Region:Middle East

Author(s):Shubham

Product Code:KRAC4326

Pages:85

Published On:October 2025

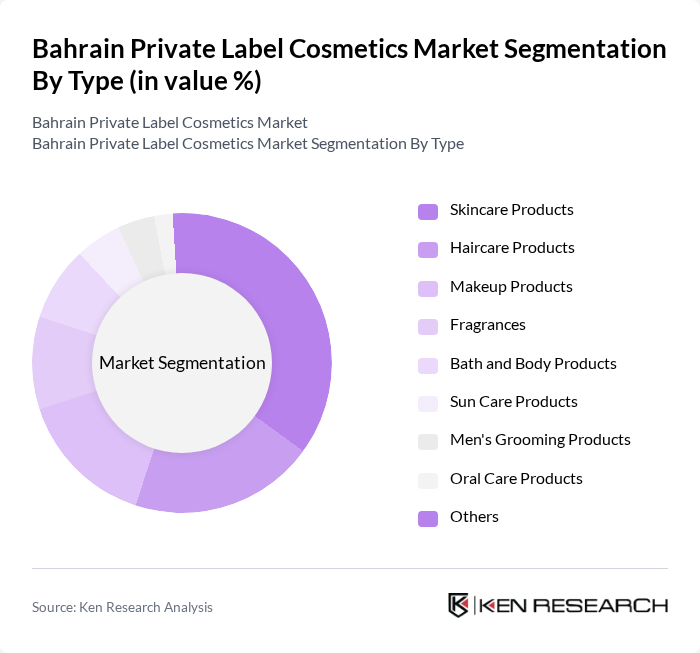

By Type:The market is segmented into various types of products, including skincare, haircare, makeup, fragrances, bath and body products, sun care products, men's grooming products, oral care products, and others. Each of these segments caters to specific consumer needs and preferences. Skincare products generally lead the market, driven by increasing awareness of skin health, demand for anti-aging and sun protection solutions, and the influence of wellness-focused beauty routines. Haircare and fragrances also represent significant shares, reflecting the region’s cultural emphasis on personal grooming and scent .

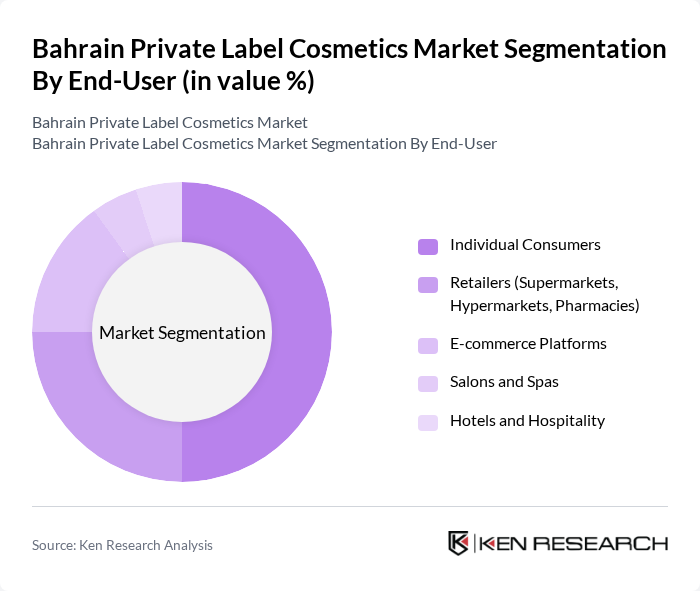

By End-User:The end-user segmentation includes individual consumers, retailers (supermarkets, hypermarkets, pharmacies), e-commerce platforms, salons and spas, and hotels and hospitality. Individual consumers represent the largest segment, driven by the increasing trend of self-care, personal grooming, and the influence of digital beauty content. Retailers and e-commerce platforms are expanding rapidly, supported by omnichannel strategies and the growth of online beauty retail .

The Bahrain Private Label Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Junaid Perfumes, Ajmal Perfumes, Rasasi Perfumes, Arabian Oud, Al Hawaj, Faces (Chalhoub Group), Nasser Pharmacy, Huda Beauty, The Body Shop, Madi International, L'Oréal Group, Unilever, Beiersdorf AG, Procter & Gamble, Estée Lauder Companies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain private label cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a growing segment of environmentally conscious consumers. Additionally, the integration of digital marketing strategies will enhance brand visibility and engagement, particularly among younger demographics. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Products Haircare Products Makeup Products Fragrances Bath and Body Products Sun Care Products Men's Grooming Products Oral Care Products Others |

| By End-User | Individual Consumers Retailers (Supermarkets, Hypermarkets, Pharmacies) E-commerce Platforms Salons and Spas Hotels and Hospitality |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Stores Pharmacies Online Retail Direct Sales Duty-Free & Travel Retail |

| By Price Range | Budget Mid-range Premium Prestige & Niche |

| By Packaging Type | Bottles Tubes Jars Sachets Pumps & Sprays |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Halal-Certified Ingredients |

| By Brand Ownership | Private Label Brands Manufacturer Brands Distributor Brands Retailer-Owned Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Label Skincare Products | 100 | Brand Managers, Product Development Specialists |

| Private Label Haircare Products | 80 | Retail Buyers, Category Managers |

| Private Label Makeup Products | 70 | Marketing Managers, Consumer Insights Analysts |

| Consumer Preferences in Cosmetics | 90 | End Consumers, Beauty Enthusiasts |

| Distribution Channel Insights | 50 | Logistics Managers, Supply Chain Coordinators |

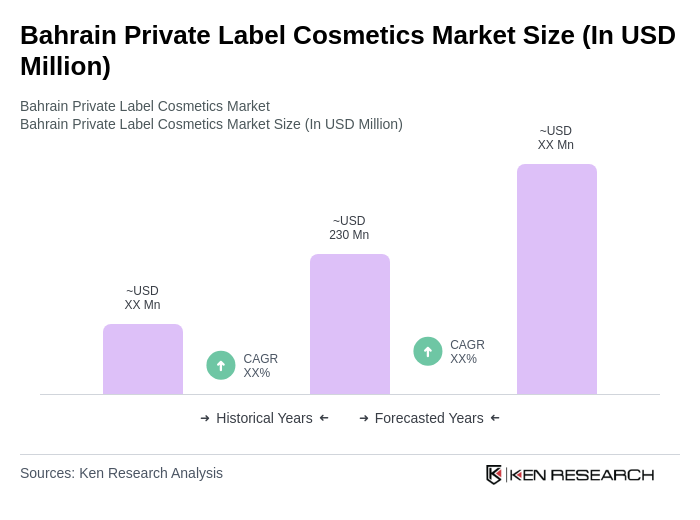

The Bahrain Private Label Cosmetics Market is valued at approximately USD 230 million, reflecting a growing consumer preference for affordable yet high-quality beauty products, alongside the increasing trend of product personalization and the influence of social media on beauty standards.