Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4112

Pages:86

Published On:December 2025

By Type:The market is segmented into various types of tire pressure monitoring systems, including Direct TPMS, Indirect TPMS, Connected TPMS, and Retrofit Aftermarket TPMS Kits. Each type serves different consumer needs and preferences, influencing market dynamics.

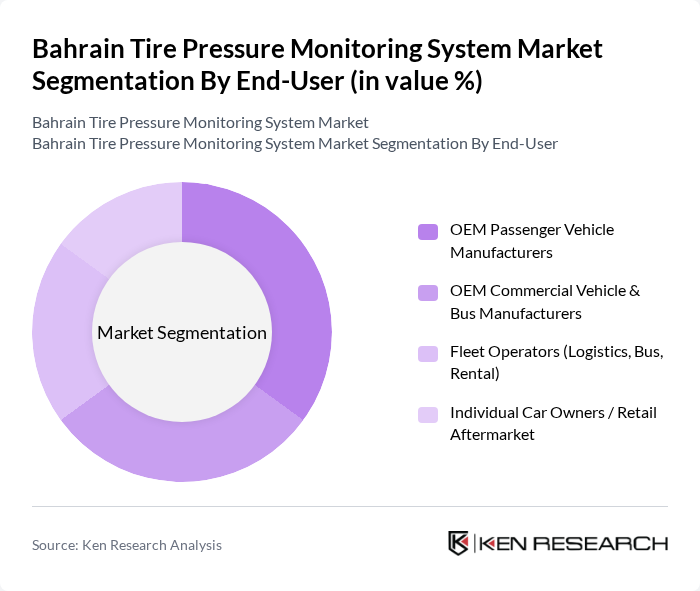

By End-User:The end-user segmentation includes OEM Passenger Vehicle Manufacturers, OEM Commercial Vehicle & Bus Manufacturers, Fleet Operators, and Individual Car Owners. Each segment has distinct requirements and influences the overall market landscape.

The Bahrain Tire Pressure Monitoring System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Michelin Group, Pirelli & C. S.p.A., Huf Hülsbeck & Fürst GmbH & Co. KG, Sensata Technologies, Inc., Denso Corporation, ATEQ TPMS Tools (ATEQ Corp.), Schrader TPMS Solutions (Sensata), CUB Elecparts Inc., NIRA Dynamics AB, Bartec Auto ID Ltd., Pacific Industrial Co., Ltd., and local and regional TPMS distributors in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the TPMS market in Bahrain appears promising, driven by increasing vehicle safety regulations and technological advancements. As the automotive industry continues to evolve, the integration of smart technologies and IoT capabilities will likely enhance consumer engagement. Additionally, the expansion of electric vehicles will create new opportunities for TPMS adoption, as these vehicles often require advanced monitoring systems to optimize performance and safety. Overall, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct TPMS (Sensor-in-Tire / Wheel) Indirect TPMS (ABS/ESC-based) Connected / Telematics-Enabled TPMS Retrofit Aftermarket TPMS Kits |

| By End-User | OEM Passenger Vehicle Manufacturers OEM Commercial Vehicle & Bus Manufacturers Fleet Operators (Logistics, Bus, Rental) Individual Car Owners / Retail Aftermarket |

| By Vehicle Type | Passenger Cars (Sedans, Hatchbacks, SUVs) Light Commercial Vehicles (LCVs & Vans) Heavy Commercial Vehicles (Trucks & Trailers) Buses & Coaches |

| By Distribution Channel | OEM Fitment (Factory-Installed) Authorized Service Centers & Dealerships Independent Workshops & Tire Retailers Online B2C & B2B Platforms |

| By Technology | Battery-Powered Pressure Sensor TPMS BLE / Smartphone-Integrated TPMS CAN / LIN-Bus Integrated TPMS Modules Cloud-Connected TPMS & Analytics Platforms |

| By Application | Safety & Regulatory Compliance Fuel Efficiency & Tire Life Optimization Predictive Maintenance & Uptime Management Driver & Fleet Performance Monitoring |

| By Policy Support | GCC / Bahrain Vehicle Safety Regulations Incentives for Fleet Safety & Telematics Government & Municipal Fleet Compliance Programs Voluntary Corporate Safety & ESG Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Product Development Managers, Safety Compliance Officers |

| Fleet Management Companies | 80 | Fleet Operations Managers, Maintenance Supervisors |

| Automotive Retailers | 70 | Sales Managers, Service Advisors |

| Government Regulatory Bodies | 50 | Policy Makers, Safety Inspectors |

| Consumer Awareness Groups | 40 | Advocacy Leaders, Community Outreach Coordinators |

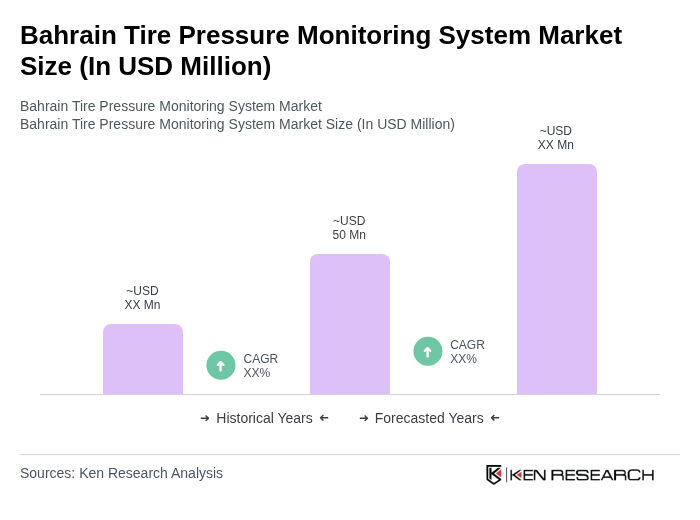

The Bahrain Tire Pressure Monitoring System (TPMS) market is valued at approximately USD 50 million, driven by factors such as increasing vehicle production, heightened road safety awareness, and a focus on fuel efficiency among consumers.