Region:Middle East

Author(s):Dev

Product Code:KRAB7570

Pages:86

Published On:October 2025

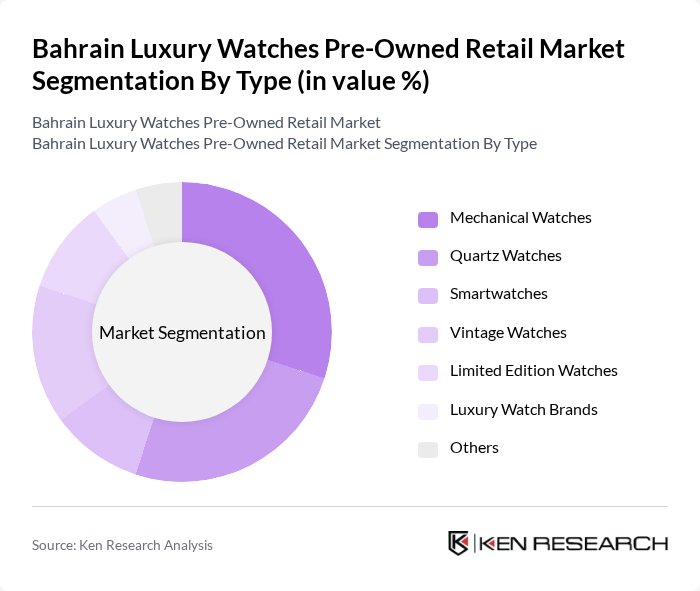

By Type:The market is segmented into various types of luxury watches, including Mechanical Watches, Quartz Watches, Smartwatches, Vintage Watches, Limited Edition Watches, Luxury Watch Brands, and Others. Among these, Mechanical Watches are particularly popular due to their craftsmanship and heritage, appealing to collectors and enthusiasts. Quartz Watches also hold a significant share due to their affordability and precision. The demand for Vintage and Limited Edition Watches is rising as consumers seek unique pieces that reflect personal style and investment potential.

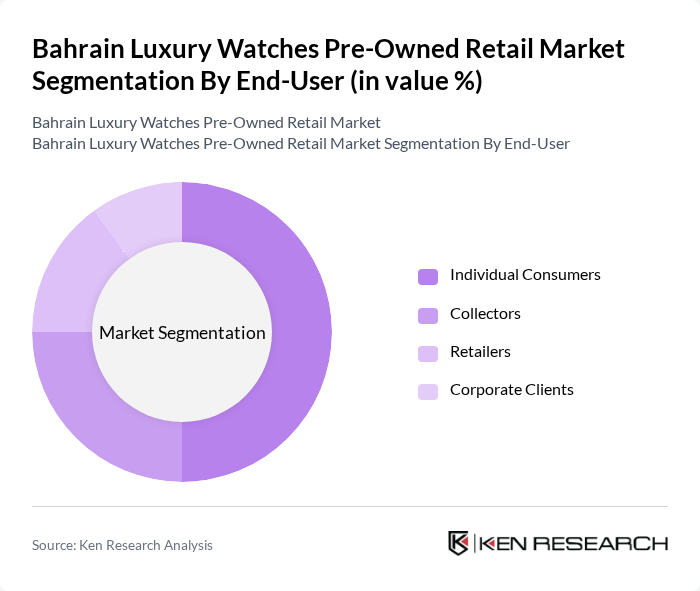

By End-User:The end-user segmentation includes Individual Consumers, Collectors, Retailers, and Corporate Clients. Individual Consumers dominate the market, driven by a growing trend of personal luxury consumption. Collectors are also significant, often seeking rare and vintage pieces as investments. Retailers play a crucial role in the distribution of pre-owned watches, while Corporate Clients are increasingly purchasing luxury watches as gifts or for employee recognition, further driving market growth.

The Bahrain Luxury Watches Pre-Owned Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ahmed Seddiqi & Sons, Al Haramain Watches, Al Jazeera Watches, Al Mufeed Watches, and Al Zain Watches contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain luxury watches pre-owned retail market appears promising, driven by evolving consumer preferences and technological advancements. The increasing shift towards sustainable luxury and vintage items is expected to reshape purchasing behaviors, with consumers valuing authenticity and heritage. Additionally, the integration of augmented reality in retail experiences will enhance customer engagement, allowing for immersive shopping experiences that could further stimulate market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Watches Quartz Watches Smartwatches Vintage Watches Limited Edition Watches Luxury Watch Brands Others |

| By End-User | Individual Consumers Collectors Retailers Corporate Clients |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Auction Houses Luxury Watch Fairs |

| By Price Range | Under $1,000 $1,000 - $5,000 $5,000 - $10,000 Above $10,000 |

| By Condition | Like New Gently Used Well-Worn |

| By Brand Popularity | High-End Brands Mid-Tier Brands Emerging Brands |

| By Certification Status | Certified Authentic Non-Certified Warranty Included |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 100 | Store Managers, Sales Executives |

| Pre-Owned Watch Dealers | 80 | Business Owners, Inventory Managers |

| Affluent Consumers | 150 | Luxury Goods Buyers, Watch Collectors |

| Market Analysts | 50 | Industry Experts, Financial Analysts |

| Luxury Watch Enthusiasts | 70 | Bloggers, Social Media Influencers |

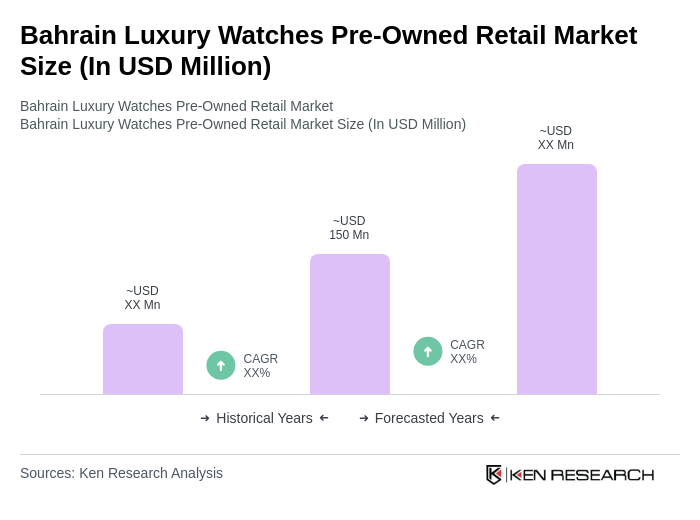

The Bahrain Luxury Watches Pre-Owned Retail Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing disposable income and a rising interest in luxury goods among consumers.