Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4097

Pages:90

Published On:December 2025

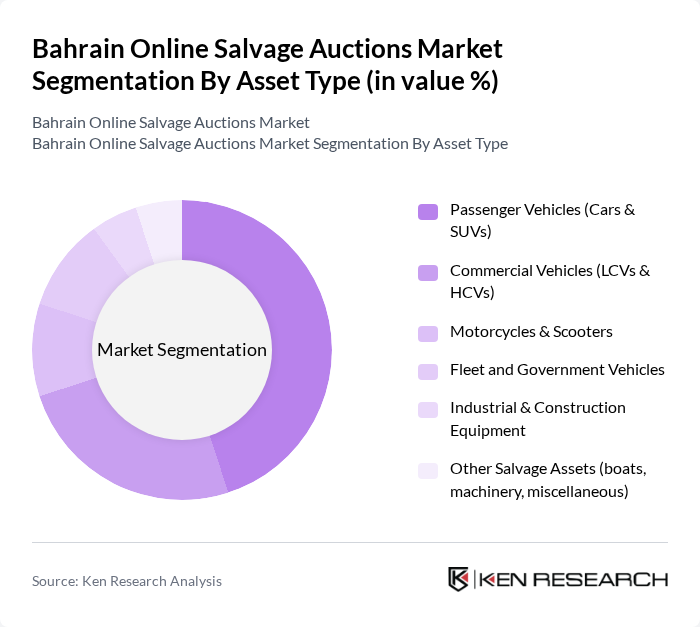

By Asset Type:The asset type segmentation includes various categories of vehicles and equipment that are typically auctioned online. The primary subsegments are Passenger Vehicles (Cars & SUVs), Commercial Vehicles (LCVs & HCVs), Motorcycles & Scooters, Fleet and Government Vehicles, Industrial & Construction Equipment, and Other Salvage Assets (boats, machinery, miscellaneous). Among these, Passenger Vehicles dominate the market due to the high volume of personal vehicles on the road and the increasing trend of online purchasing among consumers.

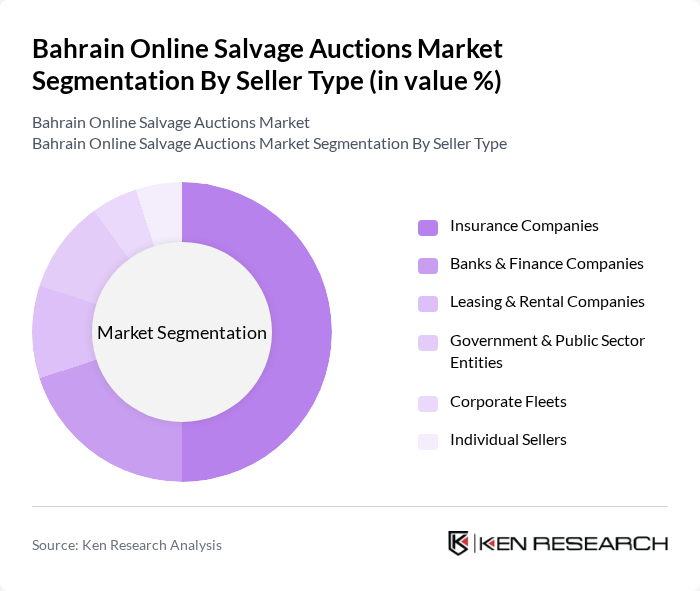

By Seller Type:The seller type segmentation encompasses various entities that contribute salvage vehicles to the auction market. This includes Insurance Companies, Banks & Finance Companies, Leasing & Rental Companies, Government & Public Sector Entities, Corporate Fleets, and Individual Sellers. Insurance Companies are the leading sellers, as they frequently auction vehicles that have been declared total losses, thus significantly influencing the volume of salvage vehicles available in the market.

The Bahrain Online Salvage Auctions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Copart Inc. (Bahrain operations), Insurance Company–run Salvage Platforms (local Bahrain insurers), Online Vehicle Auction Platforms Linked to Major Dealership Groups in Bahrain, Regional GCC Online Salvage Platforms Serving Bahrain Buyers, Classifieds & E?commerce Portals Offering Salvage Vehicle Auctions in Bahrain, Specialist Dismantler & Recycler–Backed Online Auction Platforms, Government & Public Sector E?Auction Portals for Surplus and Salvage Assets, Fleet & Rental Company Digital Disposal Platforms Active in Bahrain, Cross?Border Export-Focused Online Salvage Auction Aggregators, Local Independent Online Auction Start?ups Focused on Salvage Vehicles, Mobile App–Only Auction Platforms Targeting Bahrain Salvage Buyers, Hybrid Auction Operators (physical yards with online bidding interface), Online Platforms Specializing in Damaged Luxury and Premium Vehicles, Platforms Focused on Commercial Vehicles & Equipment Salvage, Other Niche and Emerging Digital Salvage Auction Providers in Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain online salvage auctions market appears promising, driven by technological advancements and changing consumer behaviors. As more buyers embrace digital platforms, the shift towards online-only auctions is expected to accelerate. Additionally, the integration of artificial intelligence in auction processes will enhance efficiency and transparency, attracting a broader audience. With increasing environmental awareness, the refurbishing of salvage vehicles is likely to gain traction, further expanding market opportunities and fostering sustainable practices in vehicle disposal.

| Segment | Sub-Segments |

|---|---|

| By Asset Type | Passenger Vehicles (Cars & SUVs) Commercial Vehicles (LCVs & HCVs) Motorcycles & Scooters Fleet and Government Vehicles Industrial & Construction Equipment Other Salvage Assets (boats, machinery, miscellaneous) |

| By Seller Type | Insurance Companies Banks & Finance Companies Leasing & Rental Companies Government & Public Sector Entities Corporate Fleets Individual Sellers |

| By Buyer Type | Individual Buyers Licensed Used-Car Dealers Dismantlers & Recyclers Repair & Body Shops Exporters & Traders |

| By Vehicle Condition | Total Loss / Salvage-Title Vehicles Repairable Vehicles Non-Repairable / Parts-Only Vehicles Flood / Fire / Theft-Recovered Vehicles |

| By Auction Channel | Online-Only Auctions Simulcast (Online + Physical Yard) Auctions Dealer-to-Dealer Digital Auctions Mobile App–Based Auctions |

| By Geography (Buyer Origin) | Domestic Buyers (Within Bahrain) GCC Buyers (Saudi Arabia, UAE, Kuwait, etc.) Wider MENA Buyers International Buyers (Africa, South Asia, Others) |

| By Payment & Settlement Method | Online Bank Transfer Credit / Debit Card Cash / Cashier’s Cheque at Yard Escrow & Wallet-Based Payments Buy-Now / Financing-Linked Settlement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Salvage Auctions | 100 | Auction House Managers, Salvage Operators |

| Automotive Salvage Auctions | 80 | Automotive Dealers, Salvage Yard Owners |

| Electronics Salvage Auctions | 70 | Electronics Retailers, IT Asset Managers |

| Industrial Equipment Auctions | 60 | Manufacturing Managers, Equipment Resellers |

| Consumer Goods Salvage Auctions | 90 | Retail Buyers, E-commerce Managers |

The Bahrain Online Salvage Auctions Market is valued at approximately USD 150 million, reflecting growth driven by an increasing number of vehicles on the road and a rise in accidents, leading to more salvageable assets entering the auction market.