Region:Middle East

Author(s):Dev

Product Code:KRAD6363

Pages:98

Published On:December 2025

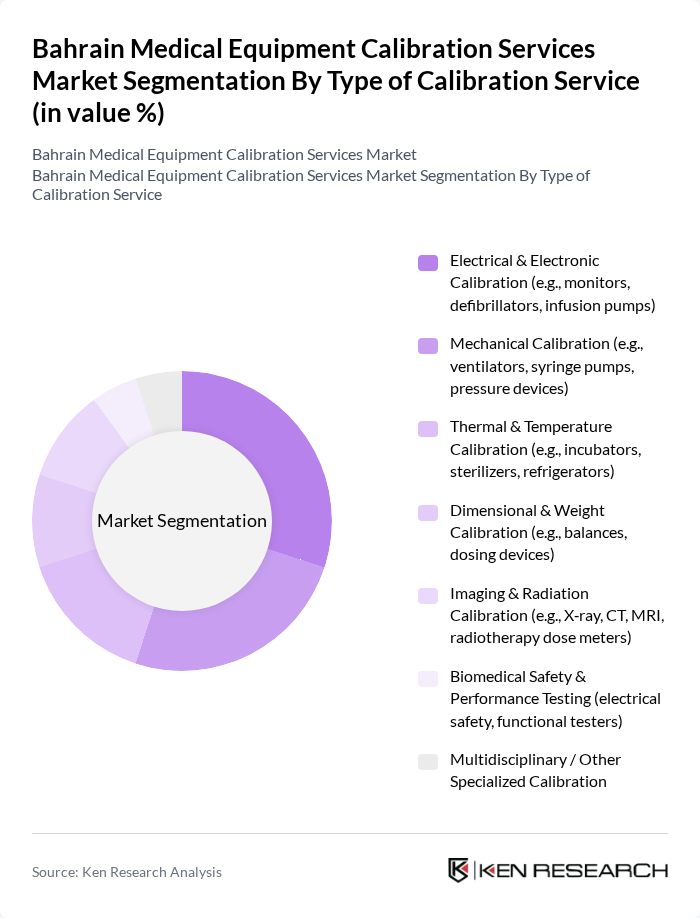

By Type of Calibration Service:

The Electrical & Electronic Calibration segment is dominating the market due to the high volume of electronic medical devices used in healthcare settings, mirroring the dominance of electrical test and measurement categories in broader calibration markets. The increasing reliance on advanced monitoring systems, life-support equipment, anesthesia workstations, and smart infusion technologies necessitates regular calibration and verification to ensure accuracy, traceability to national/international standards, and compliance with hospital safety protocols. Additionally, the growing trend of integrating technology in healthcare, such as telemedicine, networked patient monitoring, and connected medical devices (IoT-enabled), further drives demand for electronic calibration and periodic performance checks across hospital IT–biomedical interfaces. This segment's prominence is also supported by hospitals’ focus on uptime, risk-based maintenance strategies, and external accreditation audits that require evidence of calibrated and properly functioning electronic equipment.

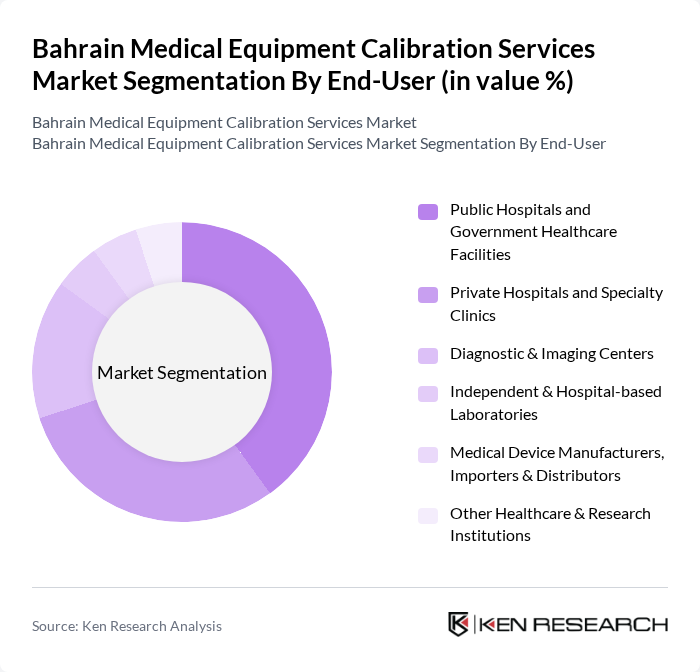

By End-User:

Public Hospitals and Government Healthcare Facilities are the leading end-users in the market, primarily due to the large installed base of medical equipment they operate and the structured quality, safety, and accreditation frameworks they must adhere to under Bahrain’s national health strategy and NHRA oversight. These facilities are required to maintain high standards of patient care, which includes documented preventive maintenance programs, routine calibration, and performance verification of critical devices in line with manufacturer recommendations and international standards. The increasing government focus on healthcare quality, expansion of specialized services, and investments in digital health and advanced diagnostics further emphasize the need for reliable calibration services in public institutions. Additionally, the growing number and sophistication of private hospitals, day-surgery centers, and specialty clinics—particularly in cardiology, oncology, and imaging—also contribute to the overall demand, but public facilities remain the largest segment due to their size, case mix, and more comprehensive service portfolios.

The Bahrain Medical Equipment Calibration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS Bahrain – Instrument Calibration and Repair, Geo S A R W.L.L. (GeoSAR) – Calibration & Testing Services, Bahrain Medical & Industrial Services W.L.L., Y.K. Almoayyed & Sons – Medical & Laboratory Equipment Division, Gulf Medical Co. W.L.L. (Bahrain), Al Jishi Corporation – Medical & Laboratory Equipment, Middle East Medical Supplies & Services W.L.L. (Bahrain), Medtronic Bahrain (Regional Office / Authorized Service Network), GE HealthCare – Bahrain Service & Calibration Support, Siemens Healthineers – Bahrain Service & Calibration Support, Philips Healthcare – Bahrain Service & Calibration Support, Mindray Medical – Authorized Service Partner in Bahrain, Dräger – Regional Service & Calibration Support for Bahrain, Skanray / Other OEM-authorized Biomedical Service Providers in Bahrain, International Third-party Calibration Providers Serving Bahrain (e.g., Tektronix, Micro Precision, Nemko) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Medical Equipment Calibration Services market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the healthcare infrastructure expands, the demand for reliable calibration services is expected to rise. Additionally, the integration of IoT technologies in medical devices will necessitate more frequent calibration, creating new opportunities for service providers. The focus on patient safety and regulatory compliance will further enhance the market's growth trajectory, ensuring a robust environment for calibration services.

| Segment | Sub-Segments |

|---|---|

| By Type of Calibration Service | Electrical & Electronic Calibration (e.g., monitors, defibrillators, infusion pumps) Mechanical Calibration (e.g., ventilators, syringe pumps, pressure devices) Thermal & Temperature Calibration (e.g., incubators, sterilizers, refrigerators) Dimensional & Weight Calibration (e.g., balances, dosing devices) Imaging & Radiation Calibration (e.g., X?ray, CT, MRI, radiotherapy dose meters) Biomedical Safety & Performance Testing (electrical safety, functional testers) Multidisciplinary / Other Specialized Calibration |

| By End-User | Public Hospitals and Government Healthcare Facilities Private Hospitals and Specialty Clinics Diagnostic & Imaging Centers Independent & Hospital-based Laboratories Medical Device Manufacturers, Importers & Distributors Other Healthcare & Research Institutions |

| By Equipment Category | Diagnostic Imaging Systems (X?ray, CT, MRI, ultrasound, mammography) Life-support & Critical Care Devices (ventilators, defibrillators, anesthesia machines) Patient Monitoring & Therapeutic Devices (vital sign monitors, infusion/syringe pumps) Laboratory & Analytical Equipment (analyzers, centrifuges, incubators, refrigerators) Radiation Protection & Dosimetry Instruments Other General Medical & Surgical Equipment |

| By Service Delivery Model | On-site Calibration at Healthcare Facility In-lab / Off-site Calibration OEM / Manufacturer-backed Calibration Services Third-party Independent Calibration Providers Emergency / Breakdown Calibration & Repair Scheduled / Contract-based Preventive Calibration |

| By Accreditation / Compliance Status | ISO/IEC 17025 Accredited Calibration Services Non-accredited but Standards-compliant Services Other Certifications (e.g., ISO 9001, OEM-authorized centers) |

| By Customer Contract Type | Long-term Comprehensive Service Contracts (AMCs) Short-term / One-off Calibration Engagements Multi-site / Group Hospital Framework Agreements Public Sector Tenders & Framework Contracts Others |

| By Geographic Coverage within Bahrain | Capital Governorate (Manama & surrounding areas) Muharraq Governorate Northern Governorate Southern Governorate Kingdom-wide / Multi-governorate Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Calibration Services | 110 | Biomedical Engineers, Hospital Administrators |

| Private Clinic Equipment Calibration | 80 | Clinic Managers, Medical Equipment Technicians |

| Calibration for Diagnostic Equipment | 65 | Radiologists, Laboratory Managers |

| Calibration for Surgical Instruments | 55 | Surgical Staff, Equipment Maintenance Supervisors |

| Regulatory Compliance in Calibration | 85 | Quality Assurance Officers, Compliance Managers |

The Bahrain Medical Equipment Calibration Services Market is valued at approximately USD 20 million, reflecting a historical analysis of the calibration services sector within Bahrain's broader test and measurement equipment domain.