Region:Central and South America

Author(s):Rebecca

Product Code:KRAB2956

Pages:95

Published On:October 2025

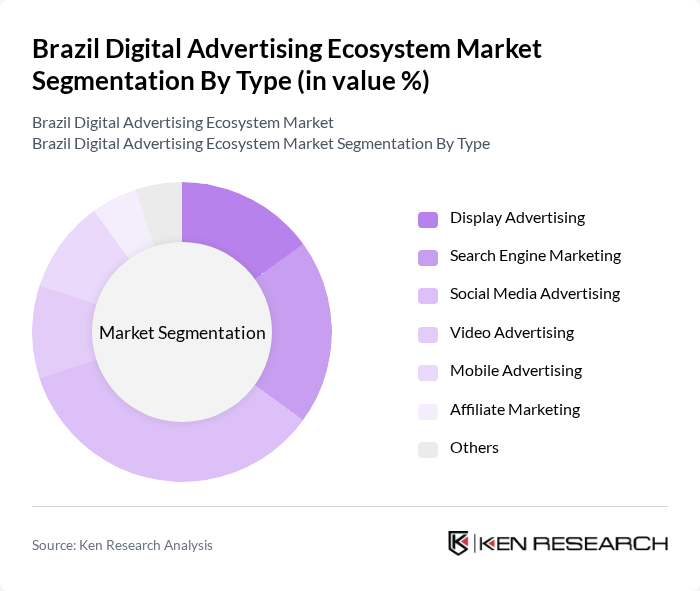

By Type:The digital advertising market in Brazil is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the widespread use of platforms like Facebook, Instagram, and WhatsApp. The increasing engagement of users on these platforms has led advertisers to allocate a significant portion of their budgets to social media campaigns, capitalizing on targeted advertising capabilities.

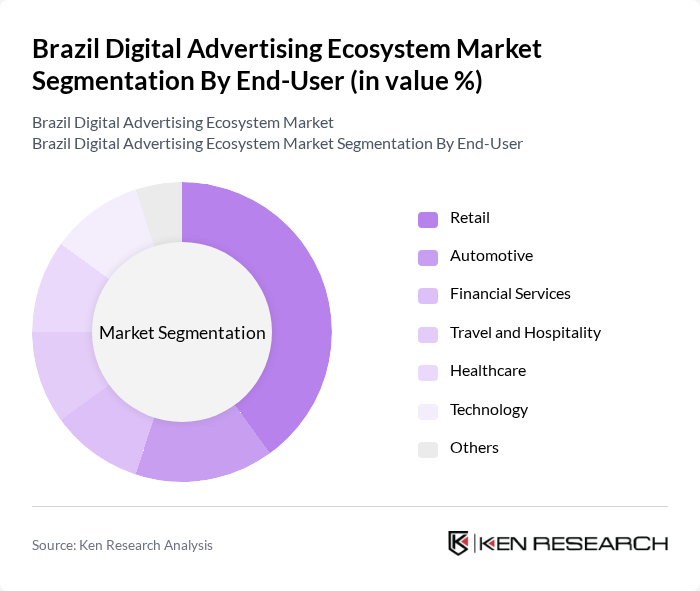

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Financial Services, Travel and Hospitality, Healthcare, Technology, and Others. The Retail sector is the leading end-user, as businesses increasingly leverage digital advertising to reach consumers directly. The shift towards online shopping has prompted retailers to invest heavily in digital marketing strategies to enhance visibility and drive sales.

The Brazil Digital Advertising Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Globo, UOL (Universo Online), Facebook Brasil, Google Brasil, Mercado Livre, iFood, OLX Brasil, Magazine Luiza, Via Varejo, Nubank, PagSeguro, Cielo, Movile, B2W Digital, Rede Globo contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil digital advertising ecosystem is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As programmatic advertising continues to gain traction, advertisers will increasingly leverage data analytics for targeted campaigns. Additionally, the integration of AI and machine learning will enhance personalization, improving engagement rates. The focus on sustainability in advertising will also shape strategies, as brands seek to align with consumer values. Overall, the market is expected to adapt rapidly to these trends, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Financial Services Travel and Hospitality Healthcare Technology Others |

| By Industry Vertical | E-commerce Entertainment Education Real Estate Telecommunications Consumer Goods Others |

| By Advertising Format | Native Advertising Sponsored Content Influencer Marketing Retargeting Ads Programmatic Ads Others |

| By Sales Channel | Direct Sales Online Platforms Agencies Resellers Others |

| By Geographic Region | Southeast Region South Region Northeast Region Central-West Region North Region Others |

| By Customer Segment | Small and Medium Enterprises Large Corporations Startups Non-Profit Organizations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising Insights | 150 | Social Media Managers, Digital Marketing Strategists |

| Search Engine Marketing Effectiveness | 100 | SEO Specialists, PPC Campaign Managers |

| Display Advertising Trends | 80 | Media Buyers, Brand Marketing Directors |

| Consumer Behavior in Digital Ads | 120 | Market Researchers, Consumer Insights Analysts |

| Emerging Digital Platforms | 90 | Innovation Managers, Digital Transformation Leads |

The Brazil Digital Advertising Ecosystem Market is valued at approximately USD 8 billion, reflecting significant growth driven by increased internet and mobile device penetration, as well as the rising trend of e-commerce and digital content consumption.