Region:Central and South America

Author(s):Shubham

Product Code:KRAB6246

Pages:99

Published On:October 2025

By Type:The market is segmented into various types of programs that cater to different aspects of executive education. The subsegments include Leadership Development Programs, Management Training Workshops, Executive Coaching Services, Online Learning Modules, Certification Programs, Industry-Specific Training, and Others. Each of these subsegments plays a crucial role in addressing the diverse needs of professionals and organizations.

The Leadership Development Programs segment is currently dominating the market due to the increasing emphasis on cultivating effective leaders within organizations. Companies recognize that strong leadership is essential for driving performance and fostering a positive workplace culture. As a result, there is a growing demand for tailored programs that focus on enhancing leadership skills, emotional intelligence, and strategic thinking. This trend is further supported by the rise of remote work, which necessitates new leadership approaches to manage distributed teams effectively.

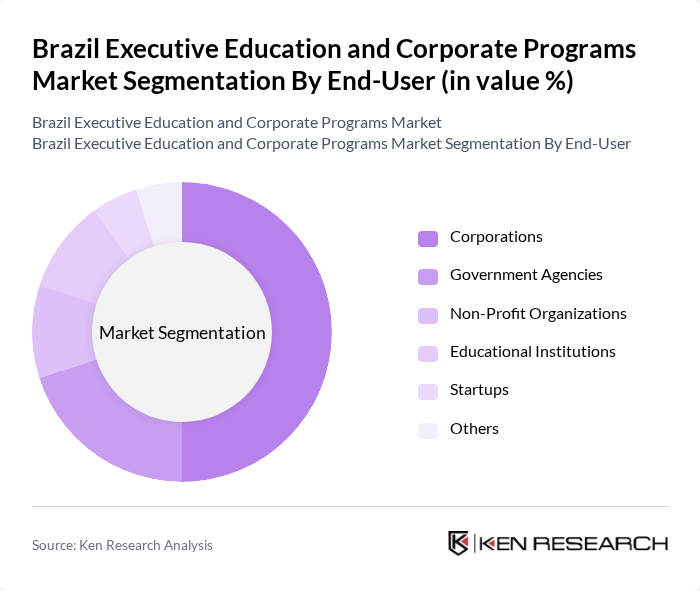

By End-User:The market is segmented based on the end-users of executive education programs, which include Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Each end-user category has unique training needs and objectives, influencing the types of programs they seek.

Corporations are the leading end-users in the market, accounting for a significant share due to their ongoing need for workforce development and skill enhancement. As businesses face rapid technological changes and competitive pressures, they increasingly invest in executive education to ensure their employees are equipped with the necessary skills to adapt and thrive. This trend is particularly evident in sectors such as technology, finance, and healthcare, where continuous learning is critical for maintaining a competitive edge.

The Brazil Executive Education and Corporate Programs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fundação Getulio Vargas (FGV), INSPER, Escola Superior de Propaganda e Marketing (ESPM), HSM Educação, Dom Cabral Foundation, PUC-Rio, FIA Business School, Universidade de São Paulo (USP), SENAC, Trevisan Escola de Negócios, Impacta Tecnologia, Uninove, ESPM Rio, IBE-FGV, CEBRAC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian executive education and corporate programs market appears promising, driven by the increasing integration of technology and a focus on personalized learning experiences. As organizations adapt to hybrid learning models, the demand for innovative training solutions is expected to rise. Additionally, the emphasis on soft skills development will likely shape program offerings, ensuring that employees are equipped to meet evolving workplace demands. This dynamic environment presents opportunities for growth and collaboration among local and international providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Management Training Workshops Executive Coaching Services Online Learning Modules Certification Programs Industry-Specific Training Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Delivery Mode | In-Person Training Virtual Training Blended Learning On-Demand Learning Others |

| By Duration | Short-Term Programs (1-3 days) Medium-Term Programs (1-3 months) Long-Term Programs (6 months and above) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Focus (North, South, East, West) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Programs | 150 | HR Managers, Training Coordinators |

| Industry-Specific Workshops | 100 | Program Directors, Industry Experts |

| Online Executive Education | 80 | eLearning Managers, IT Directors |

| Leadership Development Initiatives | 120 | Leadership Coaches, Organizational Development Specialists |

| International Executive Programs | 90 | International Relations Officers, Program Alumni |

The Brazil Executive Education and Corporate Programs Market is valued at approximately USD 1.2 billion, reflecting a significant investment by companies in enhancing workforce skills and leadership capabilities in response to a rapidly evolving business environment.