Region:Middle East

Author(s):Shubham

Product Code:KRAD5537

Pages:85

Published On:December 2025

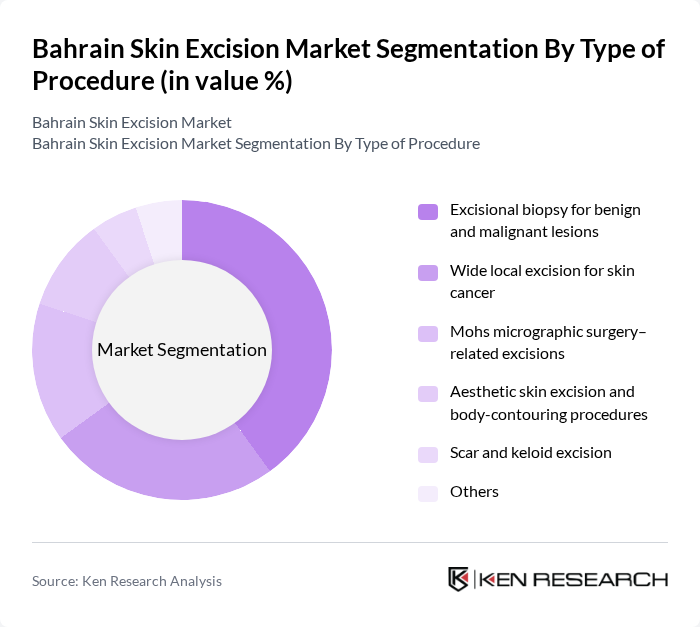

By Type of Procedure:This segmentation includes various types of skin excision procedures that cater to different medical needs. The dominant sub-segment is excisional biopsy for benign and malignant lesions, which is widely performed due to the need for accurate histopathological diagnosis of suspected skin cancers and other lesions in both hospital and clinic settings. Other notable procedures include wide local excision for skin cancer and aesthetic skin excision, reflecting the growing interest in cosmetic dermatology, body?contouring surgeries, and scar revision as documented in global and regional skin excision and cosmetic surgery trends.

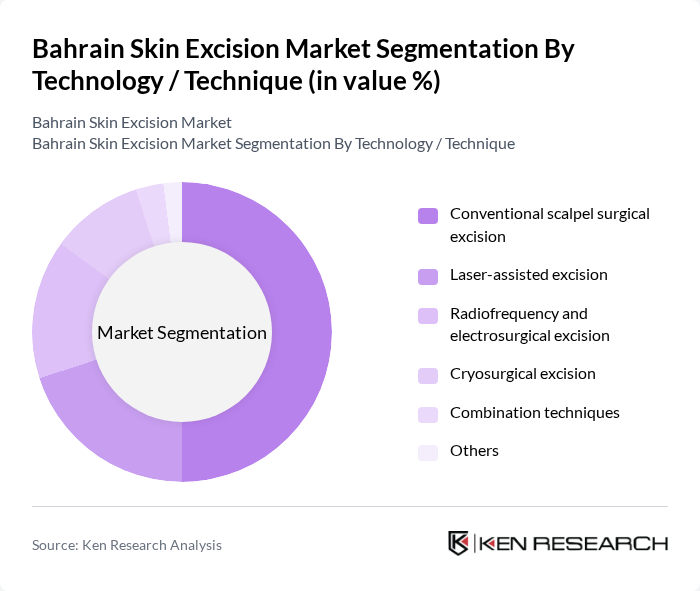

By Technology / Technique:This segmentation highlights the various technologies and techniques used in skin excision procedures. The leading sub-segment is conventional scalpel surgical excision, which remains the standard method due to its effectiveness, ability to obtain full?thickness specimens, and familiarity among surgeons worldwide. However, laser-assisted excision is gaining traction due to its minimally invasive nature, improved hemostasis, and reduced recovery times, aligning with broader trends toward energy?based and combination techniques in aesthetic and dermatologic surgery.

The Bahrain Skin Excision Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salmaniya Medical Complex (Dermatology & Plastic Surgery Units), King Hamad University Hospital, Bahrain Defence Force (BDF) Royal Medical Services Hospital, Bahrain Specialist Hospital, Royal Bahrain Hospital, American Mission Hospital, KIMSHEALTH Hospital Bahrain (KIMS Bahrain Medical Centre), Middle East Hospital & Medical Centres, Al Hilal Hospital & Medical Centers, Al Salam Specialist Hospital, Dr. Tariq Hospital, Dr. Abdulrahman Tareq Derma Clinic, German Medical Centre Bahrain (Dermatology & Aesthetics), DermaOne Clinic, Kaya Skin Clinic Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain skin excision market is poised for significant transformation, driven by technological advancements and evolving patient preferences. The integration of telemedicine is expected to enhance access to specialized care, allowing patients to consult with experts remotely. Additionally, the growing trend towards outpatient procedures will likely reshape the surgical landscape, making treatments more accessible and convenient. As healthcare providers adapt to these changes, the market is set to experience robust growth, catering to the increasing demand for effective skin excision solutions.

| Segment | Sub-Segments |

|---|---|

| By Type of Procedure | Excisional biopsy for benign and malignant lesions Wide local excision for skin cancer Mohs micrographic surgery–related excisions Aesthetic skin excision and body-contouring procedures Scar and keloid excision Others |

| By Technology / Technique | Conventional scalpel surgical excision Laser-assisted excision Radiofrequency and electrosurgical excision Cryosurgical excision Combination techniques Others |

| By Indication | Non-melanoma skin cancer (basal cell, squamous cell) Melanoma and high?risk pigmented lesions Benign tumors, nevi and cysts Post?bariatric and post?pregnancy excess skin Traumatic and surgical scar revision Cosmetic and aesthetic indications Others |

| By End-User | Tertiary care hospitals Specialized dermatology and plastic surgery centers Day-care and ambulatory surgery centers Multispecialty private clinics Others |

| By Patient Profile | Local residents – Bahraini nationals Expatriate population Inbound medical tourists Age groups (pediatric, adult, geriatric) Gender Others |

| By Setting of Care | Inpatient procedures Outpatient / office?based procedures Emergency procedures Others |

| By Payer Type | Government and public schemes Private medical insurance Self?pay and out?of?pocket Corporate / employer?sponsored plans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 60 | Dermatologists, Clinic Managers |

| Plastic Surgery Centers | 50 | Plastic Surgeons, Administrative Staff |

| Hospitals with Surgical Departments | 70 | Surgeons, Hospital Administrators |

| Patient Feedback on Procedures | 120 | Patients who have undergone skin excision |

| Health Insurance Providers | 40 | Insurance Analysts, Claims Managers |

The Bahrain Skin Excision Market is valued at approximately USD 40 million, reflecting a five-year historical analysis and regional healthcare spending trends. This valuation indicates significant growth driven by increasing skin-related conditions and advancements in surgical techniques.