Region:Middle East

Author(s):Shubham

Product Code:KRAD5507

Pages:99

Published On:December 2025

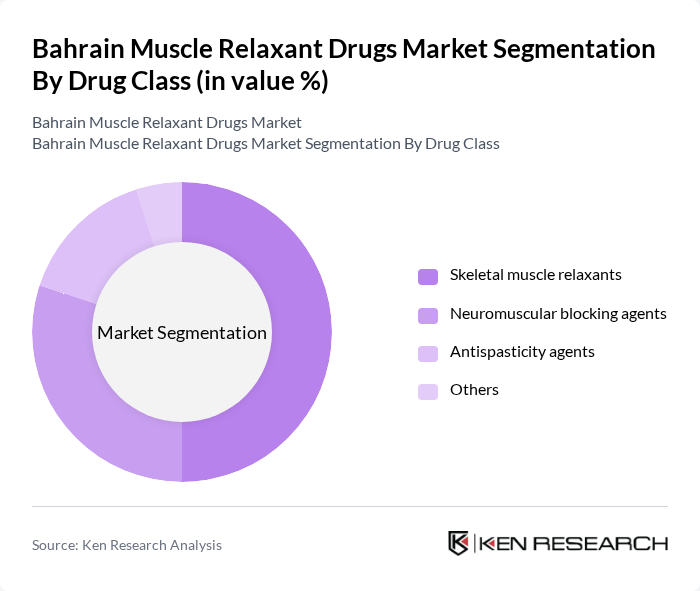

By Drug Class:

The drug class segmentation includes skeletal muscle relaxants, neuromuscular blocking agents, antispasticity agents, and others. Among these, skeletal muscle relaxants dominate the market due to their widespread use in treating muscle spasms and pain associated with various conditions. The increasing incidence of musculoskeletal disorders, coupled with a growing awareness of effective pain management strategies, drives the demand for this sub-segment. Neuromuscular blocking agents also hold a significant share, particularly in surgical settings, where they are essential for facilitating intubation and providing muscle relaxation during procedures.

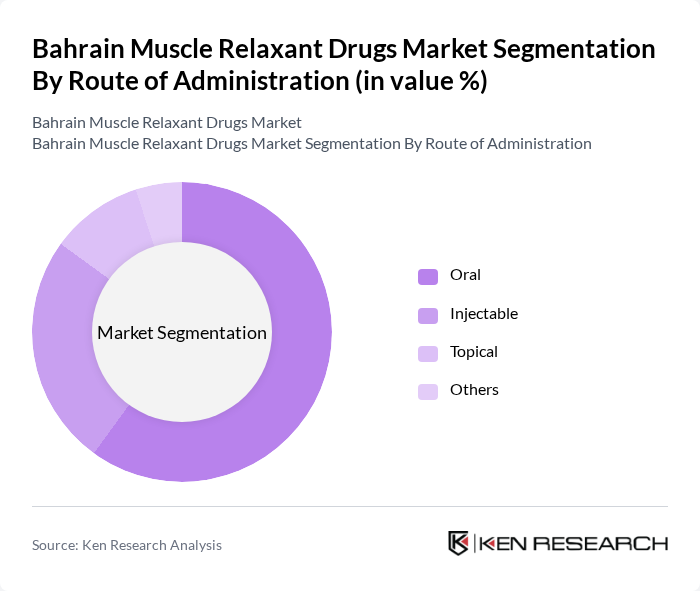

By Route of Administration:

The route of administration includes oral, injectable, topical, and others. Oral administration is the most prevalent method due to its convenience and ease of use, making it the preferred choice for patients. Injectable forms are also significant, particularly in hospital settings where rapid action is required. The topical route is gaining traction for localized treatment of muscle pain, while other methods, though less common, cater to specific patient needs. The trend towards patient-centered care is influencing the growth of these various routes of administration.

The Bahrain Muscle Relaxant Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Novartis AG, Sanofi S.A., GlaxoSmithKline plc (GSK), Bayer AG, Hikma Pharmaceuticals PLC, Julphar Gulf Pharmaceutical Industries PSC, Tabuk Pharmaceuticals Manufacturing Company, SPIMACO Addwaeih (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Gulf Biotech Company B.S.C. (Closed), Bahrain Pharma & Foods Company W.L.L., Ibn Al-Nafees Hospital Pharmacy (as representative Bahraini hospital pharmacy player), Al Haya Medical Company W.L.L., Tamkeen Drug Store (regional pharmaceutical distributor), Bahrain National Gas Company B.S.C. (BANAGAS) – medical gases division (adjacent perioperative muscle relaxant ecosystem) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain muscle relaxant drugs market appears promising, driven by increasing healthcare investments and a growing focus on personalized medicine. The integration of telemedicine is expected to enhance patient access to muscle relaxant therapies, while the rise of online pharmacies will facilitate easier procurement of these medications. Additionally, the market is likely to see a shift towards natural and herbal muscle relaxants, reflecting changing consumer preferences for alternative therapies that align with holistic health trends.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Skeletal muscle relaxants Neuromuscular blocking agents Antispasticity agents Others |

| By Route of Administration | Oral Injectable Topical Others |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies Others |

| By End-User | Public hospitals Private hospitals Specialty clinics & rehabilitation centers Home care settings Others |

| By Prescription Status | Prescription-only Over-the-counter Others |

| By Therapeutic Application | Musculoskeletal disorders Neurological disorders Perioperative & ICU care Chronic pain management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Physicians, Pharmacists, Nurse Practitioners |

| Patients Using Muscle Relaxants | 110 | Chronic Pain Patients, Post-Surgery Patients |

| Physical Therapy Clinics | 70 | Physical Therapists, Clinic Managers |

| Pharmaceutical Distributors | 50 | Sales Representatives, Distribution Managers |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Specialists |

The Bahrain Muscle Relaxant Drugs Market is valued at approximately USD 22 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of musculoskeletal disorders and an increasing geriatric population requiring muscle relaxants for therapeutic applications.