Region:Central and South America

Author(s):Dev

Product Code:KRAB3610

Pages:87

Published On:October 2025

By Type:The market is segmented into various types, including Clothing, Footwear, Accessories, Jewelry, Handbags, Watches, and Others. Each of these segments caters to different consumer preferences and trends, with specific brands focusing on unique offerings to attract their target audience. The Clothing segment is particularly dominant due to the high demand for fashion apparel, driven by changing consumer preferences and seasonal trends.

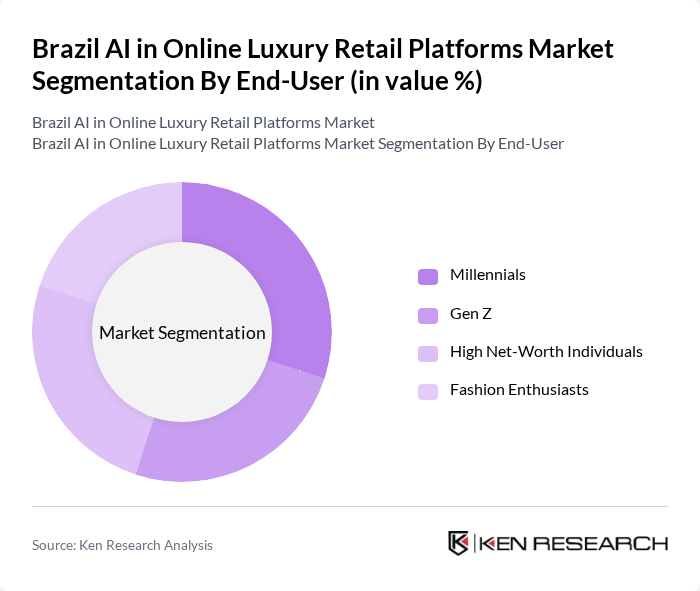

By End-User:The end-user segmentation includes Millennials, Gen Z, High Net-Worth Individuals, and Fashion Enthusiasts. Each group exhibits distinct purchasing behaviors and preferences, with Millennials and Gen Z driving the trend towards online shopping and personalized experiences. High Net-Worth Individuals tend to favor exclusive luxury items, while Fashion Enthusiasts are often influenced by the latest trends and brand collaborations.

The Brazil AI in Online Luxury Retail Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Richemont, Prada S.p.A., Burberry Group plc, Chanel S.A., Gucci, Valentino S.p.A., Hermès International S.A., Dolce & Gabbana, Versace, Fendi, Bottega Veneta, Salvatore Ferragamo, Tiffany & Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian AI in online luxury retail platforms market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt AI for personalized shopping experiences, the integration of augmented reality and virtual try-ons is expected to enhance customer engagement. Additionally, the focus on sustainability will likely shape product offerings, with luxury brands investing in eco-friendly practices. This evolving landscape presents opportunities for innovation and growth, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Jewelry Handbags Watches Others |

| By End-User | Millennials Gen Z High Net-Worth Individuals Fashion Enthusiasts |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Premium Luxury Super Luxury |

| By Customer Demographics | Age Group Gender Income Level |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Brand Loyalty | Brand Loyal Customers New Customers Occasional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Luxury Fashion Retail | 100 | Brand Managers, E-commerce Directors |

| Luxury Jewelry E-commerce | 80 | Marketing Executives, Product Managers |

| High-End Cosmetics Online Sales | 70 | Sales Managers, Digital Marketing Specialists |

| Luxury Home Goods Online Market | 60 | Retail Operations Managers, Customer Experience Leads |

| Luxury Travel and Experiences | 50 | Travel Agency Executives, Luxury Service Providers |

The Brazil AI in Online Luxury Retail Platforms Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing adoption of AI technologies in retail, particularly for enhancing customer experiences and inventory management.