KSA Personal Finance Market Outlook to 2026F

Driven by Growing Digitalization and Increased Consumption Needs

Region:Middle East

Author(s):Himanshi Kalota

Product Code:KR1249

November 2022

70

About the Report

This report provides a comprehensive analysis of the potential of the Personal Finance Industry in KSA. The report also covers the overview and genesis of the industry, market size in terms of outstanding credit and number of loans.

Its market segmentation by purpose of loan, by supplier, by tenure of loan, by booking mode, by geography, by nationality of borrower, by employment of borrower; growth enablers and drivers, challenges and bottlenecks, trends driving digital adoption; regulatory framework; industry analysis, competitive landscape including competition scenario, market shares of major players on the basis of outstanding credit. The report concludes with future market projections of each segmentation and analyst recommendations.

Market Overview:

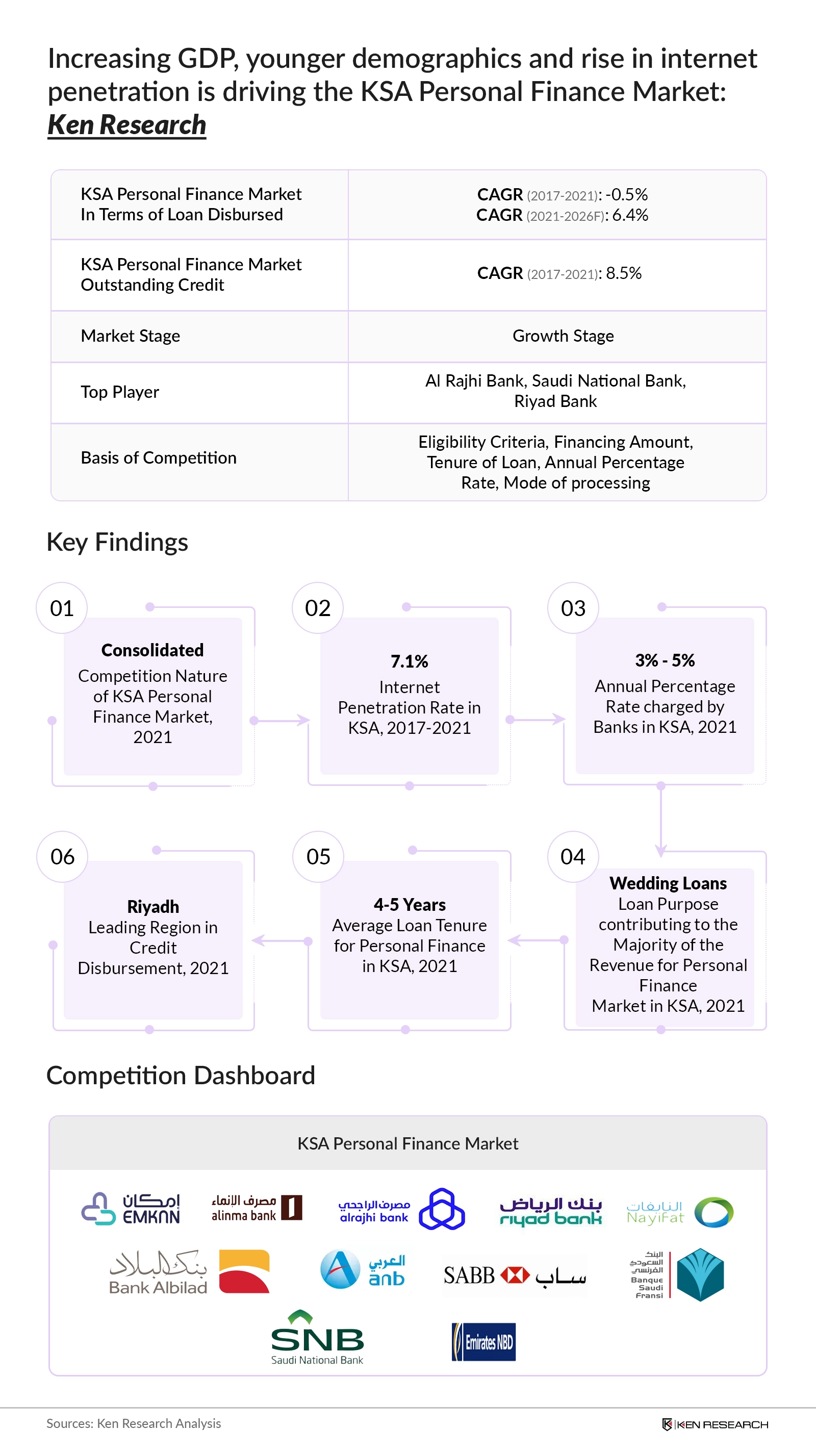

The Personal in KSA is in the growth stage, being driven by banks and NBFCs and introduction of Fin-Tech companies. With new entrants, strict changes in policies can be seen related to insolvency and other parameters. With the growing number in working women population, digitalization of personal financing and supportive government policies, the market is expected to grow over the next 4 years.

According to Ken Research estimates, the KSA Personal Finance Market is expected to grow at a CAGR of 15.7% in the forecasted period of 2022-2026F, owing to the New Government Policies under Vision 2030 and New Players in the Market.

Outstanding Credit in KSA Personal Finance Market, 2017-2026F

Key Trends by Market Segments:

By Purpose of Loan: The majority of Saudi Arabians take personal loans for the purpose of a wedding. Saudi Arabia Vision 2030 envisions to increase the level of healthcare facilities by privatization which will drive the purpose of loan towards healthcare.

By Geography: Riyadh is the hub of offices in Saudi Arabia due to which the purchasing power of people residing in Riyadh is high; however other regions are also on the curve of development.

Competitive Landscape

Conclusion

The personal finance market in Saudi Arabia has higher than average growth opportunity compared to other GCC countries, given the relative under penetration which offers a huge opportunity for Non-Banking Financial Institutions. Growth rate of total number of loans taken is going to increase over the period as financing becomes easier, internet user penetration rates increase. Commitment of SAMA to enable market entry of FinTechs is expected to foster development of an innovative ecosystem in Financial Services

Scope of the Report

|

By Purpose of Loan |

Wedding Renovation & Home Improvement Consumer Durables Tourism & Travel Medical Education Debt Consolidation Others |

|

By Supplier  |

Banks Non-Banks (NBFIs & FinTechs) |

|

By Tenure of Loan |

< 1 year 1-2 years 2-3 years 3-4 years 4-5 years |

|

By Booking Mode  |

Online Offline |

|

By Geography |

Riyadh Jeddah Dammam Others |

|

By Nationality of Borrower |

Saudi Non-Saudi |

|

By Employment of Borrower |

Government Employee Large Corporation Private Sector Employee Medium & Small Corporation Private Sector Employee Self-Employed Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

KSA Finance Industries

Government Bodies & Regulating Authorities

Finance Industry

Finance Companies

Time Period Captured in the Report

Historical Period: 2017-2021

Base Year: 2022

Forecast Period: 2022-2026F

Companies

Major Players Mentioned in the Report

Al Rajhi Bank

Saudi National Bank

Riyad Bank

Alinma Bank

Arab National Bank

The Saudi British Bank (SABB)

Banque Saudi Fransi

Al Bilad Bank

Emirates NBD

Nayifat Finance Company

Emkan Finance Company (owned by Al Rajhi Bank)

Murabaha Marena Financing Company

United Company for Financial Services (Tasheel Finance)

Al Yusr Leasing & Financing

Al-Amthal Finance Company

Tamam

Quara Finance Company

Tayseer Finance

Saudi Finance Company (acquired by Abu Dhabi Islamic Bank)

Abdul Latif Jameel United Finance Company

Osoul Modern Finance Company

Matager Finance Company

Table of Contents

1. Executive Summary

1.1. Executive Summary: KSA Personal Finance Market

2. Country Overview of KSA

2.1. Country Demographics and Socioeconomic Indicators, 2021

2.2. KSA Population Analysis, 2021

3. KSA Personal Finance Market Overview

3.1. KSA Personal Finance Supply Ecosystem

3.2. KSA Personal Finance Market Evolution

3.3. Understanding Value Chain of KSA Personal Finance

3.4. Important aspects of KSA Personal Finance

3.5. Islamic Financing

3.6. Parameters based on which customers select a company for Personal Finance

3.7. How are Fintech companies disrupting personal finance market?

4. KSA Personal Finance Market Size

4.1. KSA Personal Finance Market Size, 2017-2021

5. KSA Personal Finance Market Segmentation

5.1.  KSA Personal Finance Market by Purpose of Loan, (Wedding Loans, Home Renovation Loans, Travel Loan, Medical loans, Debt Consolidation Loan and Others), 2017-2021

5.2. KSA Personal Finance Market By Supplier of Loan (Banks and Non-Banks), 2021

5.3Â KSA Personal Finance Market By Tenure of Loan (Less than 1 Year, 1 Year, 2 Years, 3 Years, 4 Years, 5 Years, and More Than 5 Years), 2021

5.4. KSA Personal Finance Market By Booking Mode (Online, Offline), 2021

5.5. KSA Personal Finance Market By Geography (Riyadh, Jeddah, Dammam, and others), 2021

5.6. KSA Personal Finance Market By Nationality of Borrower (Saudi, Non-Saudi), 2021

5.7. KSA Personal Finance Market Employment of Borrower (Government Employees, Large Corporation Employees, Private Sector, and Professionals), 2021

6. Industry Analysis of KSA Personal Finance Services

6.1Â Porter 5 Forces Analysis of KSA Personal Finance Market

6.2Â SWOT Analysis of KSA Personal Finance Market

6.3Â Trends and Developments of KSA Personal Finance Market

6.4Â Growth Drivers of KSA Personal Finance Market

6.5Â Challenges for new entrants in KSA Personal Finance Market

6.6Â Government policies affecting the KSA Personal Finance Market

7. Competition Framework of the KSA Personal Finance Market

7.1Â KSA Personal Finance Market Competition Overview

7.2Â KSA Personal Finance Market Share

7.3Â Strengths and Weaknesses of Players in KSA Personal Finance Market

7.4Â Cross comparison of Players in KSA Personal Finance Market

7.5Â Cross comparison of Players in KSA Personal Finance Market based on Operational Parameters

7.6Â Cross Comparison of Players in KSA Personal Finance Market based on Financial Parameters

8. Future Outlook and Projections of the KSA Personal Finance Market

8.1.  KSA Personal Finance Market by Purpose of Loan, (Wedding Loans, Home Renovation Loans, Travel Loan, Medical loans, Debt Consolidation Loan and Others), 2017-2021

8.2. KSA Personal Finance Market By Supplier of Loan (Banks and Non-Banks), 2021

8.3Â KSA Personal Finance Market By Tenure of Loan (Less than 1 Year, 1 Year, 2 Years, 3 Years, 4 Years, 5 Years, and More Than 5 Years), 2021

8.4. KSA Personal Finance Market By Booking Mode (Online, Offline), 2021

8.5. KSA Personal Finance Market By Geography (Riyadh, Jeddah, Dammam, and others), 2021

8.6. KSA Personal Finance Market By Nationality of Borrower (Saudi, Non-Saudi), 2021

8.7. KSA Personal Finance Market Employment of Borrower (Government Employees, Large Corporation Employees, Private Sector, and Professionals), 2021

9. KSA Personal Finance Market: Case Studies

9.1Â Tasheel Finance

9.2Â Nayifat Finance Company

9.3Â Emkan Finance

9.4Â Quara Finance

9.5Â Tamam Finance

10. Market Opportunities and Analyst Recommendations

10.1 Growth strategies for KSA Personal finance market

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Sample Size Inclusion

11.5 Research Limitations

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on used car and new car over the years, penetration of car finance and down payment ratio to compute overall credit disbursed for cars. We will also review central bank statistics to understand credit disbursed and outstanding amount which can ensure accuracy behind the datapoint shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple finance providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from car finance providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The KSA Car Finance Market is covered from 2017–2026 in this report, including a forecast for 2022-2026.

02 What is the Future Growth Rate of the KSA Car Finance Market?

The KSA Car Finance Market is expected to witness a CAGR of ~10% over the next four years.

03 What are the Key Factors Driving the KSA Car Finance Market?

New Government Policies under Vision 2030 and Entry of Women Drivers is likely to fuel the growth in the KSA Car Finance market.

04 Which is the Largest Car Type Segment within the KSA Car Finance Market?

The Sedan Car type segment held the largest share of the KSA Car Finance Market in 2021.

05 Who are the Key Players in the KSA Car Finance Market?

Al Rajhi Bank, Saudi National Bank (SNB), Abdul Latif Jameel United Finance and Al Yusr Leasing and Financing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.