Region:Middle East

Author(s):Dev

Product Code:KRAC1300

Pages:94

Published On:October 2025

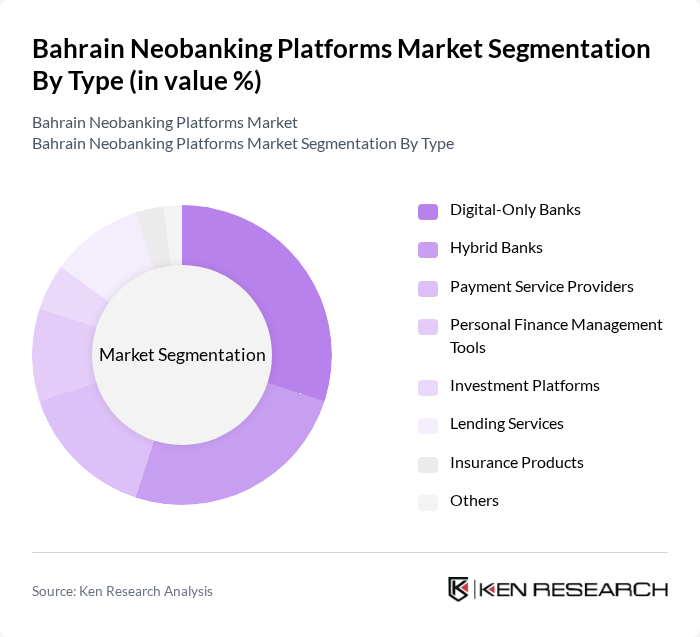

By Type:The neobanking platforms can be categorized into various types, including Digital-Only Banks, Hybrid Banks, Payment Service Providers, Personal Finance Management Tools, Investment Platforms, Lending Services, Insurance Products, and Others. Each of these sub-segments plays a crucial role in catering to the diverse needs of consumers and businesses in Bahrain. Digital-only banks are gaining traction due to their low operational costs and customer-centric services, while hybrid banks combine traditional and digital offerings to appeal to a broader customer base. Payment service providers facilitate seamless transactions, and other segments address specialized financial needs .

The Digital-Only Banks segment is currently dominating the market due to the increasing preference for fully online banking solutions that offer convenience and lower fees. Consumers are gravitating towards these platforms for their user-friendly interfaces and innovative features, such as instant account opening and real-time transaction notifications. The trend of digital banking is further fueled by the growing number of tech-savvy individuals and the increasing reliance on mobile applications for financial management. Digital-only banks leverage advanced technologies to provide seamless onboarding and personalized financial services .

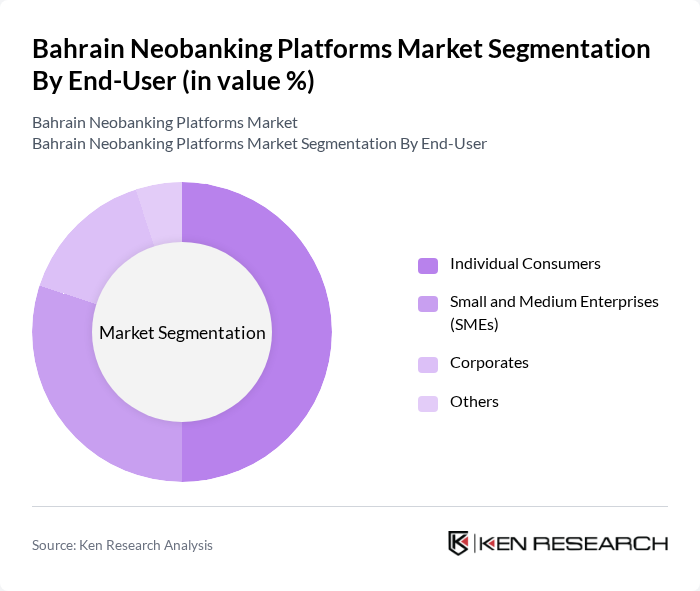

By End-User:The neobanking platforms cater to various end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Others. Each segment has unique requirements and preferences, influencing the services offered by neobanks. Individual consumers represent the largest segment, driven by the demand for convenient, digital-first banking solutions, while SMEs and corporates are increasingly adopting neobanking for their flexibility and efficiency in financial management .

The Individual Consumers segment is the largest in the market, driven by the increasing adoption of digital banking solutions among everyday users. This demographic is particularly attracted to the convenience, lower fees, and innovative features offered by neobanks. The rise of mobile banking applications has made it easier for consumers to manage their finances, leading to a significant shift from traditional banking methods to digital platforms. The segment benefits from simplified onboarding, intuitive mobile interfaces, and features tailored to everyday financial needs .

The Bahrain Neobanking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as ila Bank (Bank ABC Digital), Al Baraka Banking Group, Bahrain Islamic Bank, Gulf International Bank (meem Digital Banking), Ahli United Bank, National Bank of Bahrain (NBB Digital Banking), Bahrain Development Bank, Khaleeji Commercial Bank, Benefit Company, Tarabut Gateway, PayTabs, Zain Cash Bahrain, STC Pay Bahrain, Rain Financial, Fintech Bay contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain neobanking market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy increases, more consumers are expected to embrace neobanking solutions, leading to a broader acceptance of cashless transactions. Additionally, the integration of advanced technologies such as AI and machine learning will enhance user experiences, making financial services more personalized and efficient. This trend is likely to attract further investments and partnerships, fostering innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-Only Banks Hybrid Banks Payment Service Providers Personal Finance Management Tools Investment Platforms Lending Services Insurance Products Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Others |

| By Distribution Channel | Mobile Applications Web Platforms Third-party Integrations Direct Sales |

| By Customer Segment | Tech-savvy Users First-time Bankers High Net-worth Individuals Students and Young Professionals |

| By Service Type | Savings Accounts Current Accounts Loans and Credit Facilities Investment Services |

| By Pricing Model | Subscription-based Transaction-based Freemium Tiered Pricing |

| By Geographic Focus | Urban Areas Rural Areas Expatriate Communities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individuals aged 18-45, tech-savvy users |

| Small Business Owners | 100 | Entrepreneurs, financial decision-makers |

| Fintech Industry Experts | 70 | Consultants and analysts specializing in financial technology |

| Regulatory Authorities | 50 | Officials from Bahrain's Central Bank and financial regulatory authorities |

| Potential Neobank Users | 120 | Individuals considering switching to neobanks |

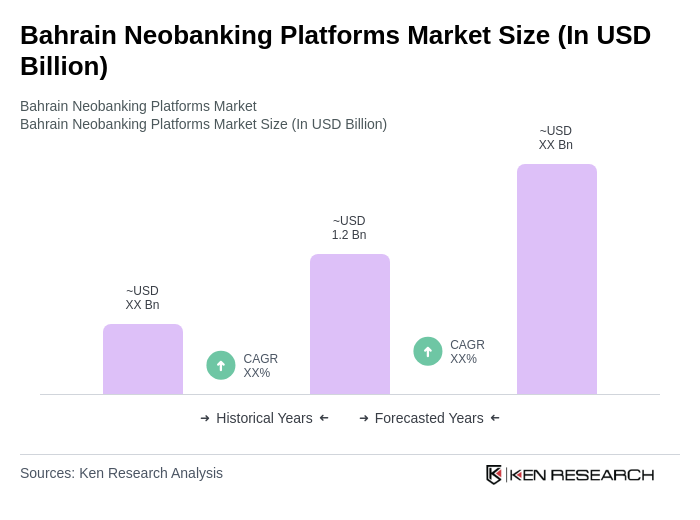

The Bahrain Neobanking Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and a surge in smartphone penetration among consumers.