Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5728

Pages:80

Published On:October 2025

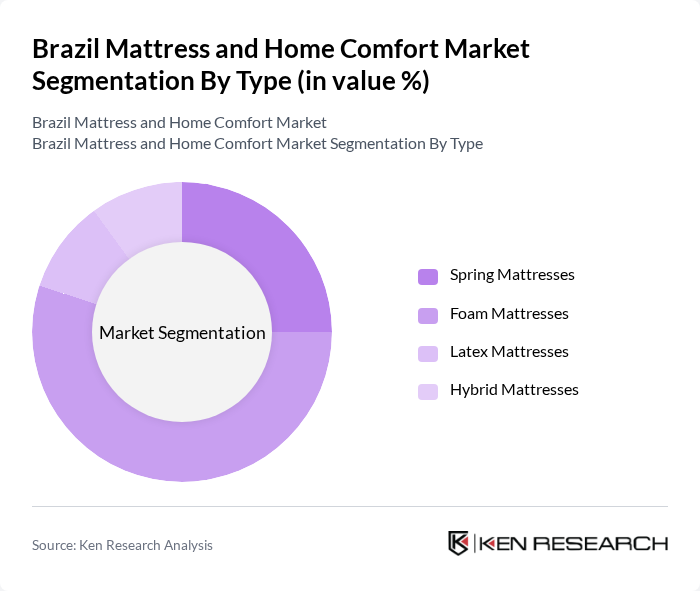

By Type:The market is segmented into various types of mattresses, including Spring Mattresses, Foam Mattresses, Latex Mattresses, and Hybrid Mattresses. Among these, Foam Mattresses have gained significant popularity due to their comfort and support features, appealing to a wide range of consumers and representing the largest segment with a revenue share of over fifty-five percent. The increasing trend of online shopping has also contributed to the growth of this segment, as consumers seek convenience and variety in their purchasing options, with foam mattresses easily adjusting to consumer shape and size preferences.

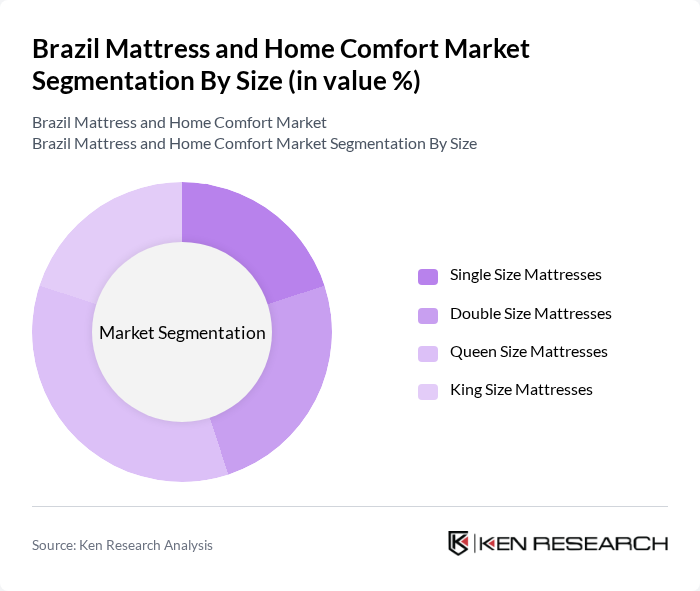

By Size:The market is also segmented by mattress size, including Single Size Mattresses, Double Size Mattresses, Queen Size Mattresses, and King Size Mattresses. The Queen Size Mattresses segment is currently leading the market, driven by consumer preferences for larger sleeping surfaces that provide enhanced comfort and space for couples. This trend is particularly evident in urban areas where living spaces are often limited, with rapid urbanization trends and increasing disposable incomes in major metropolitan areas driving demand for premium sleeping solutions.

The Brazil Mattress and Home Comfort Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International Inc., Serta Simmons Bedding LLC, Spring Air International, Sleep Number Corporation, Kingsdown, Southerland Sleep, Hästens, Casper, Silentnight Group, Emma Sleep GmbH, Orthocrin, Castor, Probel, Americanflex, Zinus Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil mattress and home comfort market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As awareness of sleep health continues to rise, manufacturers are likely to innovate with smart mattresses and eco-friendly materials. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings, enhancing consumer choice. The market is expected to adapt to these trends, positioning itself for sustainable growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Spring Mattresses Foam Mattresses Latex Mattresses Hybrid Mattresses |

| By Size | Single Size Mattresses Double Size Mattresses Queen Size Mattresses King Size Mattresses |

| By Distribution Channel | Offline Retail Stores Online Retail Stores Direct Sales |

| By End-User | Residential Commercial (Hotels, Hospitals, etc.) |

| By Material | Foam Springs Latex Hybrid Materials |

| By Price Range | Budget Mid-Range Premium |

| By Regional Distribution | São Paulo Rio de Janeiro Brasília Other Metropolitan Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 100 | Homeowners, Renters aged 25-55 |

| Retail Sales Insights | 80 | Store Managers, Sales Associates in Home Furnishings |

| Online Shopping Behavior | 70 | Frequent Online Shoppers, E-commerce Users |

| Industry Expert Opinions | 40 | Market Analysts, Industry Consultants |

| Home Comfort Product Trends | 60 | Interior Designers, Home Decor Influencers |

The Brazil Mattress and Home Comfort Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increased consumer awareness of sleep health and rising disposable incomes.