Region:Asia

Author(s):Dev

Product Code:KRAC0359

Pages:88

Published On:August 2025

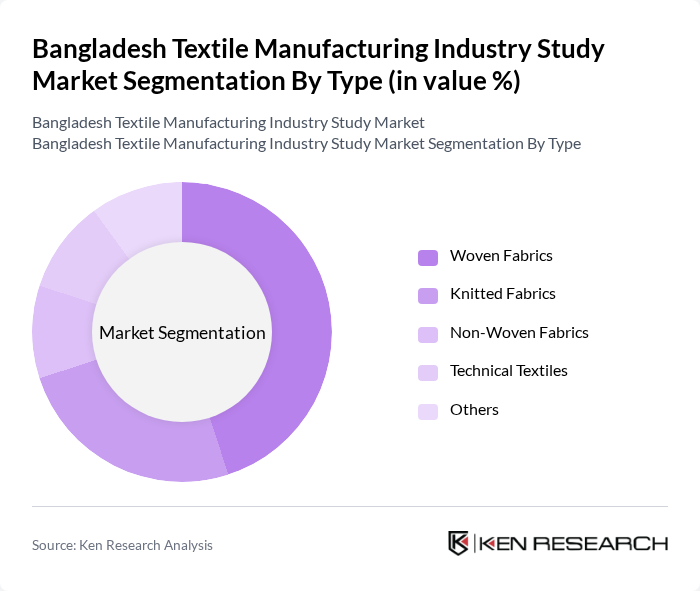

By Type:The textile manufacturing market is segmented into woven fabrics, knitted fabrics, non-woven fabrics, technical textiles, and others. Woven fabrics hold the largest share, primarily due to their extensive use in apparel and home textiles, driven by consumer demand for durability, design variety, and suitability for large-scale garment production. Knitted fabrics are also significant, especially for the knitwear segment, which is a major export category. Technical and non-woven textiles are gaining importance with the rise of value-added products and industrial applications .

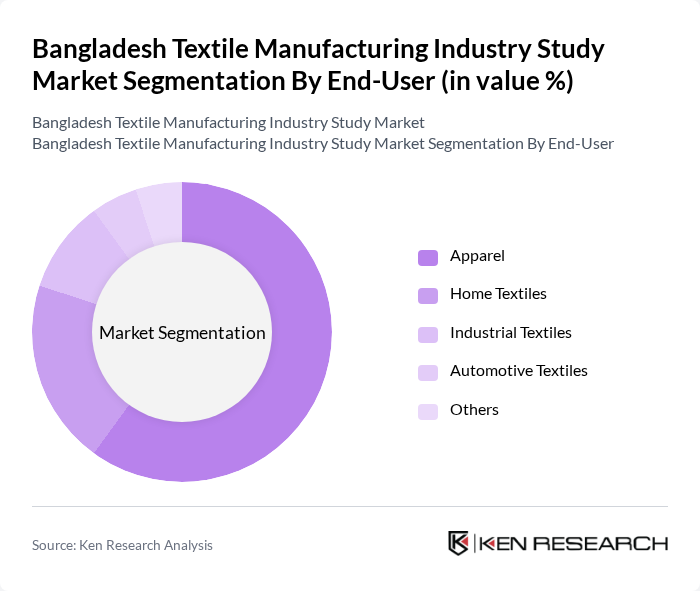

By End-User:The end-user segmentation includes apparel, home textiles, industrial textiles, automotive textiles, and others. The apparel segment leads the market, driven by Bangladesh's position as a global leader in ready-made garment exports, supplying major international brands and retailers. Home textiles and industrial textiles are also significant, with growth supported by diversification into value-added products and increased domestic consumption .

The Bangladesh Textile Manufacturing Industry Study Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grameen Knitwear Ltd., Beximco Textiles Ltd., Square Textiles Ltd., DBL Group, Knit Concern Ltd., Ananta Group, Pacific Jeans Ltd., Opex Group, Alif Group, Epyllion Group, M. S. Knitwear Ltd., Mita Group, Fakir Fashion Ltd., Ha-Meem Group, and Hossain Group contribute to innovation, geographic expansion, and service delivery in this space.

The Bangladesh textile manufacturing industry is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt automation and smart technologies, operational efficiencies are expected to improve, reducing costs and enhancing product quality. Additionally, the growing emphasis on ethical consumerism will likely push companies to innovate in sustainable practices, positioning them favorably in the global market. This evolution will create a more resilient industry capable of adapting to changing consumer demands and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Woven Fabrics Knitted Fabrics Non-Woven Fabrics Technical Textiles Others |

| By End-User | Apparel Home Textiles Industrial Textiles Automotive Textiles Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Fabric Composition | Cotton Jute Silk Wool Synthetic Blends Others |

| By Application | Clothing Application Industrial Application Household Application |

| By Sustainability Level | Conventional Eco-Friendly Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Garment Manufacturing | 100 | Factory Owners, Production Managers |

| Textile Machinery Suppliers | 50 | Sales Managers, Technical Support Staff |

| Export Market Analysis | 40 | Export Managers, Trade Analysts |

| Labor Market Conditions | 50 | HR Managers, Labor Union Representatives |

| Sustainability Practices in Textiles | 40 | Sustainability Officers, Compliance Managers |

The Bangladesh Textile Manufacturing Industry is valued at approximately USD 19 billion, primarily driven by the demand for ready-made garments, which account for over 80% of the country's export earnings and significantly contribute to the national GDP.