Region:Central and South America

Author(s):Dev

Product Code:KRAB5485

Pages:90

Published On:October 2025

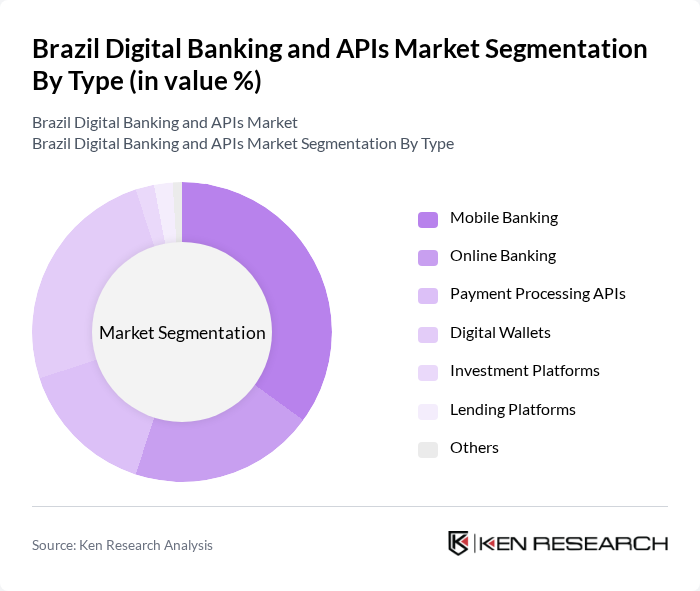

By Type:The market is segmented into various types, including Mobile Banking, Online Banking, Payment Processing APIs, Digital Wallets, Investment Platforms, Lending Platforms, and Others. Among these, Mobile Banking and Digital Wallets are particularly prominent due to the increasing reliance on smartphones for financial transactions. The convenience and accessibility offered by these services have led to a significant uptick in user adoption.

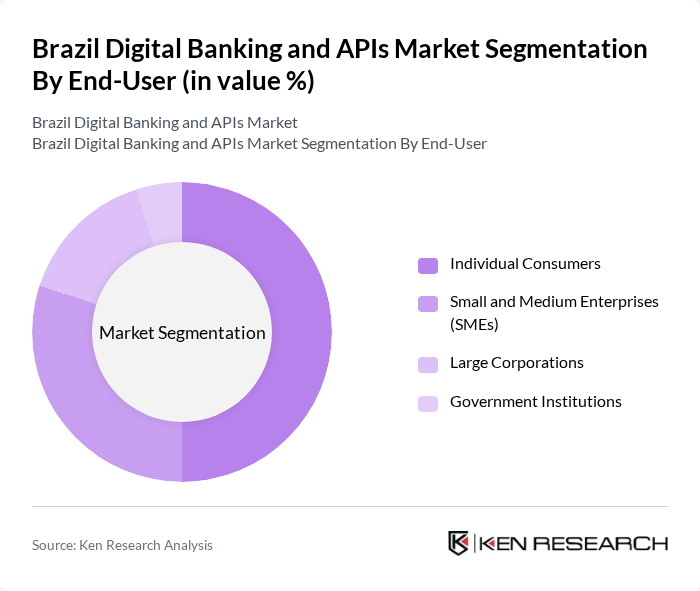

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Institutions. Individual Consumers dominate the market, driven by the increasing adoption of digital banking solutions for personal finance management. SMEs are also significant contributors, leveraging digital platforms for efficient financial operations and access to credit.

The Brazil Digital Banking and APIs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nubank, Banco Inter, C6 Bank, PagSeguro, Banco Original, BTG Pactual, PicPay, Mercado Pago, Banco do Brasil, Itaú Unibanco, Bradesco, Santander Brasil, XP Inc., StoneCo, Creditas contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital banking and APIs market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer service and operational efficiency. Additionally, the rise of open banking initiatives will foster collaboration between fintechs and traditional banks, creating a more competitive landscape. As e-commerce continues to grow, digital banking solutions will increasingly cater to the needs of consumers seeking convenience and security in their financial transactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Online Banking Payment Processing APIs Digital Wallets Investment Platforms Lending Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Institutions |

| By Application | Personal Finance Management Business Banking Solutions E-commerce Transactions Cross-border Payments |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions |

| By Customer Segment | Retail Customers Corporate Clients Institutional Investors |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2G (Business to Government) |

| By Payment Method | Credit/Debit Cards Bank Transfers Digital Currencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking User Experience | 150 | Retail Banking Customers, Digital Product Users |

| API Integration in Banking | 100 | IT Managers, API Developers, Fintech Executives |

| Regulatory Impact on Digital Banking | 80 | Compliance Officers, Legal Advisors in Financial Services |

| Consumer Preferences in Digital Payments | 120 | Payment Product Managers, Marketing Analysts |

| Trends in Digital Lending | 90 | Loan Officers, Risk Management Professionals |

The Brazil Digital Banking and APIs Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the rise of fintech companies catering to a tech-savvy population.