India Payment Services Market Outlook to 2026

Region:Asia

Author(s):Anurag Jha, Mayukh Sen

Product Code:KR1081

August 2021

141

About the Report

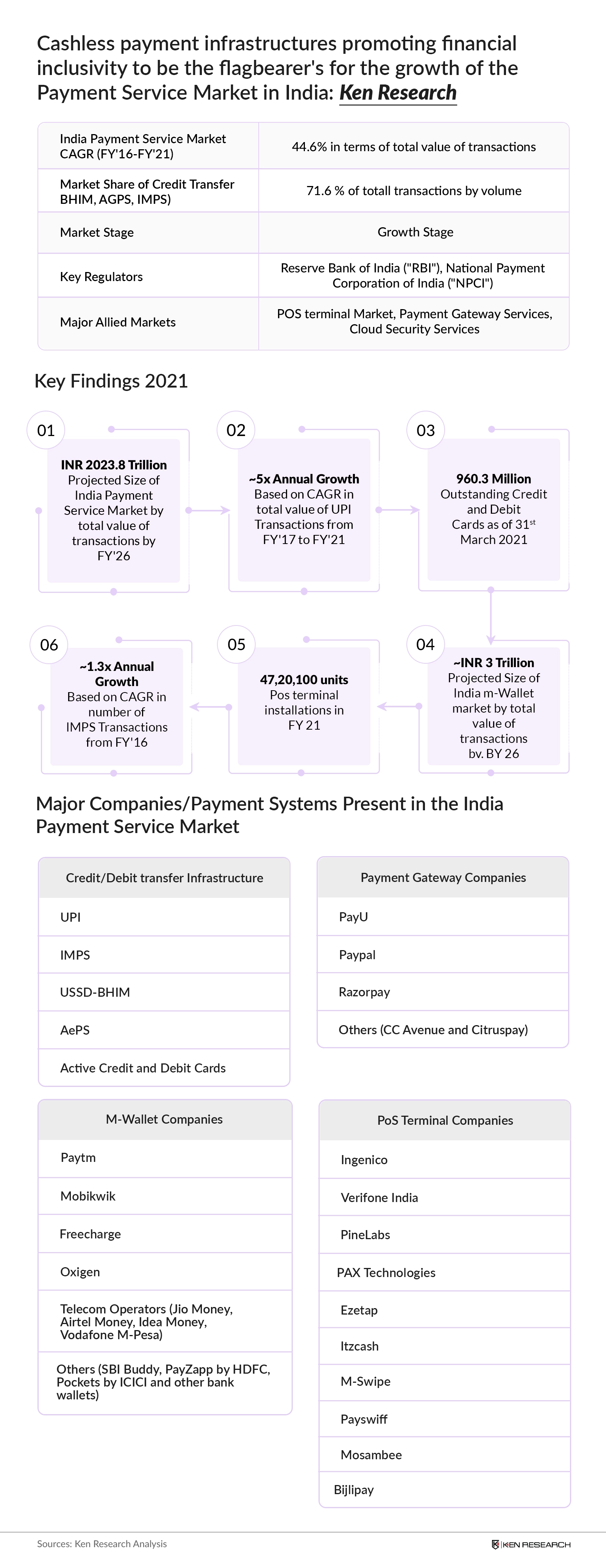

India Payment Services Market

India IMPS (Immediate Payment Service) Consumer Payment Landscape

India AePS (Aadhaar Enabled Payment System) Consumer Payment Landscape

India Bharat Interface for Money (Ussd-bhim) Consumer Payment Landscape

India UPI (Unified Payments Interface) Consumer Payment Landscape

India M-Wallet Market

India PoS (Point of sale) Terminal Market

India Payment Services Market Future Outlook and Projections

India PoS Terminals Market Future Outlook and Projections

Key Topics Covered in the Report

- India Payment Services Market

- Regulatory Framework in India Payment Services Market

- India Payment Services Market Segmentation

- India Payment Services Market Future Outlook and Projections

- Credit and Debit Card Coverage

- Immediate Payment Service (IMPS) Consumer Payment Landscape

- Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

- Unstructured Supplementary Service Data - Bharat Interface for Money (USSD-BHIM) Consumer Payment Landscape

- Unified Payments Interface (UPI) Consumer Payment Landscape

- Cross Comparison of Different Payment Modes (IMPS, AePS, USSD-BHIM and UPI) in India Payment Services Market

- India Bill Payment Market

- India Omni-Channel Payments Processing Market

- India Bank Reconciliation Software Market

- India Digital Payment Market

- India Cloud Security Services Market

- India Payment Security Services Market

- India M-Wallet Market

- Market Share of M-Wallet Players in India

- Competitive Landscape of India M-Wallet Market

- Trends and Developments in India M-Wallet Market

- India Payment Gateway Market

- India Point of Sale (PoS) Terminal Market

- India Point of Sale (PoS) Terminal Competitive Landscape

- India Point of Sale (PoS) Terminal Market Segmentation

- India Point of Sale (PoS) Terminal Market Future Outlook and Projections

- India m-PoS Market

- CUG Cards / Prepaid Closed Loop Cards

- Cloud / Security Outsourcing in Payments Technology

- Government Regulations

- Assessment of COVID Impact on Contactless Transactions and POS Terminals

- Coverage on OMC Digital Space

Products

Key Target Audience

Banks and Financial Institutions

Cash Reconciliation Companies

Payment Aggregators

Payment Network Companies

Payment Interface Companies

M-Wallet Companies

Payment Gateway Companies

PoS Terminal Companies

M-PoS Terminal Companies

Time Period Captured in the Report:

Historical Period: FY’15-FY’21

Forecast Period: FY’21-FY’26E

Companies

Key Segments Covered in India Payment Services Market

India Payment Services Market

By Payment Card Usage (Cash Payments and Cash Withdrawals)

By Number of Outstanding Debit Cards (PSU and Private Banks)

By Number of Outstanding Debit Cards: Market Share of Banks (State Bank of India, Bank of Baroda, Paytm Payments Bank, Punjab National Bank, Union Bank of India, Bank of India, Canara Bank, ICICI Bank and others)

By Number of Outstanding Credit Cards (PSU and Private Banks)

By Number of Outstanding Credit Cards: Market Share of Banks (HDFC Bank, State Bank of India, ICICI Bank, Axis Bank, Ratnakar Bank, Citi Bank, Kotak Mahindra Bank, American Express and others)

By Modes of Payment (RTGS, Credit Transfers, Debit Transfers, Direct Debits and Card Payments)

Credit and Debit Card Coverage

By Number of Credit Card Transactions (PoS and ATM)

By Credit Card Transaction Value (PoS and ATM)

By Number of Debit Card Transactions (PoS and ATM)

By Debit Card Transaction Value (PoS and ATM)

By Number of ATMs and PoS Terminals

By Number of Outstanding Cards (Credit and Debit Cards)

Immediate Payment Service (IMPS) Consumer Payment Landscape

By Type of Institution (Small Finance Bank, PSU, Private and Payments Bank, Public and Private Institutions, Regional Rural Bank and Co-operative Banks)

Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

By Types of Banks: Number of AePS Operator (Mainline Commercial Banks, Regional Rural Banks, Co-operative Banks, Payment Banks and Small Finance Banks)

India PoS Terminal Market

By Number of Terminals (Active and Inactive Terminals)

By Metro and Non-metro cities

By End User Industry (Large Enterprises, SME’s and Micro Merchants)

By Metro and Non-metro cities

M-Wallet Companies

Paytm

Mobikwik

Freecharge

Oxigen

Telecom Operators (Jio Money, Airtel Money, Idea Money, Vodafone M-Pesa)

Others (SBI Buddy, PayZapp by HDFC, Pockets by ICICI and other bank wallets)

Payment Gateway Companies

PayU

Paypal

Razorpay

Others (CC Avenue and Citruspay)

PoS Terminal Companies

Ingenico

Verifone India

PineLabs

PAX Technologies

Ezetap

Itzcash

M-PoS Companies

M-Swipe

Payswiff

Mosambee

Bijlipay

Table of Contents

1. Executive Summary

1.1. Executive Summary- India Payment Service Market

1.2. Executive Summary- Credit and Debit Card Coverage

1.3. Executive Summary- IMPS (Immediate Payment Service) Consumer Payment Landscape

1.4. Executive Summary- AePS (Aadhaar Enabled Payment System) Consumer Payment Landscape

1.5. Executive Summary- Unstructured Supplementary Service Data – Bharat Interface for Money (Ussd-bhim) Consumer Payment Landscape

1.6. Executive Summary- UPI (Unified Payments Interface) Consumer Payment Landscape

1.7. Executive Summary- India M-Wallet Market

1.8. Executive Summary- India PoS (Point of sale) Terminal Market

2. Research Methodology

2.1. Market Size and Modeling

2.2. Definitions and Approach- India Payment Services Market

2.3. Definitions and Approach- India PoS Market

2.4. Definitions and Approach- India M-Wallet Market

2.5. Definitions and Approach- India Payment Gateway Market

2.6. Other Definitions

3. India Payment Services Market

3.1. Introduction to India Payment Services Market

3.2. Snapshot on India Bill Payment Market

3.3. Private Banks V/S Public Sector Banks

3.4. Major Cards in E-commerce Segment

3.5. Growth of RuPay Cards in India

3.6. Snapshot on India Omni-Channel Payments Processing Market

3.7. Snapshot on India Bank Reconciliation Software Market

3.8. India Payments Services Market Size, FY’2016-FY’2021

3.9. India Payment Services Market Segmentation, FY’2018-FY’2021

3.10. India Payment Services Market Future Outlook and Projections, FY’2021-FY’2026E

4. Regulatory Framework in India Payment Services Market

4.1. Role of Government in India Payment Services Market

4.2. Overview of Payments and Receipts in Government Ministries / Departments

4.3 Role of Reserve Bank of India (RBI)

4.4. Role of National Payments Corporation of India (NPCI)

4.5. Evolving Outlook Of The Public Agencies

4.6. Overview of the KYC initiative

4.7. Localized Data Storage of Transactions and its Impact on Various Players

5. Credit and Debit Card Coverage

5.1. Credit Cards, FY’2016-FY’2021

5.2. Debit Cards, FY’2016-FY’2021

5.3. Proportion of Active Credit and Debit Cards in India, FY’2021

5.4. Number of ATMs and POS Terminals, FY’2013-FY’2021

5.5. Number of Outstanding Cards in India Payment Services Market, FY’2015-FY’2021

5.6. Cross Comparison of Different Payment Modes in India Payment Services Market

5.7. Value added services

6. Immediate Payment Service (IMPS) Consumer Payment Landscape

6.1. IMPS Transactions Overview, FY’14-FY21

6.2. Entities Offering Imps

6.3. Working Model of IMPS Payment Landscape in India Payment Services Market

6.4. Popular Uses of IMPS

6.5. IMPS Charges

7. Adhaar Enabled Payment System (AePS) Consumer Payment Landscape

7.1. Advantages of AePS

7.2. AePS Transactions Overview, 2016-2021

7.3. Entities Offering AePS, FY’2021

7.4. Working Model of AePS Landscape in India

8. Unstructured Supplementary Service Data – Bharat Interface for Money (USSD-BHIM) Consumer Payment Landscape

8.1. USSD-BHIM Transactions Overview, FY’17 – FY’21

8.2. Number of Operators / Downloads

8.3. Government Initiative to Promote USSD-BHIM in India

9. Unified Payments Interface (UPI) Consumer Payment Landscape

9.1. Major Government Initiatives aimed to increase UPI Adoption

9.2. Number of UPI Transactions, FY’17-FY’21

9.3. Number of UPI Operators / Downloads, FY’16-FY’21

9.4. Working Model of UPI Landscape in India Payment Services Market

9.5. Recent Trends in UPI Adoption

10. India M-Wallet Market

10.1. Introduction to India M-Wallet Market

10.2. Value Chain Analysis in India M-Wallet Market

10.3. Revenue Generation

10.4. Operations Involved In Using M-Wallet Services

10.5. India M-Wallet Market Size, FY’15-FY’21

10.6. Trends and Developments in India M-Wallets Market

10.7. Government Regulations in India M-Wallets Market

10.8. Competitive Landscape of Major Players Operating in India M-Wallets Market

10.9. Competition Scenario

10.10. Market Share of Major Players Operating in India M-Wallet Market

10.11. Company Profiles of Major Players Operating in India M-Wallet Market

10.12. Telecom operators (Jio Money, Airtel Money, Idea Money, M-Pesa) Operating in Indian Mobile Wallet Market

11. India Point of Sale (PoS) Terminal Market

11.1. Introduction to India Point of Sale (PoS) Terminal Market

11.2. Value Chain Analysis in India PoS Terminal Market

11.3. India PoS Terminal Market Size, FY’2016-FY’2021

11.4. India PoS Terminal Market Segmentation, FY’2021

11.5. Comparative Landscape in India PoS Terminal Market

11.6. India PoS Terminals Market Future Outlook and Projections, FY’2018-FY’2026E

12. Prepaid Instruments

12.1. Closed User Group (“CUG”) Cards

12.2. NCMC Cards

12.3. Open Loop Prepaid Cards

12.4. National Electronic Toll Collection (NETC) program-FasTag

13. Cloud / Security Outsourcing in Payments Technology

13.1. Global IOT Security Spending

13.2. Cyber Threats in India

13.3. Regulatory Landscape of Cyber Security Framework in India

13.4. RBI Cyber Security Guidelines for Banks and Financial Institutions

13.5. India Cloud Security Services Market

13.6. India Payment Security Services Market

14. Government Regulations

14.1. Payments Infrastructure Development Fund

14.2. Digital Incentives as mentioned in the budget

14.3. The Future of RUpay Interchange

15. COVID Impact

15.1. Assessment of COVID Impact on Contactless transactions and POS terminals

16. Coverage on OMC Digital Space

16.1. Introduction to the fuel retail sector in India

16.2. Market Snapshot of the OMC Space

16.3. Future of digital spend in petrol outlets

Disclaimer

Contact Us

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.