Region:Central and South America

Author(s):Dev

Product Code:KRAB0976

Pages:92

Published On:October 2025

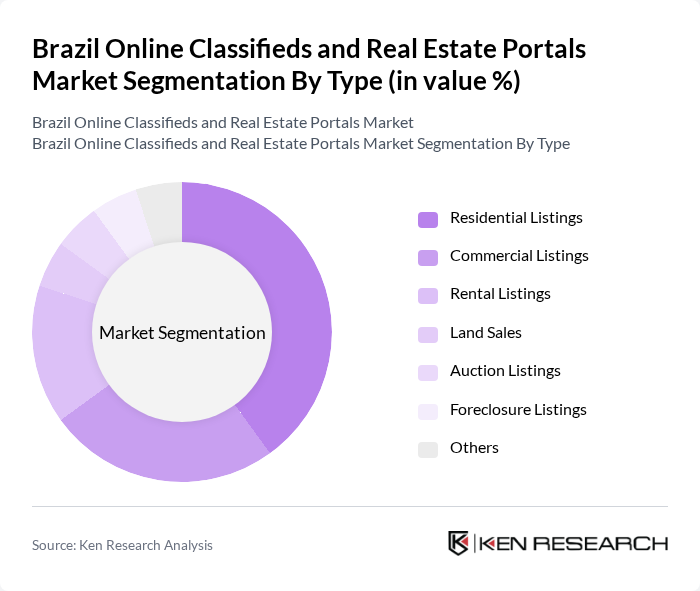

By Type:The market can be segmented into various types, including Residential Listings, Commercial Listings, Rental Listings, Land Sales, Auction Listings, Foreclosure Listings, and Others. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse nature of the real estate market in Brazil.

TheResidential Listingssubsegment dominates the market due to sustained demand for housing in urban areas, driven by population growth, urbanization, and a rising middle class. The adoption of remote work has increased interest in suburban and peri-urban properties, while digital platforms enable users to compare options, access immersive virtual tours, and utilize AI-powered recommendations. These trends have solidified Residential Listings as the leading subsegment in the market .

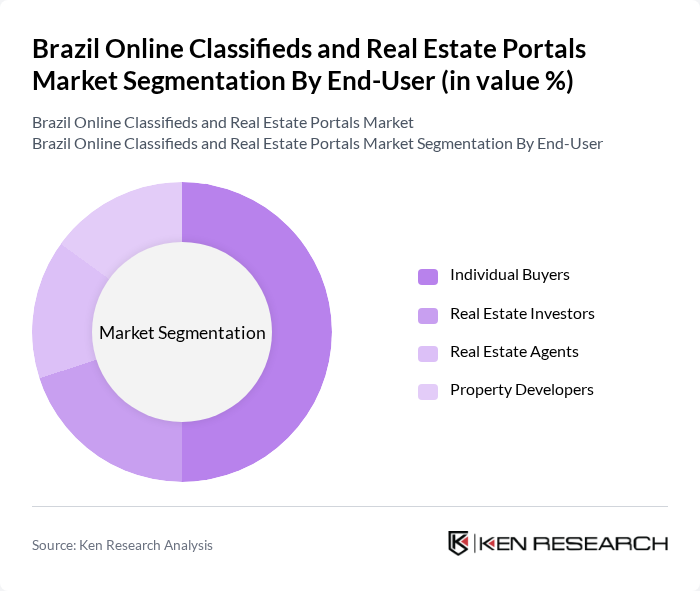

By End-User:The market can also be segmented by end-users, including Individual Buyers, Real Estate Investors, Real Estate Agents, Property Managers, Developers and Construction Companies, and Landlords. Each of these groups has distinct needs and motivations when engaging with online classifieds and real estate portals.

Individual Buyersrepresent the largest end-user segment, supported by the increasing number of first-time homebuyers, ongoing urban migration, and the widespread use of digital tools for property search and comparison. Enhanced access to detailed property data, virtual viewings, and secure digital transactions has made this segment a major contributor to market growth .

The Brazil Online Classifieds and Real Estate Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, Zap Imóveis, VivaReal, Imovelweb, 123i, QuintoAndar, Lopes Consultoria de Imóveis, Brasil Brokers, Grupo ZAP, Loft, Cia do Imóvel, Imóveis Brasil, Webimob, Apto, Imovel Aki contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's online classifieds and real estate portals market appears promising, driven by technological advancements and changing consumer preferences. As digital payment solutions become more widespread, facilitating seamless transactions, the market is likely to see increased user engagement. Additionally, the integration of AI and big data analytics will enhance user experiences, allowing for personalized property recommendations and improved search functionalities, ultimately transforming how Brazilians engage with real estate online.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings Land Sales Auction Listings Foreclosure Listings Others |

| By End-User | Individual Buyers Real Estate Investors Real Estate Agents Property Managers Developers and Construction Companies Landlords |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Direct Listings |

| By Geographic Focus | Major Urban Areas Suburban Regions Rural Areas |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Property Condition | New Properties Resale Properties Fixer-Uppers |

| By Service Type | Listing Services Marketing Services Transaction Services Consulting Services Financing and Mortgage Services Property Valuation Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Listings | 100 | Real Estate Agents, Property Owners |

| Commercial Real Estate Transactions | 60 | Commercial Brokers, Investors |

| Online Classifieds User Experience | 50 | Active Users, First-time Buyers |

| Rental Market Insights | 40 | Landlords, Tenants |

| Real Estate Technology Adoption | 45 | Technology Managers, Digital Marketing Specialists |

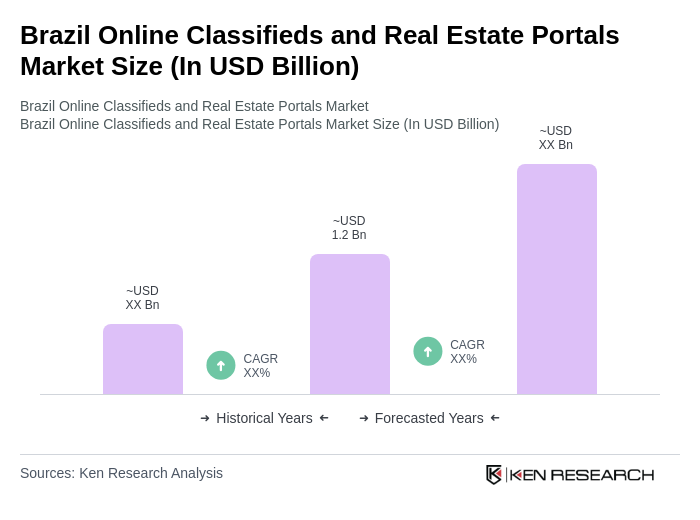

The Brazil Online Classifieds and Real Estate Portals Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by increased internet penetration and the adoption of digital platforms for real estate transactions.