Region:Central and South America

Author(s):Shubham

Product Code:KRAC0637

Pages:81

Published On:August 2025

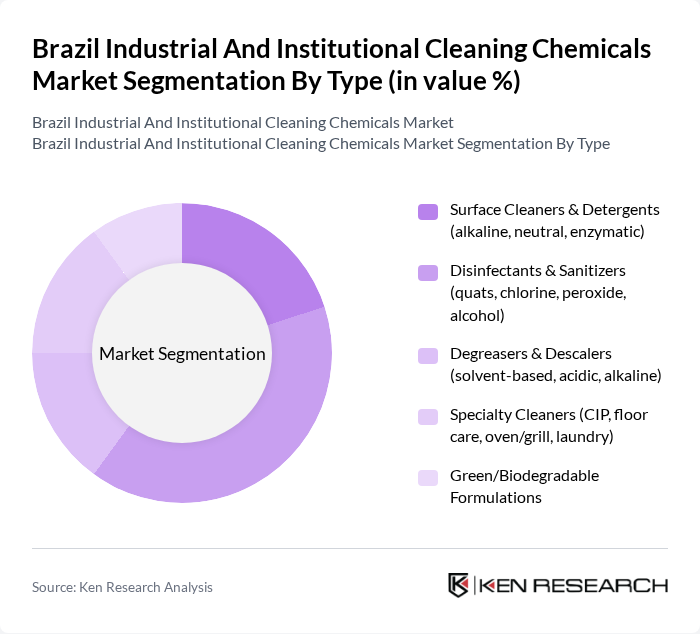

By Type:The market is segmented into various types of cleaning chemicals, each catering to specific cleaning needs across different industries. The subsegments include Surface Cleaners & Detergents, Disinfectants & Sanitizers, Degreasers & Descalers, Specialty Cleaners, and Green/Biodegradable Formulations. Among these, Disinfectants & Sanitizers are currently leading the market due to heightened awareness of hygiene and the need for effective infection control, especially in healthcare and food service sectors.

By End-User:The end-user segmentation includes Healthcare Facilities, Food & Beverage Processing and Foodservice, Hospitality & Commercial, Industrial & Manufacturing, and Public Institutions & Education. The Healthcare Facilities segment is the most significant contributor to the market, driven by the need for stringent hygiene practices and the use of specialized cleaning products to prevent infections.

The Brazil Industrial And Institutional Cleaning Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Brasil Ltda., Diversey Brasil (Diversey Holdings, Ltd.), 3M do Brasil Ltda., Reckitt Benckiser Brasil Ltda. (RB Hygiene), Procter & Gamble Professional Brasil, SC Johnson Professional Brasil, Unilever Brasil (Unilever Professional), Clorox Brasil Ltda., Spartan do Brasil Produtos Químicos Ltda., Oleak Indústria e Comércio Ltda., Renko Química Indústria e Comércio Ltda., Quimisa S.A. (QSolutions), Bombril Professional (BPRO), Cia. Heringer Química para Higiene Profissional, Oleak Oxivir/Peroxide Line Partners (where applicable) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian industrial and institutional cleaning chemicals market appears promising, driven by a strong emphasis on sustainability and hygiene. As businesses increasingly adopt eco-friendly practices, the demand for biodegradable and multi-purpose cleaning solutions is expected to rise. Additionally, the integration of automation in cleaning processes will enhance efficiency and reduce labor costs, further propelling market growth. Companies that innovate and adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Surface Cleaners & Detergents (alkaline, neutral, enzymatic) Disinfectants & Sanitizers (quats, chlorine, peroxide, alcohol) Degreasers & Descalers (solvent-based, acidic, alkaline) Specialty Cleaners (CIP, floor care, oven/grill, laundry) Green/Biodegradable Formulations |

| By End-User | Healthcare Facilities (hospitals, clinics, labs) Food & Beverage Processing and Foodservice Hospitality & Commercial (hotels, offices, retail) Industrial & Manufacturing (automotive, pulp & paper, chemicals) Public Institutions & Education (schools, government, transportation) |

| By Application | Hard Surface Cleaning & Disinfection Kitchen Hygiene & Warewashing Laundry & Textile Care Clean-in-Place (CIP) & Process Equipment Cleaning |

| By Distribution Channel | Direct Sales (key accounts, institutional tenders) Industrial Distributors & Janitorial Supply Online/Omnichannel B2B Platforms Retail/Wholesale Cash & Carry |

| By Packaging Type | Bulk Drums & IBCs Concentrates & Dosing Systems Ready-to-Use (RTU) Containers Sachets & Refills |

| By Price Range | Economy Mid-Range Premium/Performance |

| By Brand Loyalty | Contract-driven/Institutional Brands Price-Sensitive Buyers Quality- and Compliance-Driven Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities | 120 | Facility Managers, Infection Control Officers |

| Hospitality Sector | 90 | Housekeeping Managers, Operations Directors |

| Manufacturing Plants | 80 | Maintenance Supervisors, Safety Officers |

| Educational Institutions | 60 | Facility Coordinators, Procurement Managers |

| Food Processing Industry | 100 | Quality Assurance Managers, Production Supervisors |

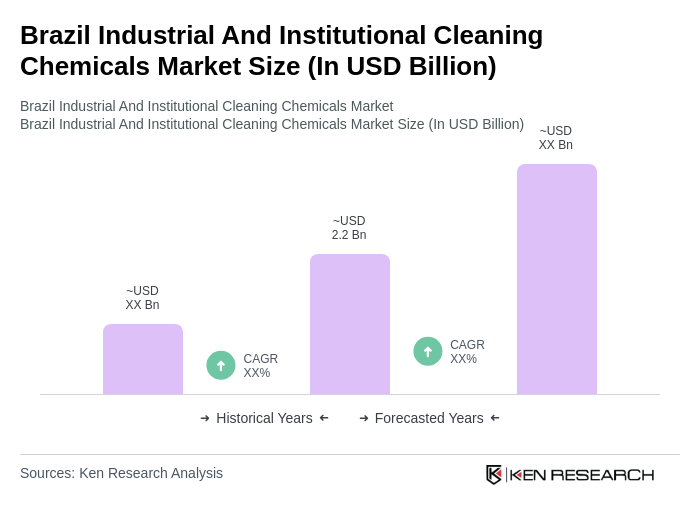

The Brazil Industrial and Institutional Cleaning Chemicals Market is valued at approximately USD 2.2 billion, reflecting a significant growth driven by increased demand for hygiene and sanitation across various sectors, including healthcare, food service, and hospitality.