Region:Middle East

Author(s):Dev

Product Code:KRAC4060

Pages:82

Published On:October 2025

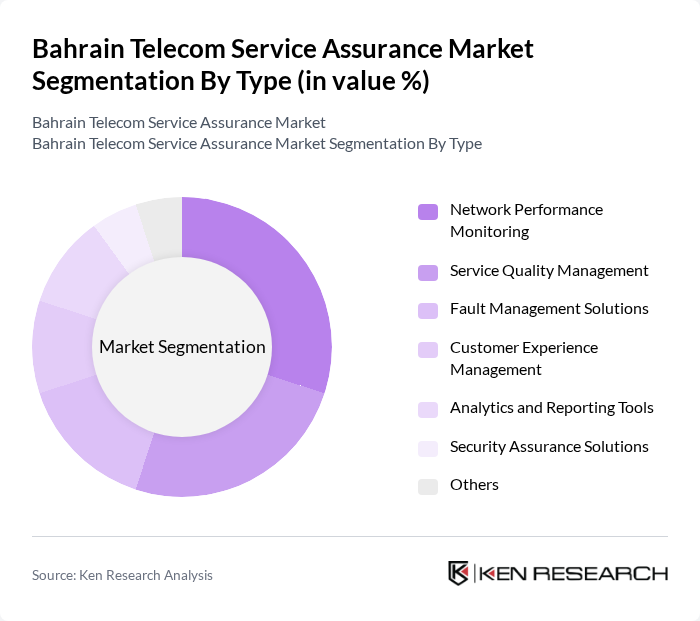

By Type:

The market is segmented into Network Performance Monitoring, Service Quality Management, Fault Management Solutions, Customer Experience Management, Analytics and Reporting Tools, Security Assurance Solutions, and Others. Network Performance Monitoring is the leading sub-segment, driven by the need for real-time monitoring and optimization of network performance to ensure seamless connectivity and service delivery. The increasing complexity of telecom networks, proliferation of IoT devices, and high expectations for uninterrupted service have made this sub-segment critical for operators. Service Quality Management and Fault Management Solutions are also prominent, reflecting the sector’s focus on proactive issue resolution and continuous improvement in service reliability.

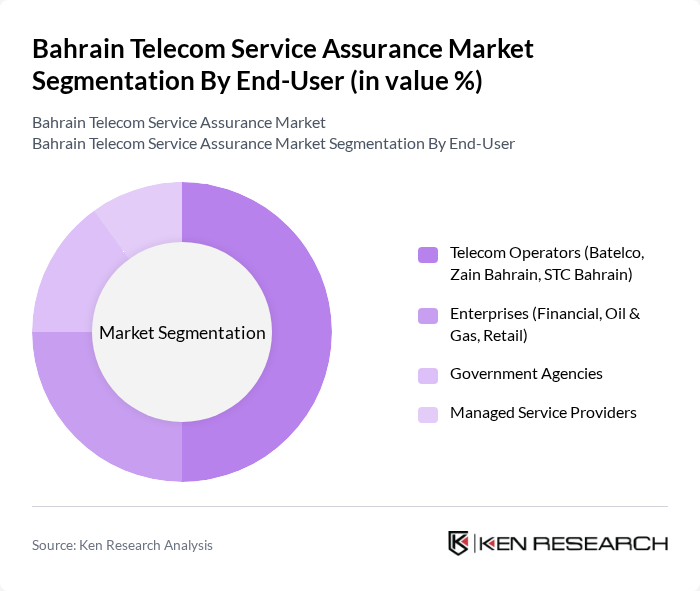

By End-User:

End-user segmentation includes Telecom Operators, Enterprises (Financial, Oil & Gas, Retail), Government Agencies, and Managed Service Providers. Telecom Operators such as Batelco, Zain Bahrain, and STC Bahrain dominate this segment due to their extensive infrastructure and the critical need for service assurance to maintain customer satisfaction and operational efficiency. The increasing reliance on digital services, cloud-based solutions, and robust network performance has further solidified their position. Enterprises and government agencies are expanding adoption, driven by digital transformation initiatives and heightened cybersecurity requirements.

The Bahrain Telecom Service Assurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Batelco, Zain Bahrain, STC Bahrain, Ericsson, Nokia, Huawei Technologies, Cisco Systems, Amdocs, Accenture, IBM, Oracle, Infosys, Tata Consultancy Services (TCS), Commscope, and NetScout Systems contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the Bahrain telecom service assurance market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As operators increasingly adopt cloud-based solutions and integrate machine learning for service monitoring, operational efficiencies are expected to improve. Additionally, the emphasis on enhancing customer experience will lead to more personalized service offerings, ensuring that telecom providers remain competitive in a rapidly changing landscape. The focus on cybersecurity will also intensify, as operators seek to protect their networks and customer data from emerging threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Performance Monitoring Service Quality Management Fault Management Solutions Customer Experience Management Analytics and Reporting Tools Security Assurance Solutions Others |

| By End-User | Telecom Operators (Batelco, Zain Bahrain, STC Bahrain) Enterprises (Financial, Oil & Gas, Retail) Government Agencies Managed Service Providers |

| By Application | Network Optimization Service Assurance Automation Incident Management Compliance Monitoring Fraud Management |

| By Deployment Model | On-Premises Cloud-Based |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services |

| By Pricing Model | Subscription-Based Pay-Per-Use |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Network Service Assurance | 100 | Network Operations Managers, Technical Directors |

| Fixed-Line Service Quality Management | 60 | Service Quality Analysts, Customer Experience Managers |

| Broadband Performance Monitoring | 50 | IT Managers, Network Engineers |

| Customer Support and Satisfaction | 80 | Customer Service Representatives, Call Center Managers |

| Emerging Technologies in Telecom | 40 | Innovation Officers, R&D Managers |

The Bahrain Telecom Service Assurance Market is valued at approximately USD 120 million, reflecting a significant growth driven by the increasing demand for reliable telecommunications services and enhanced customer experience management.