Region:Central and South America

Author(s):Shubham

Product Code:KRAB5692

Pages:97

Published On:October 2025

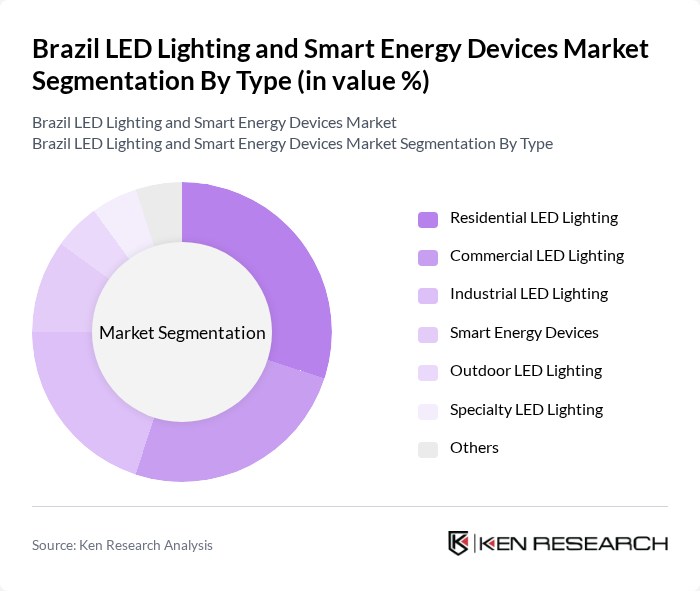

By Type:The market is segmented into various types, including Residential LED Lighting, Commercial LED Lighting, Industrial LED Lighting, Smart Energy Devices, Outdoor LED Lighting, Specialty LED Lighting, and Others. Each sub-segment caters to different consumer needs and preferences, with a growing trend towards energy-efficient solutions.

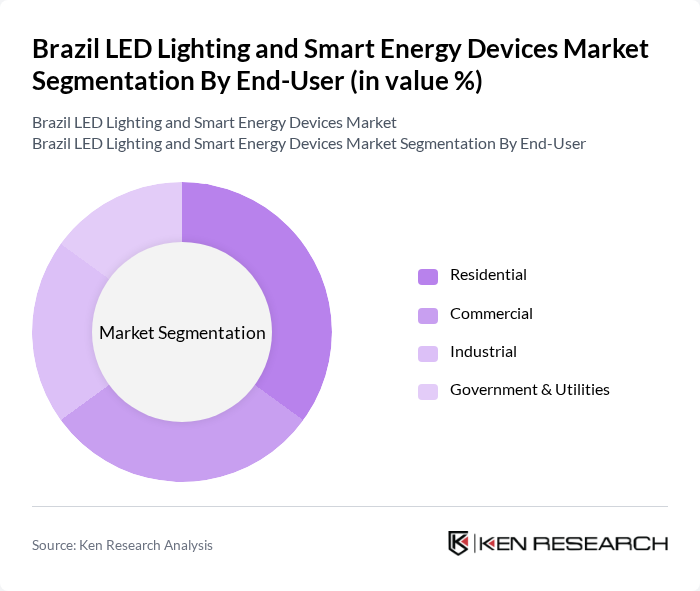

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment reflects the diverse applications of LED lighting and smart energy devices across different sectors, driven by specific energy needs and regulatory requirements.

The Brazil LED Lighting and Smart Energy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting Brasil Ltda, Osram do Brasil Ltda, General Electric do Brasil Ltda, Schneider Electric Brasil, Eaton Brasil, Cree Brasil, Legrand Brasil, Signify Brasil, Tridonic Brasil, Lutron Electronics Co., Inc., Honeywell Brasil, Siemens Brasil, ABB Brasil, Acuity Brands Lighting, Inc., Zumtobel Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil LED lighting and smart energy devices market appears promising, driven by increasing urbanization and a strong push towards sustainability. By future, the integration of IoT technologies in energy solutions is expected to enhance efficiency and user engagement. Additionally, the government's commitment to smart city initiatives will likely foster innovation and investment in energy-efficient technologies, creating a conducive environment for market expansion and consumer adoption of advanced lighting solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential LED Lighting Commercial LED Lighting Industrial LED Lighting Smart Energy Devices Outdoor LED Lighting Specialty LED Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Indoor Lighting Outdoor Lighting Street Lighting Architectural Lighting |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Technology | Smart LED Technology Traditional LED Technology |

| By Policy Support | Government Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LED Lighting Adoption | 150 | Homeowners, Property Managers |

| Commercial Smart Energy Solutions | 100 | Facility Managers, Energy Efficiency Consultants |

| Industrial LED Lighting Implementation | 80 | Operations Managers, Plant Engineers |

| Government Energy Efficiency Programs | 70 | Policy Makers, Energy Regulators |

| Consumer Attitudes Towards Smart Devices | 120 | Tech-savvy Consumers, Environmental Advocates |

The Brazil LED Lighting and Smart Energy Devices Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by urbanization, government initiatives for energy efficiency, and increased consumer awareness of sustainable energy solutions.