Region:Asia

Author(s):Dev

Product Code:KRAD0577

Pages:95

Published On:August 2025

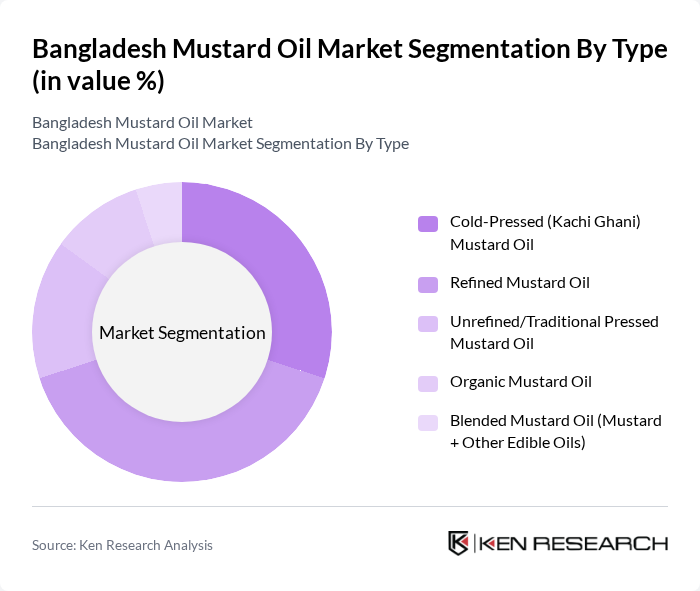

By Type:The market is segmented into various types of mustard oil, including Cold-Pressed (Kachi Ghani), Refined, Unrefined/Traditional Pressed, Organic, and Blended Mustard Oil. Among these, Cold-Pressed Mustard Oil is gaining popularity due to its perceived health benefits and traditional extraction methods. The demand for Organic Mustard Oil is also on the rise as consumers become more health-conscious and prefer organic products. Refined Mustard Oil remains a staple in households and food processing industries due to its longer shelf life and neutral flavor.

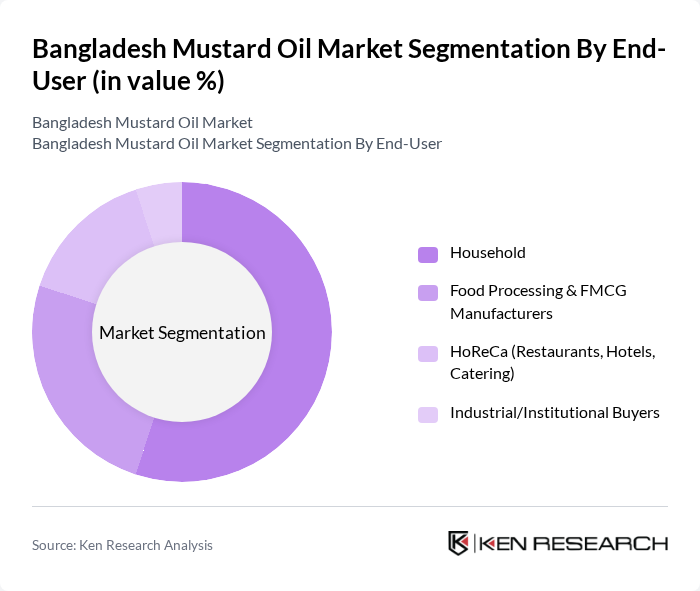

By End-User:The end-user segmentation includes Household, Food Processing & FMCG Manufacturers, HoReCa (Restaurants, Hotels, Catering), and Industrial/Institutional Buyers. The Household segment dominates the market as mustard oil is a staple cooking ingredient in Bangladeshi cuisine. The Food Processing sector is also significant, utilizing mustard oil in various products, while the HoReCa segment is growing due to the increasing number of restaurants and catering services that prefer mustard oil for its flavor and health benefits.

The Bangladesh Mustard Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangladesh Edible Oil Ltd. (BEOL) – Teer, Rupchanda, ACI Limited – ACI Pure, City Group – Teer, PRAN-RFL Group – PRAN, Meghna Group of Industries (MGI) – Fresh, Partex Star Group – Partex, TK Group of Industries – Pusti, S. S. Oil Mills Ltd. (SS Oil Mills), BD Foods Ltd., Jamuna Group – Jamuna, Globe Pharmaceuticals Group of Companies Ltd. – GPC Mustard Oil, Bashundhara Group – Bashundhara, Kazi & Kazi (KK) – Organic (niche/organic segment), Abdullah Oil Mills Ltd. (AOML), Aftab Group – Aftab contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bangladesh mustard oil market appears promising, driven by increasing health awareness and a shift towards natural products. As consumers continue to prioritize health and wellness, the demand for mustard oil is expected to rise. Additionally, the government's ongoing support for oilseed production will likely enhance local supply, stabilizing prices. Innovations in product offerings, such as organic and cold-pressed variants, will further attract health-conscious consumers, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold-Pressed (Kachi Ghani) Mustard Oil Refined Mustard Oil Unrefined/Traditional Pressed Mustard Oil Organic Mustard Oil Blended Mustard Oil (Mustard + Other Edible Oils) |

| By End-User | Household Food Processing & FMCG Manufacturers HoReCa (Restaurants, Hotels, Catering) Industrial/Institutional Buyers |

| By Packaging Type | Bottles (PET/Glass) Pouches/Sachets Tins/Cans Bulk Packaging (Jerrycans/Drums) |

| By Distribution Channel | Traditional Local Markets/Kiranas Supermarkets/Hypermarkets & Retail Chains Online Platforms (E-commerce & q-commerce) Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Region | Dhaka Chattogram Khulna Rajshahi Rangpur Sylhet |

| By Others | Specialty/Value-Added Oils (fortified, flavored) Medicinal/Ayurvedic Use Export-Oriented SKUs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Consumption Patterns | 150 | Household Heads, Primary Grocery Buyers |

| Retail Market Insights | 120 | Store Managers, Retail Buyers |

| Food Processing Industry Usage | 90 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Distributors, Supply Chain Managers |

| Agricultural Production Insights | 60 | Farmers, Agricultural Extension Officers |

The Bangladesh mustard oil market is valued at approximately USD 1.3 billion, reflecting a steady growth driven by increasing consumer demand for healthy cooking oils and the expansion of the food processing industry.