Region:Middle East

Author(s):Shubham

Product Code:KRAA8775

Pages:97

Published On:November 2025

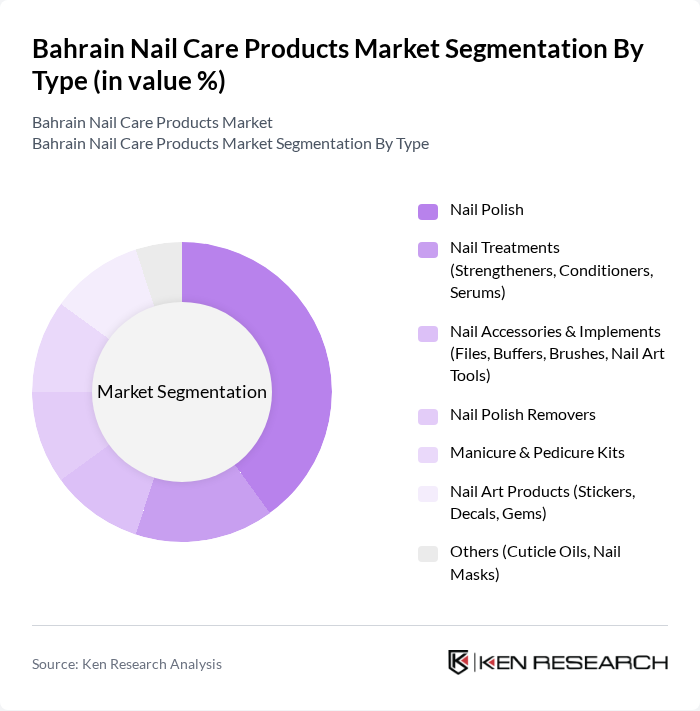

By Type:The market is segmented into various types of nail care products, including Nail Polish, Nail Treatments (Strengtheners, Conditioners, Serums), Nail Accessories & Implements (Files, Buffers, Brushes, Nail Art Tools), Nail Polish Removers, Manicure & Pedicure Kits, Nail Art Products (Stickers, Decals, Gems), and Others (Cuticle Oils, Nail Masks). Among these, Nail Polish has emerged as the leading sub-segment due to its popularity among consumers seeking to enhance their nail aesthetics. The trend towards vibrant colors, long-lasting formulas, and non-toxic ingredients has driven significant sales in this category, with consumers showing a preference for both premium and mass-market options .

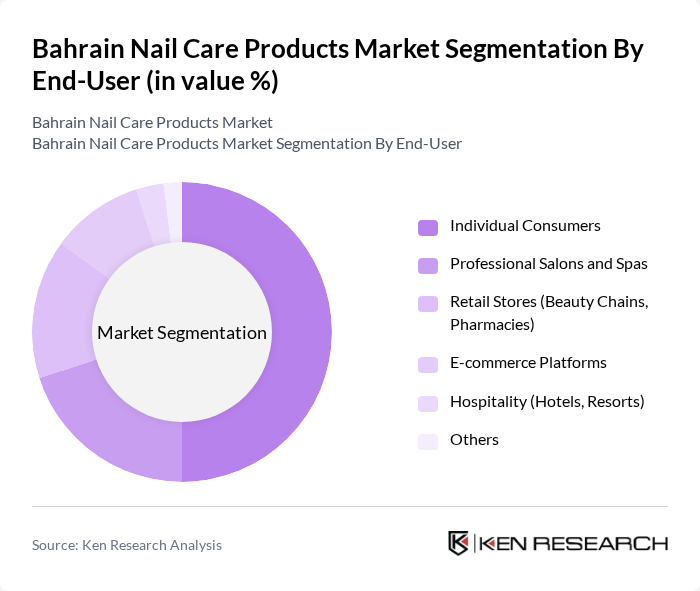

By End-User:The end-user segmentation includes Individual Consumers, Professional Salons and Spas, Retail Stores (Beauty Chains, Pharmacies), E-commerce Platforms, Hospitality (Hotels, Resorts), and Others. The Individual Consumers segment dominates the market, driven by the increasing trend of DIY nail care and the growing interest in personal grooming among the general population. This segment's growth is further supported by the rise of social media influencers promoting nail art and care, as well as the accessibility of products through both offline and online channels .

The Bahrain Nail Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as OPI Products Inc., Essie Cosmetics, Sally Hansen, CND (Creative Nail Design), Orly International, Revlon, China Glaze, Zoya, Nailtopia, KISS Products, Deborah Lippmann, Mavala, The Nail Hub, Nailtiques, Ciaté London, Junaid Perfumes, Al Hawaj, L'Oréal, Coty Inc., Beiersdorf AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nail care products market in Bahrain appears promising, driven by evolving consumer preferences and technological advancements. As the demand for personalized and innovative products grows, brands are likely to invest in research and development to create unique offerings. Additionally, the increasing influence of social media and beauty influencers will further shape consumer choices, encouraging brands to enhance their online presence and engage with customers through targeted marketing strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Nail Polish Nail Treatments (Strengtheners, Conditioners, Serums) Nail Accessories & Implements (Files, Buffers, Brushes, Nail Art Tools) Nail Polish Removers Manicure & Pedicure Kits Nail Art Products (Stickers, Decals, Gems) Others (Cuticle Oils, Nail Masks) |

| By End-User | Individual Consumers Professional Salons and Spas Retail Stores (Beauty Chains, Pharmacies) E-commerce Platforms Hospitality (Hotels, Resorts) Others |

| By Distribution Channel | Online Retail (E-commerce, Marketplaces) Offline Retail (Beauty Specialty Stores, Pharmacies, Supermarkets/Hypermarkets) Direct Sales (Brand Outlets, Distributors) Wholesale Duty-Free & Travel Retail Others |

| By Price Range | Premium Mid-range Budget Others |

| By Packaging Type | Bottles Tubes Jars Sachets Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Vegan Ingredients Others |

| By Brand Type | Local Brands (e.g., Junaid Perfumes, Al Hawaj) International Brands (e.g., OPI, Essie, Sally Hansen) Private Labels (Retailer-owned) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Nail Care Preferences | 150 | Female Consumers, Ages 18-45 |

| Retailer Insights on Nail Care Products | 100 | Store Managers, Beauty Product Buyers |

| Professional Nail Technicians' Product Usage | 80 | Nail Salon Owners, Licensed Nail Technicians |

| Market Trends and Innovations | 60 | Industry Experts, Beauty Influencers |

| Distribution Channel Effectiveness | 70 | Distributors, Wholesalers in Beauty Products |

The Bahrain Nail Care Products Market is valued at approximately USD 2 million, reflecting a growing interest in personal grooming and beauty standards among consumers, alongside increased disposable income.