Region:Middle East

Author(s):Geetanshi

Product Code:KRAE2032

Pages:95

Published On:December 2025

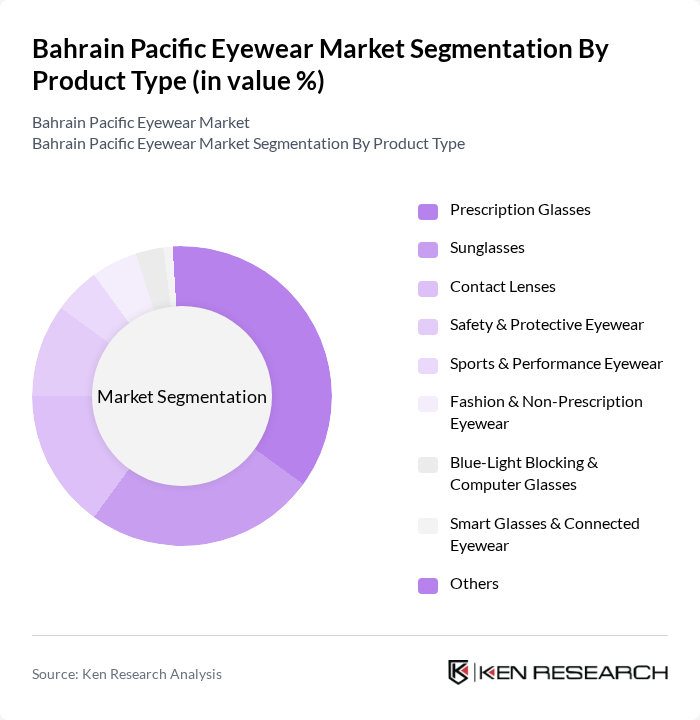

By Product Type:The product type segmentation includes various categories such as Prescription Glasses, Sunglasses, Contact Lenses, Safety & Protective Eyewear, Sports & Performance Eyewear, Fashion & Non-Prescription Eyewear, Blue-Light Blocking & Computer Glasses, Smart Glasses & Connected Eyewear, and Others. Among these, Prescription Glasses dominate the market due to the increasing prevalence of vision-related issues and the growing trend of personalized eyewear solutions. Consumers are increasingly opting for customized lenses that cater to their specific vision needs, driving the demand for this sub-segment.

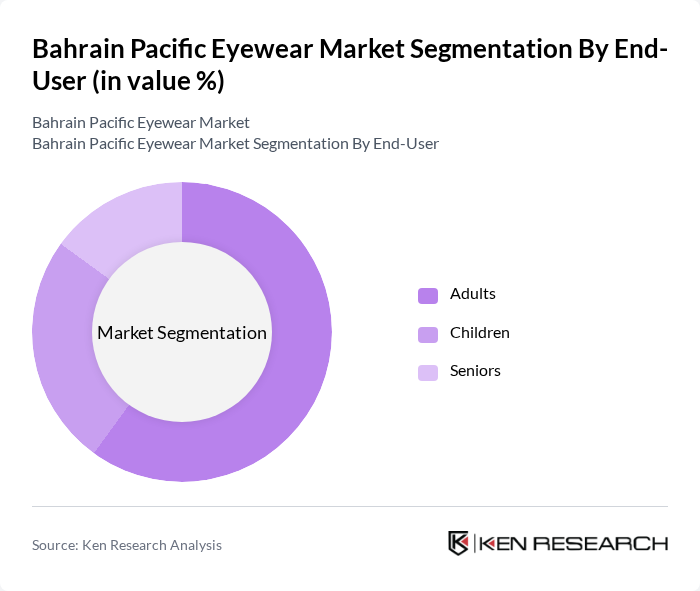

By End-User:The end-user segmentation includes Adults, Children, and Seniors. Adults represent the largest segment due to the increasing awareness of eye health and the need for corrective eyewear. The growing trend of digital device usage among adults has also led to a rise in demand for blue-light blocking glasses, further solidifying their dominance in the market. Additionally, the aging population is contributing to the demand for eyewear solutions tailored for seniors.

The Bahrain Pacific Eyewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jazeera Optical, Vision Express, Al Mufeed Opticians, Bahrain Opticians, Al Hekma Optical, Optica, Al Noor Opticians, Eyezone, Al Ahlia Opticians, Hassan’s Opticians & Contact Lenses, Yateem Optician, Magrabi Opticals, Rivoli EyeZone, Salem Opticals, Al Habbib Optician contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Pacific eyewear market is poised for significant growth, driven by evolving consumer preferences and technological advancements. The increasing integration of smart eyewear technology is expected to attract tech-savvy consumers, while the demand for sustainable products will likely shape future offerings. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to diverse eyewear options. As the market adapts to these trends, local brands may find opportunities to innovate and capture a larger share of the growing consumer base.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Glasses Sunglasses Contact Lenses Safety & Protective Eyewear Sports & Performance Eyewear Fashion & Non-Prescription Eyewear Blue-Light Blocking & Computer Glasses Smart Glasses & Connected Eyewear Others |

| By End-User | Adults Children Seniors |

| By Customer Segment | Mass-Market Consumers Premium & Luxury Consumers Corporate & Institutional Buyers |

| By Sales Channel | Optical Chains & Brick-and-Mortar Stores Independent Optical Stores Online Retail & E-commerce Platforms Optical Clinics & Hospitals Others |

| By Frame Material | Plastic & Acetate Metal & Alloy Mixed & Combination Frames Sustainable & Specialty Materials Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand Origin | Local & Regional Brands International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Eyewear Outlets | 100 | Store Managers, Sales Representatives |

| Online Eyewear Consumers | 120 | Frequent Online Shoppers, E-commerce Users |

| Optometrists and Eye Care Professionals | 80 | Optometrists, Ophthalmologists |

| Eyewear Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Fashion Influencers and Bloggers | 50 | Fashion Bloggers, Social Media Influencers |

The Bahrain Pacific Eyewear Market is valued at approximately USD 300 million, reflecting a significant growth trend driven by increased consumer awareness of eye health and rising disposable incomes among the middle-class population.