Region:Middle East

Author(s):Shubham

Product Code:KRAB8817

Pages:83

Published On:October 2025

By Type:The market is segmented into various types of electric vans, including Light Duty Vans, Medium Duty Vans, Heavy Duty Vans, Refrigerated Vans, Cargo Vans, Chassis Cabs, and Others. Among these, Light Duty Vans are currently leading the market due to their versatility and suitability for urban deliveries. The growing e-commerce sector has significantly increased the demand for these vehicles, as they are ideal for last-mile delivery solutions.

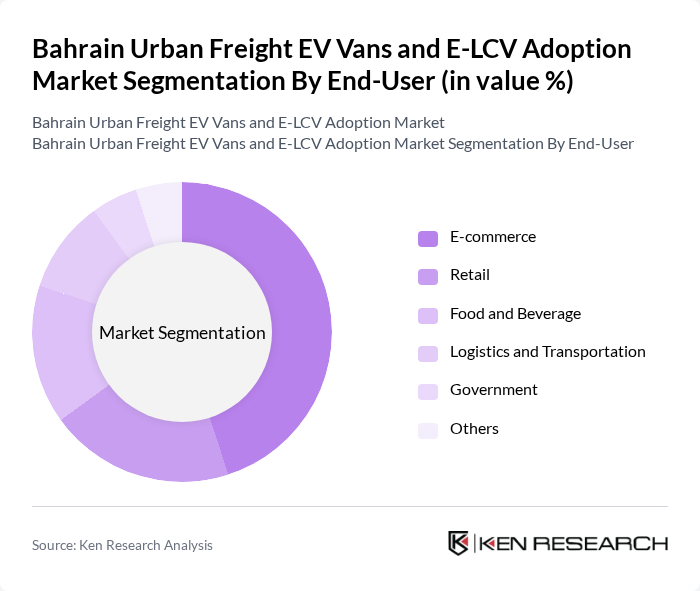

By End-User:The market is segmented by end-users, including E-commerce, Retail, Food and Beverage, Logistics and Transportation, Government, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient delivery solutions. The demand for electric vans in this sector is fueled by the need for sustainable practices and the reduction of delivery costs.

The Bahrain Urban Freight EV Vans and E-LCV Adoption Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, Mercedes-Benz AG, Nissan Motor Corporation, Ford Motor Company, Tesla, Inc., Renault S.A., Volkswagen AG, Mitsubishi Motors Corporation, Chanje Energy, Inc., Workhorse Group Inc., Arrival Ltd., Proterra Inc., GreenPower Motor Company Inc., Rivian Automotive, Inc., Lordstown Motors Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain urban freight EV vans and e-LCV market appears promising, driven by increasing environmental awareness and government initiatives. As the country invests in expanding its charging infrastructure and offers more incentives for electric vehicle adoption, logistics companies are likely to embrace these changes. Additionally, the rise of e-commerce is expected to further fuel demand for electric delivery vehicles, creating a more sustainable urban logistics landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Duty Vans Medium Duty Vans Heavy Duty Vans Refrigerated Vans Cargo Vans Chassis Cabs Others |

| By End-User | E-commerce Retail Food and Beverage Logistics and Transportation Government Others |

| By Payload Capacity | Up to 1 Ton 2 Tons 3 Tons Above 3 Tons |

| By Charging Type | Fast Charging Slow Charging Battery Swapping |

| By Distribution Channel | Direct Sales Online Sales Dealerships Fleet Management Companies |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Policy Support | Subsidies Tax Exemptions Grants Incentives for Charging Infrastructure |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Companies with EV Fleets | 100 | Fleet Managers, Operations Directors |

| Retail Sector Urban Freight Users | 80 | Supply Chain Managers, Procurement Officers |

| Government Transportation Officials | 50 | Policy Makers, Urban Planners |

| Environmental NGOs Focused on Urban Transport | 40 | Sustainability Advocates, Program Directors |

| End-Users of Urban Freight Services | 70 | Business Owners, Logistics Coordinators |

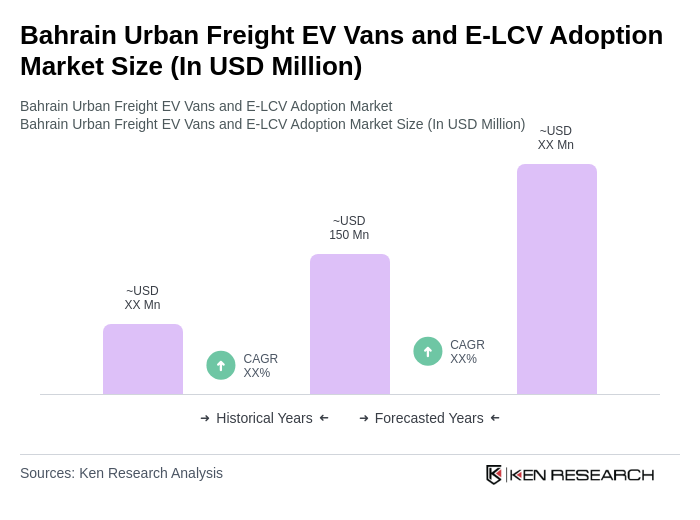

The Bahrain Urban Freight EV Vans and E-LCV Adoption Market is valued at approximately USD 150 million, reflecting a significant growth driven by urbanization, government initiatives, and the demand for sustainable logistics solutions.