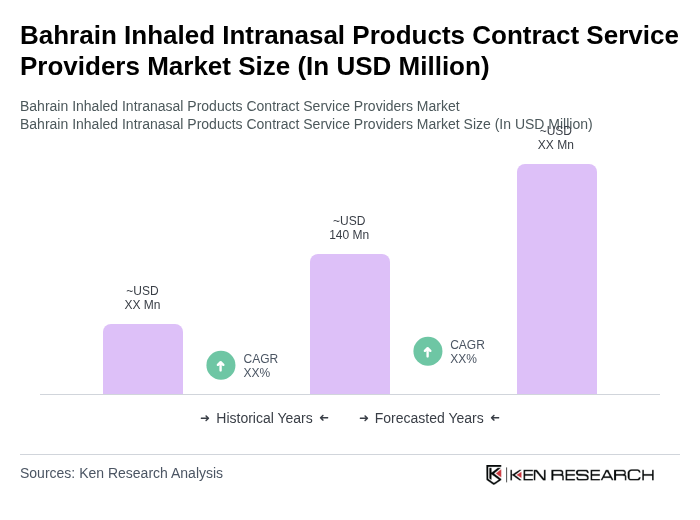

The Bahrain Inhaled Intranasal Products Contract Service Providers Market is valued at approximately USD 140 million, reflecting a robust growth trajectory influenced by rising respiratory disease prevalence and advancements in drug delivery technologies.