Region:Middle East

Author(s):Dev

Product Code:KRAA9679

Pages:86

Published On:November 2025

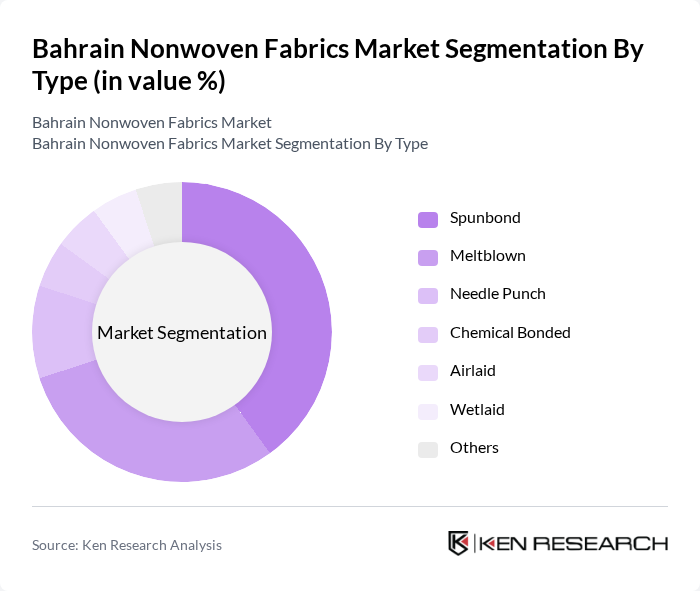

By Type:The nonwoven fabrics market in Bahrain is segmented into Spunbond, Meltblown, Needle Punch, Chemical Bonded, Airlaid, Wetlaid, and Others. Spunbond and Meltblown remain the most prominent categories, driven by their extensive use in hygiene products, medical supplies, and filtration applications. These types are preferred for their superior strength, durability, and cost-effectiveness, making them suitable for a diverse range of end-use sectors. The market is also witnessing increased adoption of sustainable and specialty nonwovens, particularly in filtration and automotive applications .

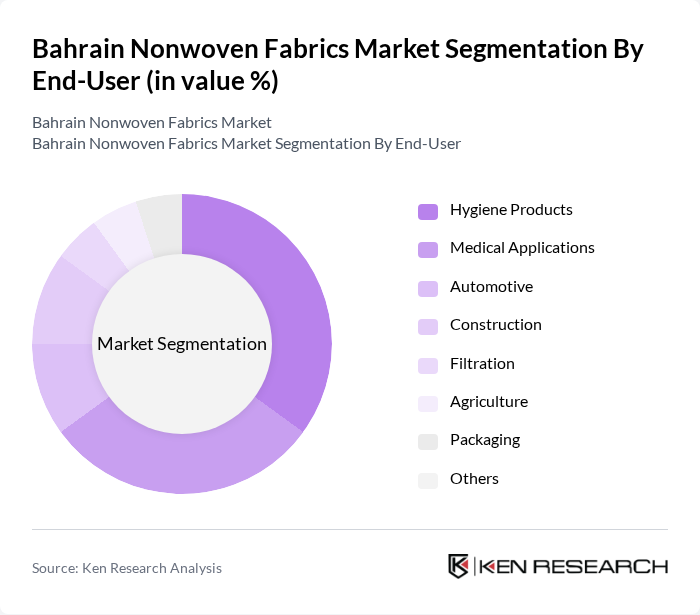

By End-User:The end-user segmentation comprises Hygiene Products, Medical Applications, Automotive, Construction, Filtration, Agriculture, Packaging, and Others. Hygiene Products constitute the largest segment, propelled by rising demand for disposable items such as diapers, wipes, and feminine care products. Medical Applications have grown significantly, supported by increased health and safety awareness and the expanded use of nonwoven fabrics in surgical masks, gowns, and protective apparel. Automotive and construction sectors are also notable contributors, utilizing nonwovens for insulation, filtration, and reinforcement .

The Bahrain Nonwoven Fabrics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Nonwovens W.L.L., Gulf Plastic Industries W.L.L., Al-Ahlia Nonwoven Fabrics Co., Almoayyed International Group, Gulf Woven Fabrics W.L.L., Al Hilal Group, Bahrain Fiber Glass Company, Foulath Holding B.S.C., Advanced Fabrics (SAAF), Petrochemical Industries Company (PIC) – Bahrain, Al Futtaim Group (Regional Distributor), Al Mansoori Specialized Engineering, Al Salam Specialist Hospital (Medical End-User), Bahrain International Investment Park (Industrial Cluster), Bahrain Development Bank (Sector Financier) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain nonwoven fabrics market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt innovative production techniques, the efficiency and quality of nonwoven fabrics are expected to improve. Additionally, the growing emphasis on eco-friendly materials will likely lead to the development of biodegradable options, catering to environmentally conscious consumers. This evolving landscape presents opportunities for market players to enhance their product offerings and expand their reach in both local and regional markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Spunbond Meltblown Needle Punch Chemical Bonded Airlaid Wetlaid Others |

| By End-User | Hygiene Products (e.g., diapers, wipes, feminine care) Medical Applications (e.g., surgical drapes, gowns, masks) Automotive (e.g., interior linings, insulation) Construction (e.g., roofing, geotextiles) Filtration Agriculture Packaging Others |

| By Application | Filtration Geotextiles Packaging Agriculture Personal Care Furniture & Upholstery Others |

| By Material | Polypropylene (PP) Polyester (PET) Polyethylene (PE) Rayon Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hygiene Products Manufacturing | 60 | Production Managers, Quality Control Supervisors |

| Medical Nonwoven Applications | 50 | Healthcare Product Developers, Regulatory Affairs Specialists |

| Automotive Nonwoven Suppliers | 40 | Supply Chain Managers, Procurement Specialists |

| Geotextiles and Construction | 45 | Project Managers, Civil Engineers |

| Consumer Goods Packaging | 55 | Marketing Managers, Product Development Leads |

The Bahrain Nonwoven Fabrics Market is valued at approximately USD 3 million. This figure reflects a contraction in recent years due to changes in regional manufacturing and import dynamics, despite growth drivers such as increased demand for hygiene and medical products.