Global Remittance Market Outlook to 2030

segmented by mode of transfer (digital, traditional), type of channel (Banks, online platforms, money transfer operators), type of end use (migrant labour workforce, personal, small business & others) Geography (Latin America, Africa, Asia Pacific, Europe, Middle East)

Region:Asia

Author(s):Rishita Trivedi

Product Code:KROD163

March 2023

70

About the Report

The report provides a comprehensive analysis of the potential of the Global Remittance Market. The report covers an overview and genesis of the industry, market size in terms of product demand.

Its market segment includes by mode of transfer (Digital & Traditional), by type of Remittance (Inward Remittance & Outward Remittance), by type of Channel (Banks, Money transfer operators & online platforms), by Geography (North America, Europe, Asia Pacific, Latin America, Middle East, Africa), by end use (Migrant labour workforce, personal, small business & others). The report includes growth enablers, recent trends & developments, pain points & solutions. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview

According to Ken Research estimates, the Global Remittance Market which has seen a steady growth in last few years excluding the pandemic year is driven by rise in mobile-based payment channels and cross-border transactions and decrease in remittance transfer time & cost drives the growth of the market. In addition, increase in adoption of banking & financial sectors across the globe fuels the . However, rise in number of financial crimes and lack of awareness for digital remittance is expected to impede the market growth. Furthermore, technological advancements in digital remittance market is expected to provide lucrative opportunities for the market growth. The most important growth driver is the remittance flows coming via migrant workers.

- The digital segment is projected to witness significant growth over the forecast period. The growth can be attributed to the growing wave of digitalization in developing countries such as India and China

- The inward remittance segment is anticipated to witness the fastest growth over the forecast period. The segment's growth is ascribed to the determination of migrants to support their families back home during the difficult post-pandemic recovery period

- The Asia Pacific is expected to emerge as the fastest-growing region owing to a wider customer base & a substantial number of key market players as well as innovators in the region.

Key Trends by Market Segment:

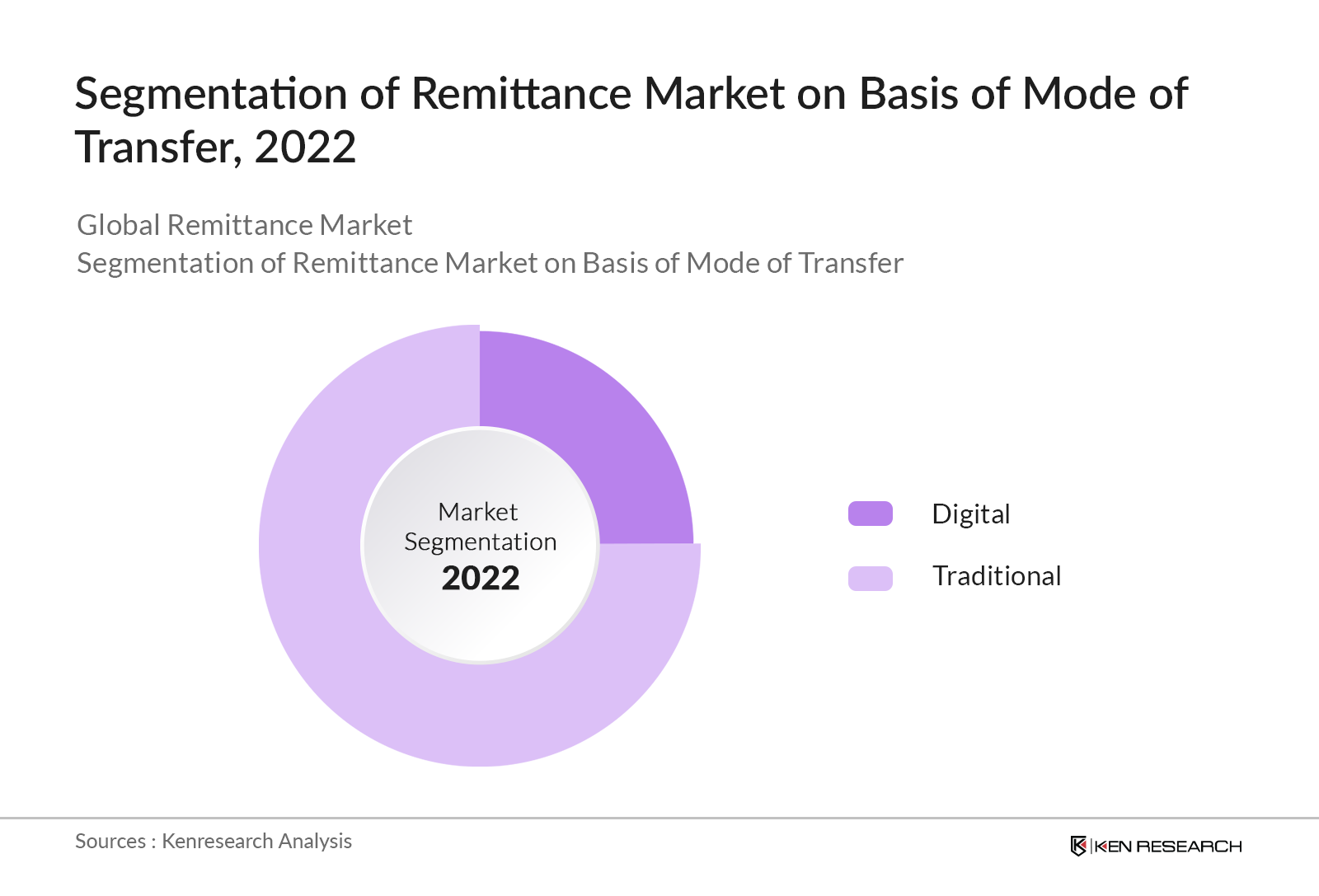

By Mode of Transfer: The traditional (non-digital) segment accounted for the largest revenue share of more than 75.0% in 2021.The major factor contributing to the segment's growth is the sense of security and safety the consumer experiences while remitting funds through an offline channel. However, in the upcoming years, digital mode of transfer is anticipated to register massive growth.

By Type: The outward remittance segment dominated the market in 2022 and accounted for a revenue share of more than 54.0%. Most businesses are a part of the global economy, and a company must deal with competition everywhere to compete on this grand scale.

By Channel: The money transfer operators segment accounted for the largest revenue share & the online platforms (wallets) segment is anticipated to register significant growth over the forecast period. The segment's growth can be attributed to the fact that online platforms save a lot of time. People no longer have to stand in lines, write cheques, or wait for paper bills, and they are not required to wait for banks to clear their cheques before accessing the funds.

Competitive Landscape

Global Remittance Market is concentrated among the top 10 players. Prominent players are pursuing various strategies, such as research & development initiatives, product innovations, joint ventures & strategic partnerships, expansion, and mergers & acquisitions to gain a competitive edge in the market. Market players are focusing on leveraging the capabilities of newly emerged fintech companies to offer their consumers the utmost convince of remitting funds. The major companies dominating the Global Remittance market for its products, services, and continuous product developments are Bank of America, Citi Group Inc., Pay Pal, Wells Fargo, JP Morgan Chase among others.

Future Outlook

According to Ken Research estimates, the Global Remittance Market which was valued at USD ~701 Bn in 2020 to USD ~1000 Bn by 2027 is driven by rise in mobile-based payment channels and cross-border transactions and decrease in remittance transfer time & cost drives the growth of the market. In addition, increase in adoption of banking & financial sectors across the globe fuels the remittance market growth. However, rise in number of financial crimes and lack of awareness for digital remittance is expected to impede the market growth. Furthermore, technological advancements in is expected to provide lucrative opportunities for the market growth.

Scope of the Report

|

By Mode of Transfer |

Digital Traditional |

|

By Type of Remittance |

Inward Remittance Outward Remittance |

|

By Type of Channel |

Banks Money Transfer Operators Online Transfers |

|

By Type of End Use |

Migrant Labor Workforce Personal Small Business Others |

|

By Region |

Latin America Europe North America Africa Asia Pacific Middle East |

Products

Key Audience

Banks

Money Transfer Operators

Digital Payment Companies

M-Wallet Companies

Bills Payments Companies

Investors & Venture Capital Firms

Government Bodies

Mobile Money Companies

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2027

Companies

Key Players Covered

Citi Group

JP Morgan Chase

Bank Of America

Pay Pal

OFX

UAE Exchange

Ria Financial Services

‘Digital Wallet Corporation

InstaRem

Transfer Go

Fly Remit

Western Union

Table of Contents

1. Executive Summary

2. Global Remittance Market Overview

2.1 Taxonomy of Global Remittance Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for Global Remittance Market

2.5 Growth Drivers of the Market

2.6 Issues and Challenges of Global Remittance Market

2.7 Impact of COVID-19 on Global Remittance Market

2.8 PESTLE/SWOT Analysis

3. Global Remittance Market Size, 2017 – 2022

4. Global Remittance Market Segmentation

4.1 By Distribution Channel, 2017 - 2022

4.2 By End User, 2017 - 2022

4.3 By Regional Split (Latin America/Europe/North America/Africa/Asia Pacific/Middle East), 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles – (Top 5 - 7 Major Players)

5.3.1 Citi Group

5.3.2 JP Morgan Chase

5.3.3 Bank of America

5.3.4 OFX

5.3.5 InstaRem

5.3.6 Fly Remit

5.3.7 Digital Wallet Corporation

6. Global Remittance Future Market Size, 2022 – 2027

7. Global Remittance Future Market Segmentation

7.1 By Distribution Channel, 2022 - 2027

7.2 By End User, 2022 - 2027

7.3 By Regional Split (Latin America/Europe/North America/Africa/Asia Pacific/Middle East), 2022 - 2027

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on used car and new car over the years, penetration of car finance and down payment ratio to compute overall credit disbursed for cars. We will also review central bank statistics to understand credit disbursed and outstanding amount which can ensure accuracy behind the datapoint shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple finance providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from car finance providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Global Remittance Market is covered from 2017–2022 in this report, including a forecast for 2022-2027.

02 What are the Key Factors Driving the Global Remittance Market?

Rise in mobile-based payment channels and cross-border transactions and decrease in remittance transfer time & cost drives the growth of the market are some of the major growth drivers of Global Remittance Market.

03 Who are the Key Players in the Global Remittances Market?

Citi Group, Bank of America, OFX, JP Morgan Chase are some of the prominent players in the market.

04 Which segment dominated the global remittance market (by type)?

Outward remittance accounted for a major part of the Global Remittance Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.