Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB3340

Pages:96

Published On:October 2025

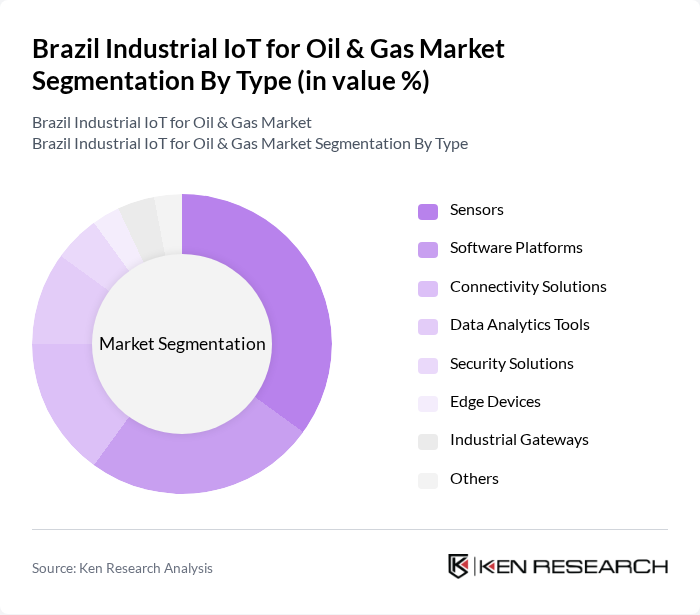

By Type:The market is segmented into various types, including sensors, software platforms, connectivity solutions, data analytics tools, security solutions, edge devices, industrial gateways, and others. Each of these subsegments plays a crucial role in the overall functionality and efficiency of IoT systems in the oil and gas sector. Among these, sensors are particularly dominant due to their essential role in data collection and monitoring, which is vital for operational efficiency and safety.

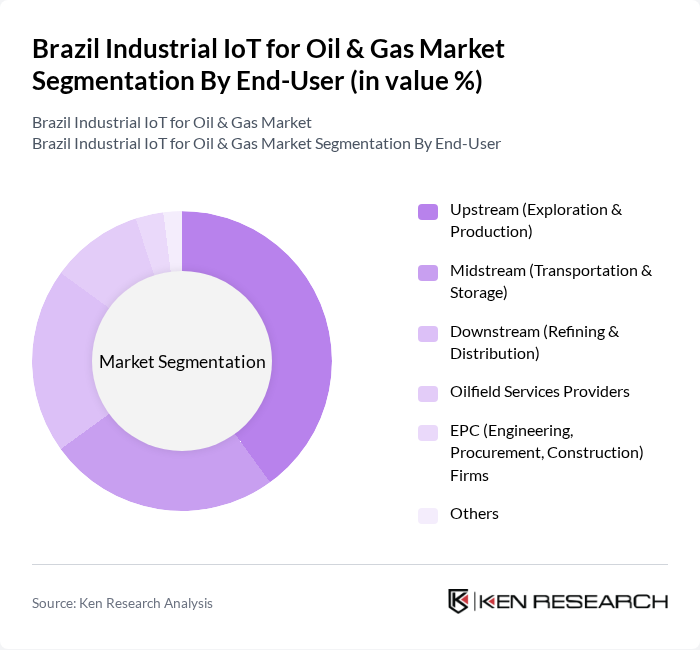

By End-User:The end-user segmentation includes upstream (exploration & production), midstream (transportation & storage), downstream (refining & distribution), oilfield services providers, EPC (engineering, procurement, construction) firms, and others. The upstream segment is particularly significant as it involves the initial stages of oil and gas extraction, where IoT technologies can greatly enhance exploration efficiency and safety measures.

The Brazil Industrial IoT for Oil & Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petrobras (Petróleo Brasileiro S.A.), Siemens AG, Honeywell International Inc., Schneider Electric SE, Rockwell Automation, Inc., IBM Corporation, Cisco Systems, Inc., GE Digital, Emerson Electric Co., ABB Ltd., Yokogawa Electric Corporation, Microsoft Corporation, Oracle Corporation, Schneider Electric Brasil Ltda., Radix Engenharia e Software, TOTVS S.A., SAP SE, National Instruments Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Industrial IoT market in Brazil's oil and gas sector appears promising, driven by technological advancements and increasing investments in digital solutions. As companies prioritize operational efficiency and safety, the adoption of IoT technologies is expected to accelerate. Furthermore, the integration of renewable energy sources and smart oilfield technologies will reshape the industry landscape, fostering innovation and sustainability. Collaborative efforts between oil companies and technology firms will also play a crucial role in driving this transformation.

| Segment | Sub-Segments |

|---|---|

| By Type | Sensors Software Platforms Connectivity Solutions Data Analytics Tools Security Solutions Edge Devices Industrial Gateways Others |

| By End-User | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) Oilfield Services Providers EPC (Engineering, Procurement, Construction) Firms Others |

| By Application | Asset Tracking & Management Predictive Maintenance Environmental & Emissions Monitoring Pipeline Monitoring & Leak Detection Production Optimization Supply Chain Management Remote Operations & Monitoring Health, Safety & Compliance Others |

| By Component | Hardware Software Services (Integration, Consulting, Managed Services) |

| By Sales Channel | Direct Sales Distributors/VARs Online Sales |

| By Distribution Mode | Offline Online |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil & Gas IoT Solutions | 100 | Field Engineers, Operations Managers |

| Midstream Monitoring Technologies | 60 | Pipeline Managers, Safety Officers |

| Downstream Refinery Automation | 50 | Plant Managers, IT Directors |

| IoT Security Solutions in Oil & Gas | 40 | Cybersecurity Analysts, Compliance Officers |

| Data Analytics for Oil & Gas Operations | 70 | Data Scientists, Business Analysts |

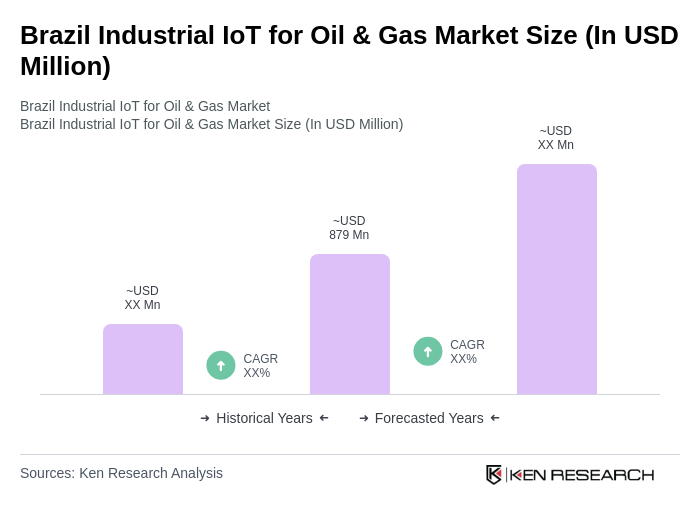

The Brazil Industrial IoT for Oil & Gas Market is valued at approximately USD 879 million, reflecting significant growth driven by the adoption of advanced technologies aimed at enhancing operational efficiency and reducing costs in the sector.