Region:Central and South America

Author(s):Shubham

Product Code:KRAC0853

Pages:93

Published On:August 2025

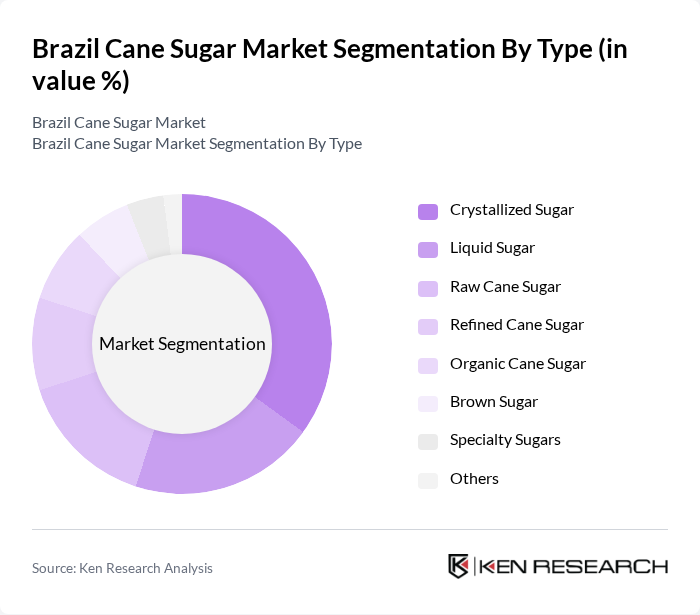

By Type:The market is segmented into crystallized sugar, liquid sugar, raw cane sugar, refined cane sugar, organic cane sugar, brown sugar, specialty sugars, and others. Crystallized sugar remains the dominant segment, widely used in both household and industrial applications due to its versatility and long shelf life. The growing consumer preference for natural and less processed sweeteners is fueling demand for organic and specialty cane sugars, particularly among health-conscious consumers and premium product manufacturers .

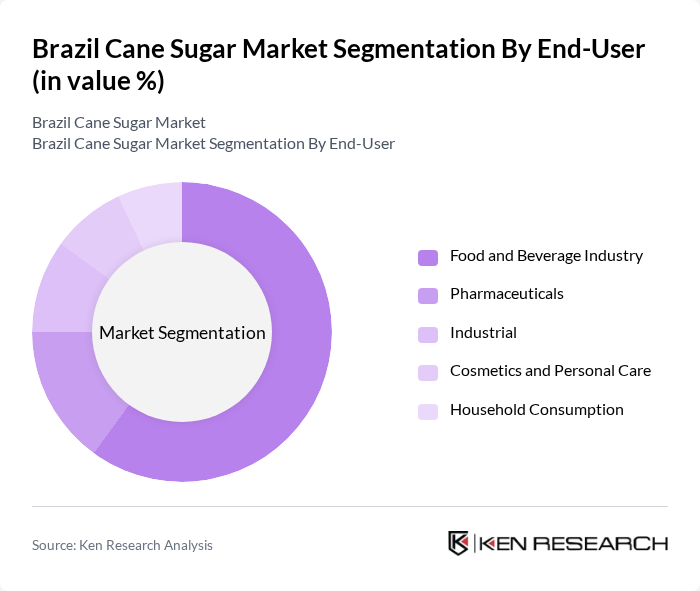

By End-User:The end-user segmentation includes the food and beverage industry, pharmaceuticals, industrial applications, cosmetics and personal care, and household consumption. The food and beverage industry remains the largest end-user, accounting for the majority of cane sugar demand due to its use in soft drinks, baked goods, confectionery, and processed foods. The trend toward health and wellness is also increasing demand for organic and specialty sugars in both food and non-food applications .

The Brazil Cane Sugar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cosan S.A., Raízen S.A., São Martinho S.A., Grupo Tereos, Usina Coruripe, Biosev S.A., Adecoagro S.A., Usina São João S.A., Usina Santa Terezinha S.A., Usina da Pedra S.A., Usina São Francisco S.A., Usina São José S.A., Usina São Miguel S.A., Usina Batatais S.A., Usina Alto Alegre S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil cane sugar market is poised for significant transformation as sustainability becomes a central focus. With increasing global demand for biofuels and natural sweeteners, producers are likely to invest in innovative processing technologies and sustainable farming practices. Additionally, the rise of e-commerce platforms for sugar sales will facilitate broader market access. As Brazil continues to strengthen its position as a leading exporter, the industry is expected to adapt to evolving consumer preferences and regulatory landscapes, ensuring long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Crystallized Sugar Liquid Sugar Raw Cane Sugar Refined Cane Sugar Organic Cane Sugar Brown Sugar Specialty Sugars Others |

| By End-User | Food and Beverage Industry Pharmaceuticals Industrial Cosmetics and Personal Care Household Consumption |

| By Application | Sweeteners Fermentation Food Preservation Baking Other Applications |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Wholesale Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging |

| By Price Range | Economy Mid-range Premium |

| By Region | Center-South Brazil North-Northeast Brazil |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sugarcane Farmers | 120 | Farm Owners, Agricultural Managers |

| Sugar Processing Mills | 90 | Mill Operators, Production Managers |

| Exporters and Importers | 60 | Trade Managers, Logistics Coordinators |

| Food and Beverage Manufacturers | 50 | Product Development Managers, Procurement Officers |

| Government Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

The Brazil Cane Sugar Market is valued at approximately USD 4 billion, driven by strong demand from the food and beverage sector, Brazil's leadership in cane sugar production, and the increasing use of sugarcane for biofuels and ethanol.