Region:Middle East

Author(s):Rebecca

Product Code:KRAD6216

Pages:86

Published On:December 2025

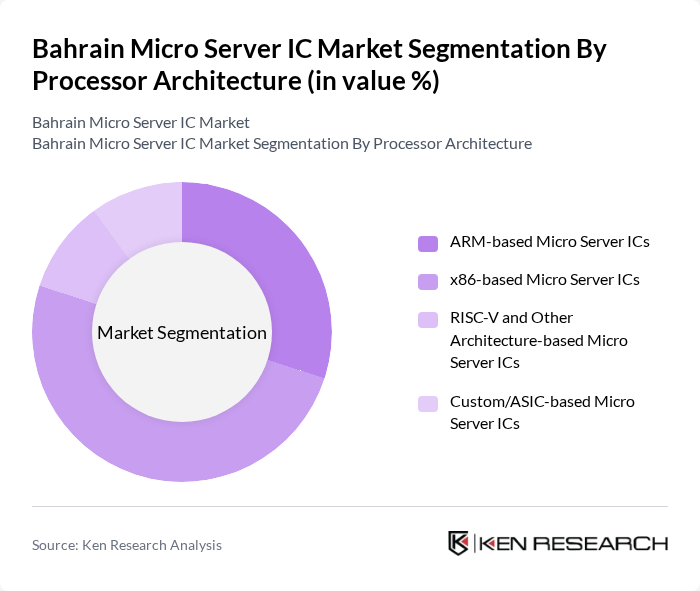

By Processor Architecture:The market is segmented into four main processor architectures: ARM-based Micro Server ICs, x86-based Micro Server ICs, RISC-V and Other Architecture-based Micro Server ICs, and Custom/ASIC-based Micro Server ICs. Each architecture serves different performance needs and application requirements, influencing their market share and growth dynamics.

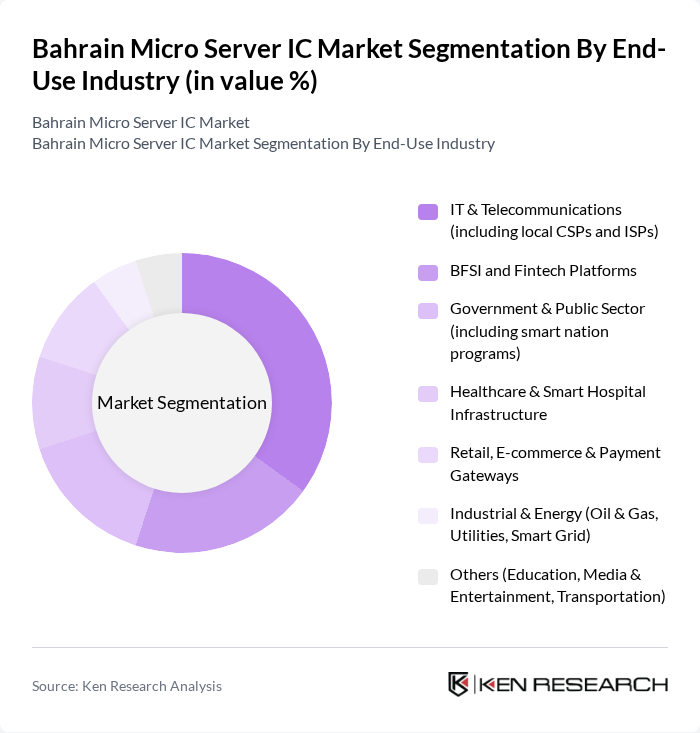

By End-Use Industry:The micro server IC market is further segmented by end-use industries, including IT & Telecommunications, BFSI and Fintech Platforms, Government & Public Sector, Healthcare & Smart Hospital Infrastructure, Retail, E-commerce & Payment Gateways, Industrial & Energy, and Others. Each industry has unique requirements that drive the adoption of micro server ICs, such as low-latency cloud services, high-throughput data analytics, and edge computing for IoT and smart city applications.

The Bahrain Micro Server IC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Advanced Micro Devices, Inc. (AMD), Arm Limited, Qualcomm Technologies, Inc., Marvell Technology, Inc., Broadcom Inc., NXP Semiconductors N.V., Texas Instruments Incorporated, International Business Machines Corporation (IBM), Huawei Technologies Co., Ltd., Fujitsu Limited, Super Micro Computer, Inc. (Supermicro), Dell Technologies Inc., Cisco Systems, Inc., Lenovo Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Micro Server IC market is poised for significant transformation as technological advancements and government initiatives converge. With a focus on energy efficiency and the integration of AI, the market is expected to witness increased innovation. Additionally, the expansion of smart city projects will further drive demand for micro server ICs, creating a robust ecosystem. As businesses adapt to these changes, the market will likely see enhanced collaboration between tech firms and startups, fostering a dynamic environment for growth and development.

| Segment | Sub-Segments |

|---|---|

| By Processor Architecture | ARM-based Micro Server ICs x86-based Micro Server ICs RISC-V and Other Architecture-based Micro Server ICs Custom/ASIC-based Micro Server ICs |

| By End-Use Industry | IT & Telecommunications (including local CSPs and ISPs) BFSI and Fintech Platforms Government & Public Sector (including smart nation programs) Healthcare & Smart Hospital Infrastructure Retail, E-commerce & Payment Gateways Industrial & Energy (Oil & Gas, Utilities, Smart Grid) Others (Education, Media & Entertainment, Transportation) |

| By Application Workload | Web Hosting & Content Delivery Cloud & Virtualized Workloads Edge Computing & IoT Gateways Data Analytics & Real-time Processing Network Function Virtualization (NFV) & Telco Cloud Backup, Storage & Archival |

| By Performance / Power Class | Ultra-Low Power Micro Server ICs (<10W TDP) Low to Mid Power Micro Server ICs (10–40W TDP) High-density Performance Micro Server ICs (>40W TDP) |

| By Deployment Model | Core Data Centers (Tier III / Colocation) Enterprise On-premise Micro Data Centers Edge Sites (Telecom Edge, Branch, Remote Sites) Cloud / Managed Service Provider Infrastructure |

| By Sales / Procurement Channel | Direct OEM Sales (Global Server Vendors) Regional Distributors & System Integrators in Bahrain Online & Cloud Marketplace Procurement Others (Value-added Resellers, Local Assemblers) |

| By Governorate | Capital Governorate (Manama) Muharraq Governorate Northern Governorate Southern Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Micro Server Adoption | 120 | IT Managers, System Administrators |

| Data Center Infrastructure | 100 | Data Center Managers, Operations Directors |

| SME Technology Utilization | 80 | Business Owners, IT Consultants |

| Cloud Services Integration | 110 | Cloud Architects, IT Strategy Planners |

| Government IT Initiatives | 70 | Public Sector IT Managers, Policy Makers |

The Bahrain Micro Server IC Market is valued at approximately USD 8 million, reflecting its growth driven by the demand for energy-efficient computing solutions and the rise of cloud computing services in the region.