Global Cash Logistics Market Outlook to 2023

By Region (North America, APAC, Europe, and Latin America Middle East and Africa) and Service (Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Services – Cash Processing, Counting, Sorting, Packing and Transportation of Valuables and Bullion

Region:Asia

Author(s):Veturi Sundara Karthik

Product Code:KR929

December 2019

180

About the Report

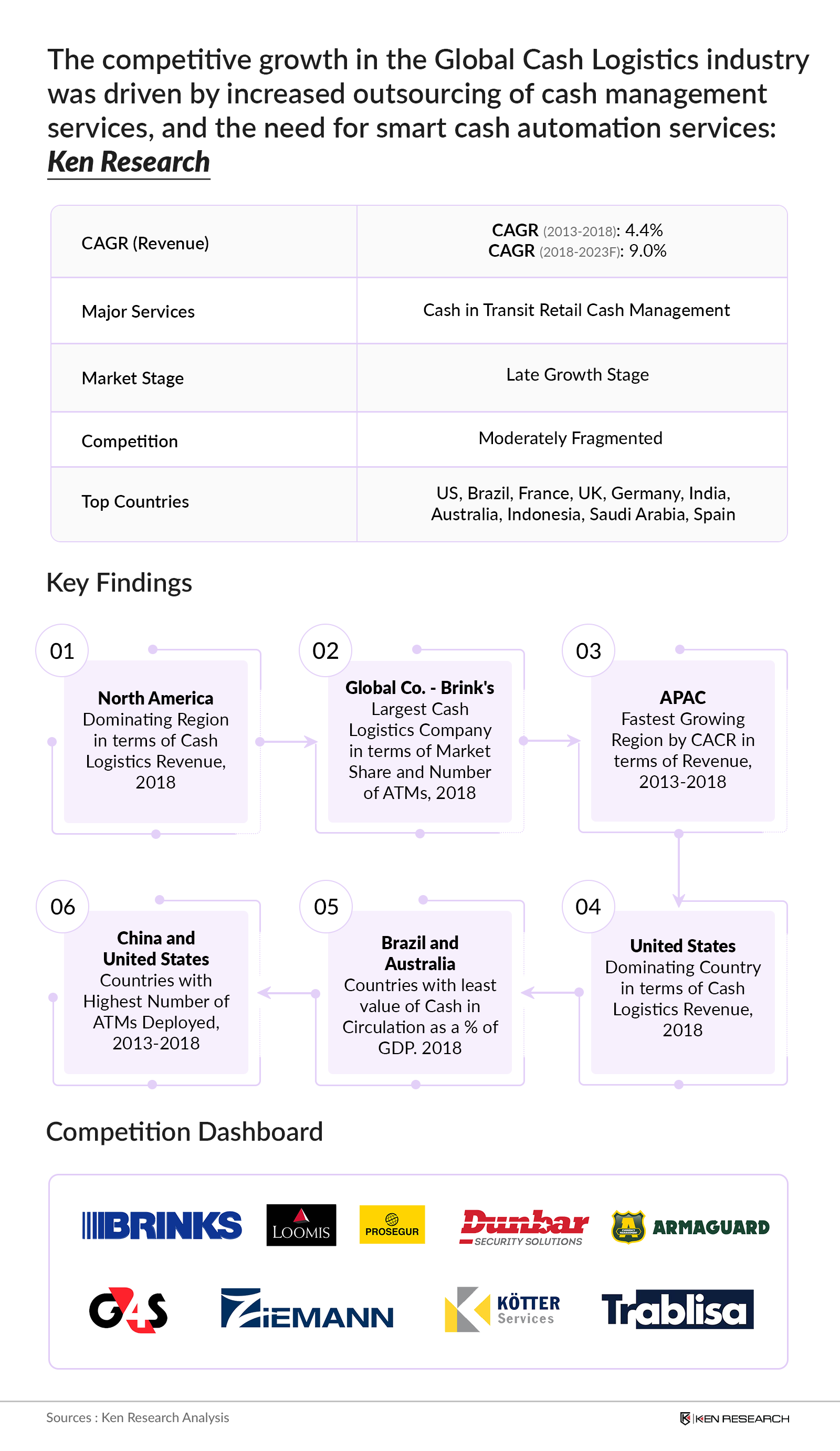

Global Cash Logistics Market Overview and Size

Global Cash Logistics Market Segmentation

Country Profiles

Global Cash Logistics Market Competition Scenario

Global Cash Logistics Market Future Outlook and Projections

Key Topics Covered in the Report

- Global Cash Logistics Market Value Chain Analysis

- Global Cash Logistics Market Overview

- Global Cash Logistics Market Trends

- Global Cash Logistics Market Challenges

- Global Cash Logistics Future Projections

- Global Cash Logistics Market Segmentation by Region

- Global Cash Logistics Market Segmentation by Service

- Competition Analysis of Global Cash Logistics Companies

- Country Profiles – United States, Brazil, France, United Kingdom, Germany, India, Australia, Indonesia, Saudi Arabia, Spain

Products

Key Target Audience

Existing Cash Logistics Companies

Investors and Venture Capital Firms

Technology Based Startups

Banking and Financial Institutions

Government Entities

ATM Managed Services Companies

ATM Supply Companies

Retail Stores

Time Period Captured in the Report:

Historical Period: 2013 -2018

Forecast Period: 2019-2023

Companies

Key Segments Covered

By Region

North America

Europe

APAC

Latin America, Middle East and Africa

By Service

Cash in Transit

Cash Replenishment

Retail Cash ManagementOther Cash Services – Cash Processing, Counting, Sorting, Packaging

By Countries Covered

United States of America

Brazil

France

United Kingdom

Germany

India

Australia

Indonesia

Spain

Saudi Arabia

- Global

- Brink’s, Loomis, Prosegur, G4S

- France

- Temis

- Germany

- Ziemann, Kotter

- Spain

- Trablisa

- Australia

- Armaguard

- United States

- Dunbar

- Brazil

- Rodoban, Protégé, TB Forte

- India

- CMS Infosystem, Writer Safeguard, Securevalue, Logicash, Radiant Cash

- Saudi Arabia

- ABANA, AlHamrani

- Indonesia

- ABACUS, SSI, Kejar, Advantage, APSG

Table of Contents

1. Executive Summary

1.1 Global Cash Logistics Market Overview

1.2 Global Cash Logistics Market Segmentation by Service

1.3 Global Cash Logistics Market Segmentation by Region

1.4 Global Cash Logistics Market Competition Scenario

1.5 Global Cash Logistics Market Future Analysis

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

Research Methodology

Approach – Market Sizing

Limitations

Market Sizing – Global Cash Logistics Market

Country Approach - Correlation Matrix: Macroeconomic Variables (Dependent and Independent Variables), Conclusion, Regression Matrix

2.3.1. Germany

2.3.2. Spain

2.3.3. United States

2.3.4. United Kingdom

2.3.5. France

2.3.6. India

2.3.7. Australia

2.3.8. Brazil

2.3.9. Saudi Arabia

2.3.10. Indonesia

3. Market Overview and Genesis

3.1Market Stage

3.2Product and Service Diversification

3.3Consolidation in Developed Markets

3.4Industry Life Cycle Analysis

3.5Timeline of Major Companies

4. Value Chain Analysis - Flow Chart

Challenges faced by the Entities

5. Market Size, 2013-2018

5.1. By Revenue, 2013-2018

6. Market Segmentation, 2013-2018

6.1. By Region, 2013-2018

North America

APAC

Europe

LAMEA

6.2. By Service, 2018

Cash in Transit

Cash Replenishment

Retail Cash Management

Other Cash Solutions - Cash Processing, Counting, Sorting and Packaging

7. Competition Scenario

Market Share by Revenue

Cross Comparison by Inception Year, Annual Revenue, Number of Employees, Number of ATMs Managed, Number of Vehicles, Number of Branches and Countries Present

8. Company Profiles of Major Companies

(Introduction, Future Strategies, Operating Indicators, Recent Developments, Financial Matrix and Service Portfolio including Service Segment, Services and Revenue Matrix)

8.1. Brink’s Company

8.2. Loomis AB

8.3. Prosegur Cash

8.4. G4S

9. Country Profiles

9.1. Germany Cash Logistics Market

9.1.1. Market Overview and Size by Revenue, 2013-2018

including ATM Managed Services Market Business Model: On-Site, Off-Site and White Label ATMs)

9.1.2. Market Segmentation

By Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Solutions, 2018

By Bank and Non-Bank, 2018

9.1.3. Competition Scenario

Strength and Weakness of Major Players - Prosegur, Ziemann, Koetter, Others

Cross Comparison of Major Players by Revenue, ATMs Managed, Armored Fleet Size, Employees, Active Regions

Market Share of Major Players by Revenue, 2018

9.1.4. Number of Onsite, Offsite, Independent ATMs, ATM Withdrawal Volume & Value & Cash Circulation Scenario, 2014-2018

9.1.5. Regulatory Framework

License Requirements, Competent Authority, Mandatory Requirements, Specific Requirements and Powers and Responsibilities

9.1.6. Future Projections and Trends, 2019-2023

9.2 Spain Cash Logistics Market, 2013-2023

9.2.1 Market Overview and Size by Revenue, 2013-2018

(including ATM Managed Services Market Business Model: On-Site, Off-Site and White Label ATMs)

9.2.2 Market Segmentation

By Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Solutions, 2018

9.2.3 Competition Scenario

Strength and Weakness of Major Players - Prosegur, Loomis, Trablisa

Cross Comparison of Major Players by Revenue, ATMs Managed, Armored Fleet Size, Employees, Active Regions

Market Share of Major Players by Revenue, 2018

9.2.4 ATM Withdrawal and Cash Circulation Scenario

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.2.5 Regulatory Framework

License Requirements, Competent Authority, Mandatory Requirements, Specific Requirements and Recirculation of Banknotes

9.2.6 Future Outlook and Projections by Revenue, 2019-2023

9.3.United States Cash Logistics Market, 2013-2023

9.3.1 Market Overview and Size by Revenue, 2013-2018

(Including ATM Managed Services Business Model: Number of Off-Site and On-Site ATMs, and White Label ATMs)

9.3.2 Market Segmentation

By Banking CIT and Cash Replenishment, Retail Cash Management, Other Cash Services, 2018

9.3.3 Competition Scenario

Strength and Weakness of Major Players - Loomis, Brink's Garda, Dunbar

Cross Comparison of Major Players by Revenue, ATMs Managed, Armored Fleet Size, Employees, Active Regions

Market Share of Major Players by Revenue, 2018

9.3.4 ATM Withdrawal and Cash Circulation Scenario, 2014-2018

Including Value and Volume of ATM Withdrawals and Cash in Circulation to GDP in Percentage, 2014-2018

9.3.5 Regulatory Framework

Including Rules for Bank Operated ATMs, Rules for Non-Bank Operated ATMs and Cash Transportation

9.3.6 Future Outlook and Projections by Revenue, 2019F-2023F

9.4.United Kingdom Cash Logistics Market, 2015-2023

9.4.1 Market Overview and Size by Revenue, 2015-2018

Including ATM Managed Services Business Models including Outsourced and White Label ATMs

9.4.2 Market Segmentation

By Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Solutions, 2018

9.4.3 Competition Scenario

Strengths and Weaknesses of Major Players: G4S, Prosegur, Loomi

Cross Comparison of Major Players by Revenue, ATMs Managed, Armored Fleet Size, Cash Machine Name, Number of Employees, Regions Active and Clientele, 2018

Market Share of Major Players by Revenue, 2018

9.4.4 ATM Withdrawal and Cash Circulation Scenario, 2013-2018

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2013-2018

9.4.5 Regulatory Framework

Licensing Requirements, Wage Requirements, Competent Authority and Relevant Law, Scope of Legislation and Business Regulation

9.4.6 Future Outlook Projections by Revenue, 2019-2023

9.5. France Cash Logistics Market, 2015-2023

9.5.1 Market Overview and Size by Revenue, 2015-2018

(Including Managed Services Market Business Models including On-Site, Off-Site)

9.5.2 Market Segmentation

Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Solutions, 2018

9.5.3 Competition Scenario Strengths and Weaknesses of Major Players: Brink's, Loomis

Market Share of Major Players by Revenue, 2018

9.5.4 ATM Withdrawal and Cash Circulation Statistics, 2014-2018

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.5.5 Regulatory Framework

Licensing Requirements, Competent Authority and Relevant Law, Wage Requirements and Working Hours and Scope of Legislation

9.5.6 Future Outlook and Projections, 2019F-2023F

9.6. India Cash Logistics Market, 2013-2023

9.6.1 Market Overview and Size by Revenue, 2013-2018

9.6.2 Market Segmentation

ATM Replenishment, Cash in Transit, Retail Cash Management and Other Services, 2017-2018

9.6.3 Competition Scenario

Strengths and Weaknesses of Major Players: CMS Infosystems, SIS Prosegur, Brink's Arya, Writer Safeguard, Securevalue, RadiantCash, Logicash, Cross Comparison Number of ATMs, Retail Touch Points, Number of Branch Offices, Employees, Cash Vans and Market Share in Number of ATMs Serviced

Market Share of Major Players by Revenue, 2018

9.6.4 ATM Withdrawal and Cash Circulation Scenario

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.6.5 Regulatory Framework

White Label ATMs, Net Worth Requirements, Replenishment Restrictions and CIT Regulations

9.6.6 Future Outlook and Projections, 2019-2023

9.7. Australia Cash Logistics Market, 2014-2023

9.7.1 Market Overview and Size by Revenue, 2014-2018 (Including Business Model for ATM Cash Replenishment and Outsourced ATMs)

9.7.2 Market Segmentation, 2018

By Cash in Transit, Cash Replenishment, Retail Cash Management and Other Cash Services, 2018

9.7.3 Competition Scenario, 2018

Strengths and Weaknesses of Major Players: Armaguard, Prosegur; Cross Comparison Number of ATMs, Number of Branch Offices, Employees, Market Share in Number of ATMs Serviced and Annual Revenue

Market Share of Major Players by Revenue, 2018

9.7.3 ATM Withdrawal and Cash Scenario, 2014-2018

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.7.4 Regulatory Framework

Relevant Laws and Risk Management Process

9.7.5 Future Outlook and Projections, 2019-2023

9.8. Brazil Cash Logistics Market, 2015-2023

9.8.1 Market Overview and Size by Revenue, 2013-2018

9.8.2 Competition Scenario, 2018

Cross Comparison of Major Players including Prosegur, Brink’s, Protégé, Rodoban and TB Forte on the Basis of Number of Cash Vans, Revenue in USD Million for 2018, Regions Active and Number of Employees

Market Share of Major Players by Revenue, 2018

9.8.3 ATM Withdrawal and Cash Circulation Scenario, 2014-2018

Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.8.4 Regulatory Framework

Competent Authority, Relevant Laws and Requirements

9.8.5 Future Outlook and Projections by Revenue, 2019-2023

9.9. Indonesia Cash Logistics Market, 2013-2023

9.9.1 Market Overview and Size by Revenue, 2013-2018

(including ATM Managed Services Market Business Model: On-Site, Off-Site and White Label ATMs)

9.9.2 Market Segmentation CIT and Cash Replenishment, Retail Cash Solutions and other services, 2018

9.9.3 Competition Scenario, 2018

Strengths and Weaknesses of Major Players: SSI, Bringing Gigantara, Advantage, G4S, Kejar, TAG, Abacus; Market Share in terms of Number of ATMs Managed

Market Share of Major Players by Number of ATMs Managed, 2018

9.9.4 ATM Withdrawal and Cash Scenario, 2013-2018

Number of ATMs, Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2013-2018

9.9.5 Regulatory Framework

License Required for Cash Replenishment, MOU between Bank Indonesia & Police Commissioner General, Branchless Banking & Key Parameters for Foreign Investors

9.9.6 Future Projections and Outlook by Revenue, 2019-2023

9.10. Saudi Arabia Cash Logistics Market, 2013-2023

9.10.1 Market Overview and Size by Revenue, 2013-2018

(Including ATM Managed Services Market Business Model: On-Site, Off-Site and White Label ATMs)

9.10.2 Market Segmentation, 2018

Cash replenishment and FLM, Cash in Transit and Other Cash Services

9.10.3 Competition Scenario, 2018

Strengths and Weaknesses of Major Players: Hamrani, NCR, Hyosung, GRG Baning, Abana, AMNCO, Abu-Sarhad, G4S Almajal, Sanid & Hemaia Group; Heat Map on the basis of ATM Equipment Supply, Maintenance of ATM, Site Monitoring and Maintenance, ATM Replenishment, FLM and CIT

Market Share of Major Players by Number of ATMs Managed, 2018

9.10.4 ATM Withdrawal and Cash Circulation Scenario, 2014-2018

Number of ATMs, Value and Volume of ATM Withdrawals, and Cash in Circulation to GDP Percentage, 2014-2018

9.10.5 Regulatory Framework

SAMA’s role in banking Industry, SPAN, ATM Membership, E-banking Regulations and Incentives for Foreign Investors

9.10.6 Future Outlook and Projections , 2019-2023

10. Trends and Developments

Increase in Number of ATMs

introduction of Advanced ATM Machines

Increasing White Label ATM Penetration

Consolidation in Cash Logistics Industry

Digitization in Banking & ATM Industry

Increase in Bank Branches & Debit Card Penetration

11. Issues and Challenges

Rise of Digital Payment

Branch Closures and Rise of Internet Banking

Decline in Number of Free Transactions at ATMs

Lack of Network Infrastructure

Declining Margins

Theft and Robberies

12. Global Cash Logistics Market Future Outlook and Projections, 2019-2023 By Revenue, 2019-2023

13. Analyst Recommendations

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.