Region:Middle East

Author(s):Shubham

Product Code:KRAD3638

Pages:89

Published On:November 2025

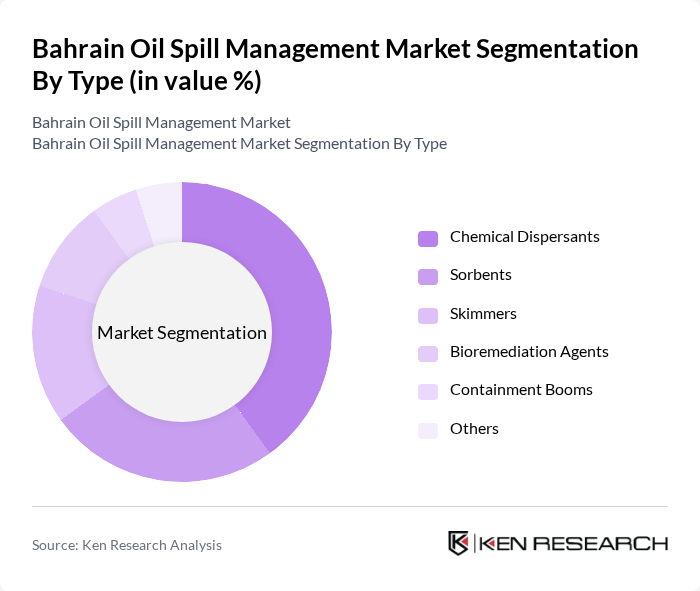

By Type:The segmentation by type includes various methods and materials used in oil spill management. The subsegments are Chemical Dispersants, Sorbents, Skimmers, Bioremediation Agents, Containment Booms, and Others. Among these, Chemical Dispersants are the most widely used due to their effectiveness in breaking down oil slicks quickly, making them a preferred choice for rapid response teams. The increasing focus on minimizing environmental damage drives the demand for these products.

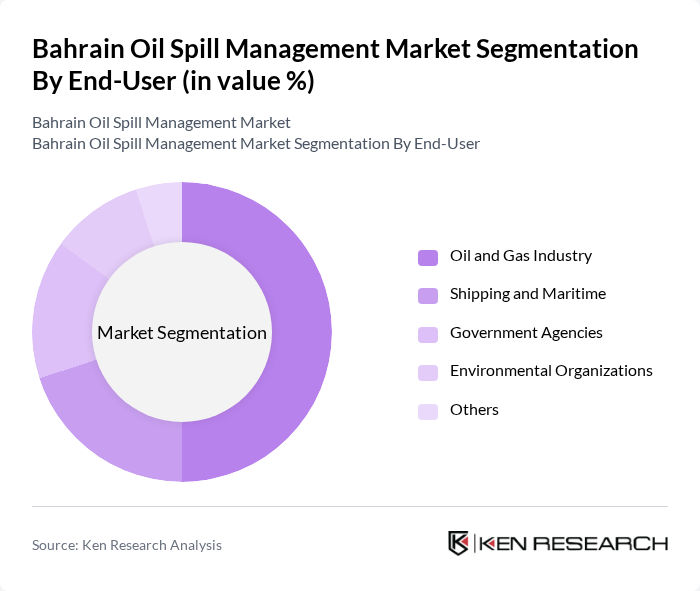

By End-User:The end-user segmentation includes the Oil and Gas Industry, Shipping and Maritime, Government Agencies, Environmental Organizations, and Others. The Oil and Gas Industry is the leading segment, driven by the high volume of oil production and transportation activities in Bahrain. This sector's stringent regulations and the need for effective spill management solutions significantly contribute to its dominance in the market.

The Bahrain Oil Spill Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Petroleum Company (BAPCO), Fairdeal Marine Services, Al Jazeera Shipping Co., Oil Spill Response Limited (OSRL), DESMI RO-CLEAN A/S, ACME Environmental, Gulf Petrochemical Industries Company (GPIC), Ministry of Environment, Kingdom of Bahrain, Directorate General of Ports, Bahrain, Bahrain Defence Force (BDF), Public Works Directorate, Bahrain, Municipalities of Bahrain, Regional Clean Sea Organisation (RECSO), Ministry of Works, Power and Water, Bahrain, Ministry of Interior, Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain oil spill management market appears promising, driven by increasing investments in technology and a commitment to environmental sustainability. As the government continues to enforce stringent regulations, companies are likely to enhance their spill response capabilities. Furthermore, the integration of innovative technologies, such as AI and bioremediation, will play a crucial role in improving efficiency and effectiveness in spill management. This evolving landscape presents opportunities for growth and collaboration among stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Dispersants Sorbents Skimmers Bioremediation Agents Containment Booms Others |

| By End-User | Oil and Gas Industry Shipping and Maritime Government Agencies Environmental Organizations Others |

| By Application | Offshore Oil Spill Management Onshore Oil Spill Management Emergency Response Services Training and Consultancy Services Others |

| By Technology | Mechanical Recovery Chemical Treatment Biological Treatment Physical Barriers Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Spill Response Services | 100 | Environmental Managers, Operations Directors |

| Regulatory Compliance and Policy | 80 | Government Officials, Policy Advisors |

| Technology Providers for Spill Management | 70 | Product Managers, R&D Specialists |

| Training and Preparedness Programs | 60 | Training Coordinators, Safety Officers |

| Community Engagement and Awareness | 50 | Community Leaders, NGO Representatives |

The Bahrain Oil Spill Management Market is valued at approximately USD 148 million, reflecting a five-year historical analysis. This growth is driven by increasing oil production, stringent environmental regulations, and the need for effective spill response strategies.