Region:Middle East

Author(s):Shubham

Product Code:KRAD3604

Pages:99

Published On:November 2025

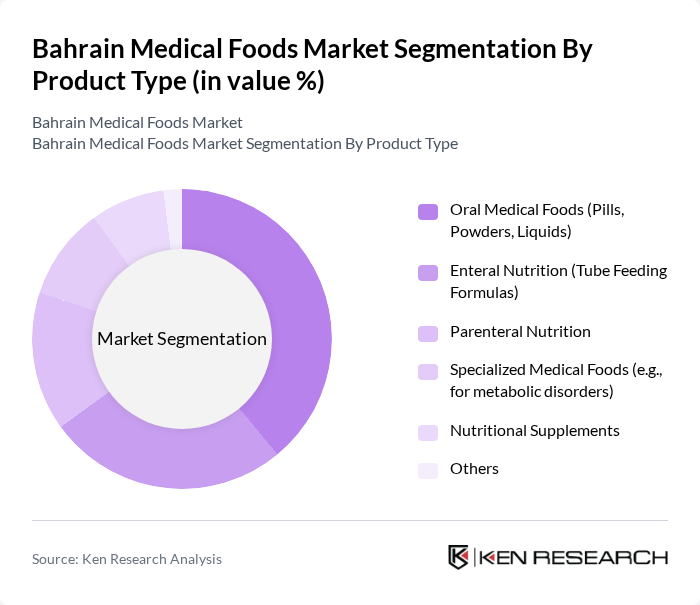

By Product Type:The product type segmentation includes various categories of medical foods that cater to different health needs. The subsegments include Oral Medical Foods (Pills, Powders, Liquids), Enteral Nutrition (Tube Feeding Formulas), Parenteral Nutrition, Specialized Medical Foods (e.g., for metabolic disorders), Nutritional Supplements, and Others. Among these, Oral Medical Foods are leading the market due to their convenience, wide acceptance among consumers, and preference in both outpatient and home care settings .

By Route of Administration:This segmentation focuses on how medical foods are administered to patients. The subsegments include Oral, Enteral, and Parenteral routes. The Oral route is the most dominant due to its ease of use, patient preference, and suitability for chronic disease management and elderly care .

The Bahrain Medical Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Nestlé Health Science, Danone Nutricia, Mead Johnson Nutrition, Fresenius Kabi, B. Braun Melsungen AG, Hormel Health Labs, Reckitt Benckiser Group plc, GlaxoSmithKline plc, Herbalife Nutrition Ltd., Ordesa S.L., Rousselot, Eucare Pharmaceuticals Pvt. Ltd., Nutricia Middle East DMCC, Novartis AG, Ajinomoto Co., Inc., Baxter International Inc., Vitaflo International Ltd., Nestlé Bahrain Trading LLC, Almarai Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain medical foods market appears promising, driven by increasing consumer awareness and government support for health initiatives. As healthcare infrastructure continues to expand, the accessibility of medical foods will improve, fostering greater adoption. Additionally, the trend towards personalized nutrition solutions is expected to gain traction, aligning with the growing demand for tailored dietary interventions. This evolving landscape presents a unique opportunity for innovation and collaboration within the sector, paving the way for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Oral Medical Foods (Pills, Powders, Liquids) Enteral Nutrition (Tube Feeding Formulas) Parenteral Nutrition Specialized Medical Foods (e.g., for metabolic disorders) Nutritional Supplements Others |

| By Route of Administration | Oral Enteral Parenteral |

| By End-User | Hospitals Homecare Settings Long-term Care Facilities Outpatient Clinics Elderly Population Others |

| By Distribution Channel | Institutional Sales (Hospitals, Clinics) Pharmacies Online Retail Supermarkets/Hypermarkets Direct Sales Others |

| By Health Condition | Diabetes Cancer Gastrointestinal Disorders Neurological Disorders Renal Disorders Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Packaging Type | Bottles Tetra Packs Sachets Cans Others |

| By Price Range | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Dietitians, Nutritionists, Physicians |

| Patients Using Medical Foods | 120 | Individuals with chronic illnesses, Elderly patients |

| Caregivers and Family Members | 80 | Caregivers of patients with dietary restrictions |

| Pharmaceutical and Medical Food Distributors | 60 | Sales Managers, Product Managers |

| Health Policy Makers | 50 | Government Officials, Health Administrators |

The Bahrain Medical Foods Market is valued at approximately USD 120 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, an aging population, and heightened health awareness among consumers.