Region:Middle East

Author(s):Dev

Product Code:KRAC4170

Pages:95

Published On:October 2025

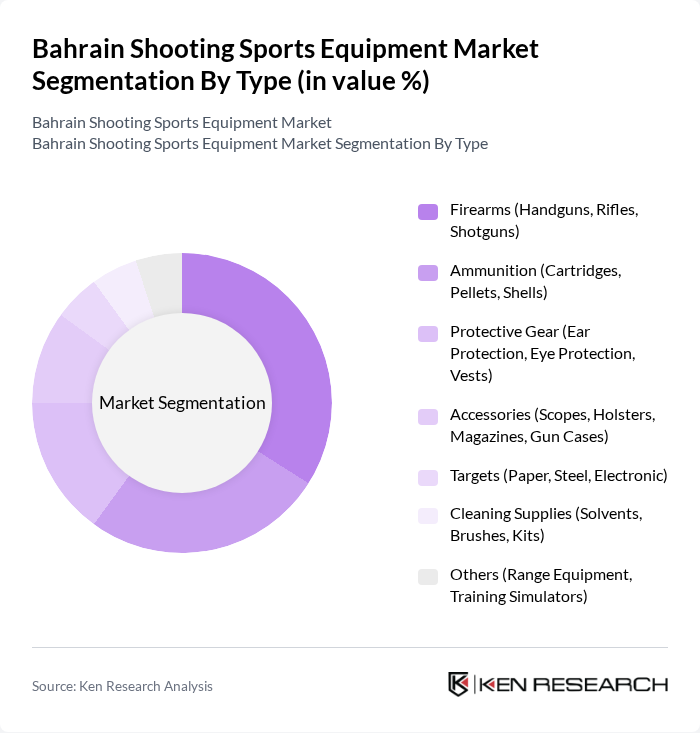

By Type:The market is segmented into firearms, ammunition, protective gear, accessories, targets, cleaning supplies, and others. Each sub-segment addresses distinct shooter requirements, ranging from recreational to competitive use. Firearms include handguns, rifles, and shotguns; ammunition covers cartridges, pellets, and shells; protective gear encompasses ear and eye protection and vests; accessories feature scopes, holsters, magazines, and gun cases; targets include paper, steel, and electronic types; cleaning supplies consist of solvents, brushes, and kits; and others comprise range equipment and training simulators.

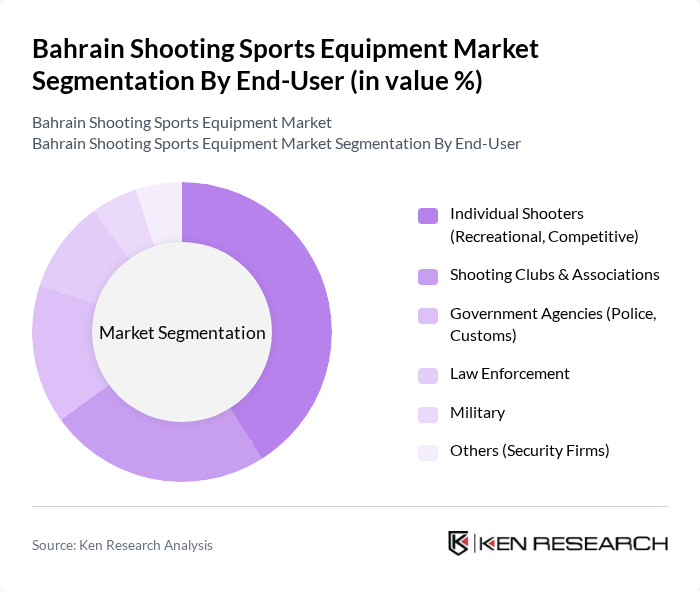

By End-User:The end-user segmentation comprises individual shooters, shooting clubs and associations, government agencies, law enforcement, military, and others. This segmentation reflects the broad application of shooting sports equipment, from personal recreation to institutional and professional use. Individual shooters include both recreational and competitive participants; clubs and associations organize events and training; government agencies and law enforcement utilize equipment for operational and training purposes; military segments focus on specialized use; and others include private security firms.

The Bahrain Shooting Sports Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beretta Holding S.p.A., Smith & Wesson Brands, Inc., Glock Ges.m.b.H., SIG Sauer, Inc., Browning Arms Company, Remington Arms Company, LLC, Winchester Repeating Arms Company, CZ-USA (?eská Zbrojovka), Sturm, Ruger & Company, Inc., Savage Arms, Tikka (Sako Ltd.), Beretta USA Corp., FN Herstal S.A., Walther Arms, Inc., Taurus International Manufacturing, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the Bahrain shooting sports equipment market appears promising, driven by increasing participation and government support. With a projected rise in disposable income, more consumers are likely to invest in shooting sports. Additionally, the expansion of shooting ranges and facilities will enhance accessibility. As the market evolves, technological advancements in equipment and a growing emphasis on safety training will further shape the landscape, fostering a more engaged and informed shooting community.

| Segment | Sub-Segments |

|---|---|

| By Type | Firearms (Handguns, Rifles, Shotguns) Ammunition (Cartridges, Pellets, Shells) Protective Gear (Ear Protection, Eye Protection, Vests) Accessories (Scopes, Holsters, Magazines, Gun Cases) Targets (Paper, Steel, Electronic) Cleaning Supplies (Solvents, Brushes, Kits) Others (Range Equipment, Training Simulators) |

| By End-User | Individual Shooters (Recreational, Competitive) Shooting Clubs & Associations Government Agencies (Police, Customs) Law Enforcement Military Others (Security Firms) |

| By Sales Channel | Online Retail (E-commerce Platforms) Specialty Stores (Firearms Dealers, Pro Shops) Sporting Goods Stores Direct Sales (Manufacturer to End-User) Others (Trade Shows, Auctions) |

| By Price Range | Low-End Mid-Range High-End Luxury |

| By Brand | Local Brands (Bahrain-based manufacturers/distributors) International Brands (Beretta, Glock, Smith & Wesson, etc.) Emerging Brands Others |

| By Usage | Recreational Competitive (Sport Shooting, Olympic Events) Training (Law Enforcement, Military) Others |

| By Distribution Mode | Direct Distribution Indirect Distribution (Wholesalers, Distributors) E-commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Shooting Equipment | 60 | Store Managers, Sales Representatives |

| Shooting Range Operations | 40 | Range Owners, Facility Managers |

| Competitive Shooting Events | 40 | Event Organizers, Coaches |

| Consumer Insights on Shooting Equipment | 80 | Avid Shooters, Recreational Participants |

| Government and Regulatory Bodies | 40 | Policy Makers, Sports Administrators |

The Bahrain Shooting Sports Equipment Market is valued at approximately USD 140 million, reflecting steady growth driven by increased participation in shooting sports, government investments in shooting ranges, and a rising interest in competitive shooting events among younger demographics.