Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB1415

Pages:85

Published On:October 2025

By Type:The market is segmented into various types of furniture, including residential, office, outdoor, custom, modular, eco-friendly, luxury, contract, and others. Among these,residential furnitureis currently the leading segment, driven by the increasing trend of home renovations and the growing demand for stylish and functional living spaces. Office furniture is also gaining traction as businesses adapt to hybrid work models, necessitating ergonomic and flexible office solutions. The demand for eco-friendly and modular furniture is rising, reflecting consumer preferences for sustainability and adaptability.

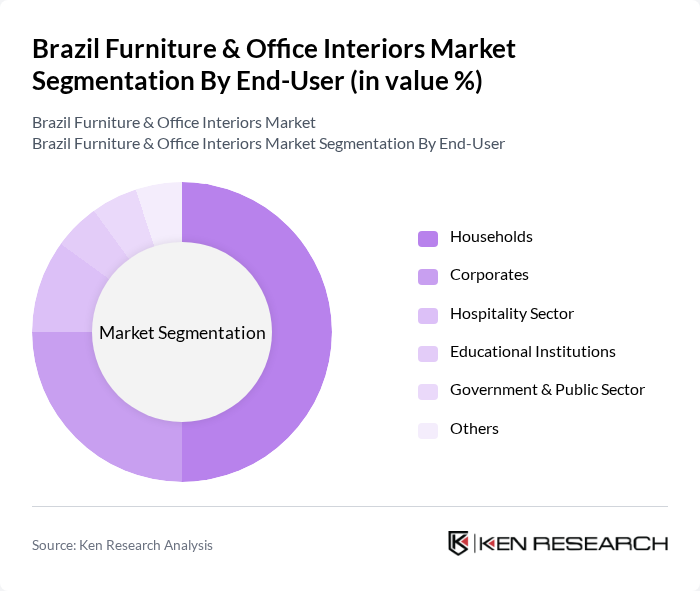

By End-User:The end-user segmentation includes households, corporates, the hospitality sector, educational institutions, government and public sector, and others.Householdsrepresent the largest segment, driven by the increasing trend of home improvement and the desire for personalized living spaces. Corporates are also a significant segment, as businesses invest in modern office environments to enhance employee productivity and comfort. The hospitality sector and educational institutions are experiencing steady demand for specialized furniture solutions.

The Brazil Furniture & Office Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tok&Stok, Etna, Mobly, Leroy Merlin Brasil, Casas Bahia, Magazine Luiza, Ponto (formerly Ponto Frio), Havan, Artefama Móveis, Sierra Móveis, Móveis Simonetto, Dalla Costa Móveis, Todeschini, Bertolini Móveis, Bartzen Móveis contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian furniture and office interiors market is poised for significant transformation as urbanization continues to rise and consumer preferences evolve. The integration of technology in furniture design and the increasing demand for sustainable products are expected to shape future trends. Additionally, the expansion of online retail channels will likely enhance market accessibility, allowing consumers to explore diverse options. As the economy stabilizes, the market may witness a resurgence in demand for innovative and customizable furniture solutions that cater to modern lifestyles.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Modular Furniture Eco-Friendly Furniture Luxury Furniture Contract Furniture Others |

| By End-User | Households Corporates Hospitality Sector Educational Institutions Government & Public Sector Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Showrooms Others |

| By Material | Wood Metal Plastic Fabric Glass Engineered Wood/Composites Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Modern Traditional Contemporary Industrial Rustic Others |

| By Functionality | Multi-functional Space-saving Ergonomic Smart Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 80 | Procurement Managers, Office Administrators |

| Home Office Furniture Trends | 100 | Homeowners, Freelancers, Remote Workers |

| Commercial Interior Design Projects | 60 | Interior Designers, Architects |

| Furniture Retail Insights | 100 | Store Managers, Sales Representatives |

| Office Space Utilization Studies | 40 | Facility Managers, Real Estate Developers |

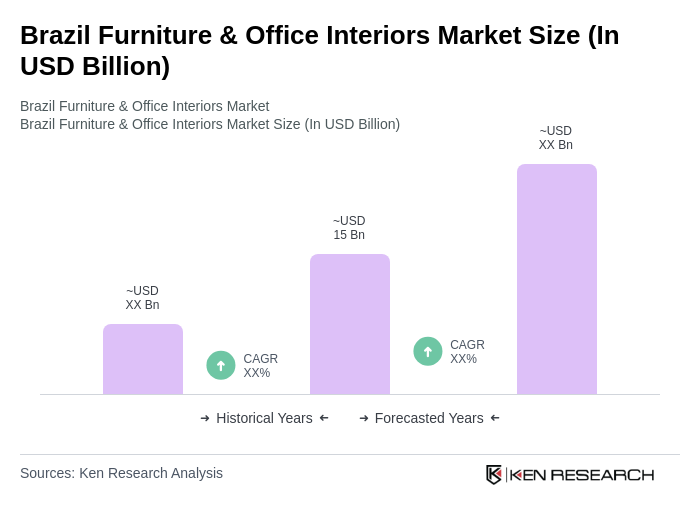

The Brazil Furniture & Office Interiors Market is valued at approximately USD 15 billion, driven by urbanization, rising disposable incomes, and a growing demand for modern furniture solutions. This market is expected to continue evolving with changing consumer preferences and economic conditions.